A number of monetary establishments and market analysts are actually projecting the US Federal Reserve, the nation’s central financial institution, will slash rates of interest from the present goal charge of 4.25%-4.5% no less than twice in 2025.

The banking forecasts adopted a weak August jobs report that noticed solely 22,000 jobs added for the month, versus expectations of about 75,000.

Analysts at Financial institution of America, a banking and monetary companies firm, reversed their long-held stance of no charge cuts in 2025 and are actually projecting two 25 foundation level (BPS) cuts, one in September and one other in December, in line with Bloomberg.

Economists at Funding banking agency Goldman Sachs are projecting three 25 BPS cuts in 2025, starting in September and persevering with all through October and November.

Banking large Citigroup likewise forecasts a complete 75 BPS reduce in 2025, spaced out in 25 BPS increments in September, October and December, Reuters reported.

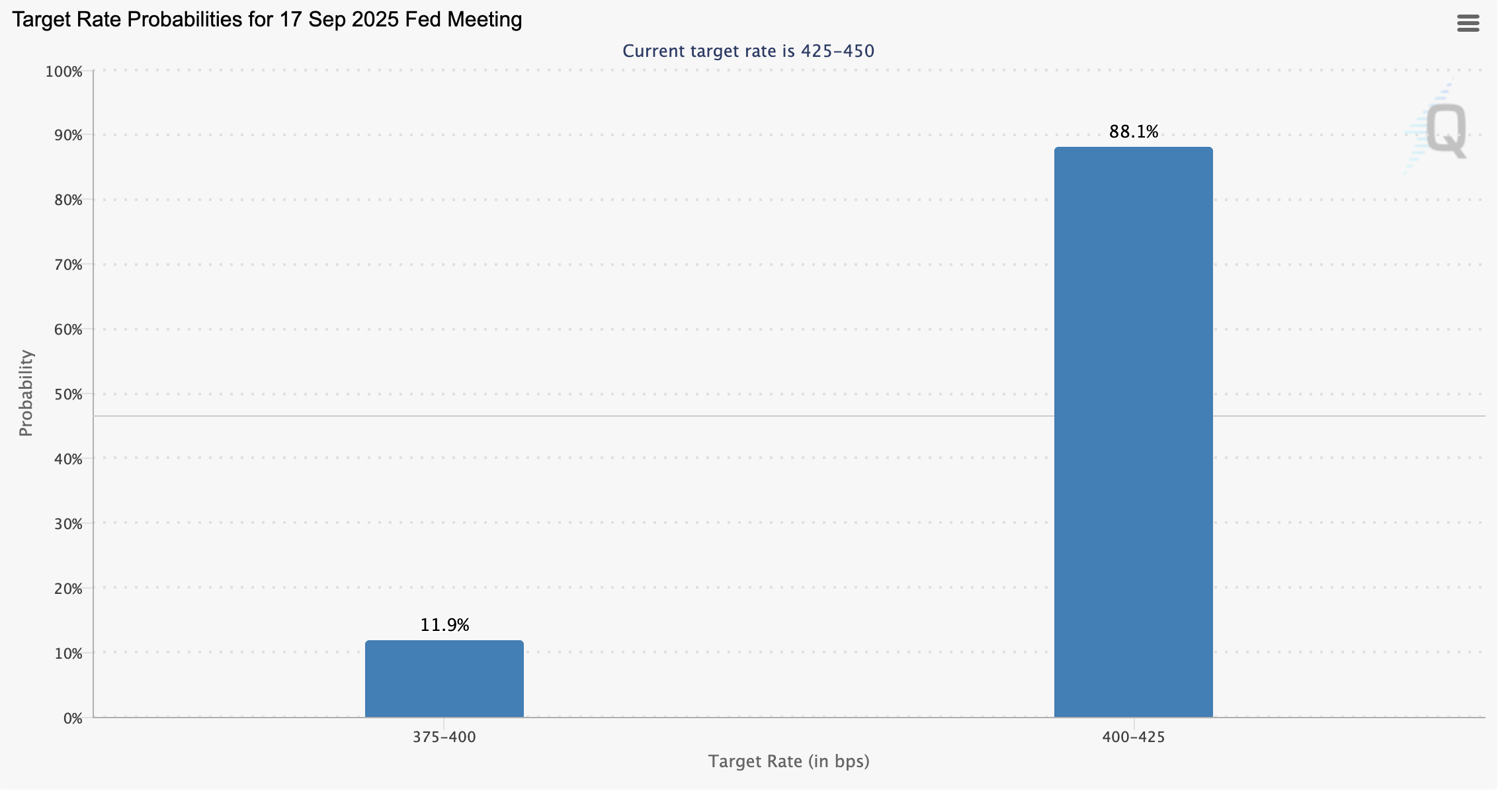

Rate of interest goal chances on the subsequent Federal Reserve assembly in September. Supply: CME Group

Over 88% of merchants now count on a charge reduce of 25 BPS on the subsequent Federal Open Market Committee (FOMC) Assembly in September, and about 12% of merchants count on a 50 BPS reduce, in line with knowledge from the Chicago Mercantile Alternate (CME) Group.

Decrease rates of interest drive liquidity into crypto markets and are seen as a serious catalyst for rising crypto costs and sustained bull runs, with larger charges having the alternative impact on asset costs.

Most merchants now anticipate charge cuts amid huge job numbers revisions

Federal Reserve Chair Jerome Powell signaled a possible charge reduce in September throughout his keynote speech on the Jackson Gap Financial Symposium in Wyoming on August 22.

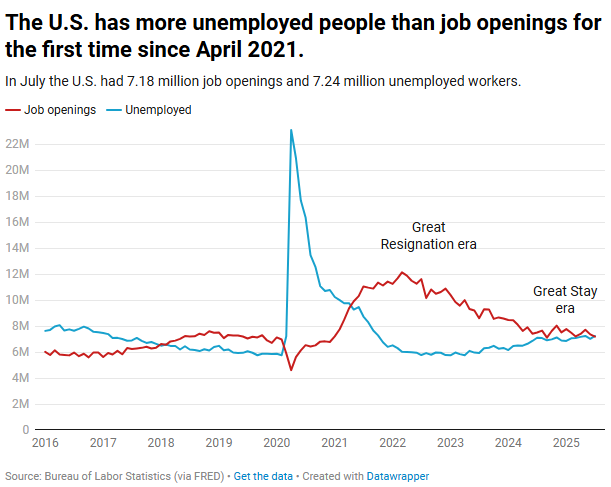

The speech got here amid indicators of a weakening US jobs market, which is a part of the Federal Reserve’s twin mandate of attaining most employment and holding costs steady.

US Jobs market exhibits indicators of weakening, with extra unemployed folks than job openings. Supply: The Kobeissi Letter

“The US simply revised the June jobs report decrease for a second time, for a complete of -160,000 jobs. Now, the US has formally misplaced 13,000 jobs in June,” the Kobeissi Letter mentioned in a submit on X.

The Kobeissi Letter additionally warned that the US Bureau of Labor Statistics (BLS) revised 2024 job numbers downward by about 818,000, and should revise 2025 figures down by as a lot as 950,000 jobs.