This can be a section from The Breakdown publication. To learn extra editions, subscribe.

“The continual rise of the debt-to-GDP ratio signifies that present coverage is unsustainable.”

— Monetary Report of america Authorities

There as soon as was a cheerful time when Fed chairs felt free to lecture politicians on their irresponsible spending habits.

In 1990, for instance, Alan Greenspan informed Congress he would decrease rates of interest, however provided that it minimize the deficit.

In 1985, Paul Volcker even specified a quantity, telling Congress that the Fed’s “steady” financial coverage was contingent on Congress slicing about $50 billion from the federal price range deficit.

(Oh, for the times when $50 billion of federal debt wasn’t only a rounding error.)

In each circumstances, the Fed chairs have been not-so-subtly threatening Congress and the White Home with recession: That’s a pleasant economic system you’ve acquired there. Could be a disgrace if one thing occurred to it.

Now, nonetheless, it’s the opposite approach round, with President Trump lecturing the Consumed rates of interest.

In simply the previous couple of weeks, the president has opined that the fed funds fee is “AT LEAST 3 factors too excessive,” insisted there may be “no inflation” and mocked the Fed Chair as Jerome “Too Late” Powell.

This, too, is a shakedown: That’s some good central-bank independence you’ve acquired there…

President Trump lobbied for decrease rates of interest throughout his first time period as effectively. Like practically each trendy US president, he needed the Fed to stimulate the economic system.

This time, nonetheless, it’s about way more than that: Trump desires the Fed to finance the deficit.

The Trump vs. Powell showdown is ostensibly in regards to the present degree of rates of interest (which the FOMC left unchanged at the moment, presumably to the president’s displeasure).

However what the president has been threatening is “fiscal dominance” — the state of affairs when financial coverage is subordinated to the wants of presidency spending.

“Our Fee needs to be three factors decrease than they’re saving us $1 trillion a 12 months (as a Nation),” the president just lately wrote on Reality Social (in his signature fashion of random capitalization).

With repeated such statements, Mr. Trump has made historical past by being the primary US president to explicitly name for fiscal dominance.

However he’s removed from the primary to acknowledge the chance.

When Volcker and Greenspan threatened Congress with fee hikes, it introduced the often hidden hyperlink between financial and monetary coverage out into the open.

It labored for them: Each Fed chairs had some success in utilizing the specter of recession to get Congress to deal with its deficit spending, which is a hopeful precedent.

However that tactic appears unlikely to work this time.

Chair Powell has typically warned in regards to the dangers of rising deficits, and even defined that greater deficits may imply greater long-term rates of interest.

Nevertheless it’s arduous to think about him making an specific risk in the way in which Volcker and Greenspan did — maybe as a result of he is aware of he’s bargaining from a a lot weaker place.

Within the Eighties, the most-feared impact of upper rates of interest was recession, which the Fed was prepared to danger to be able to get Congress to vary its free-spending methods.

Again then, lawmakers confronted a ballooning protection price range and a stagnant economic system, each of which appeared manageable.

At simply 35% of GDP, the nationwide debt appeared manageable too.

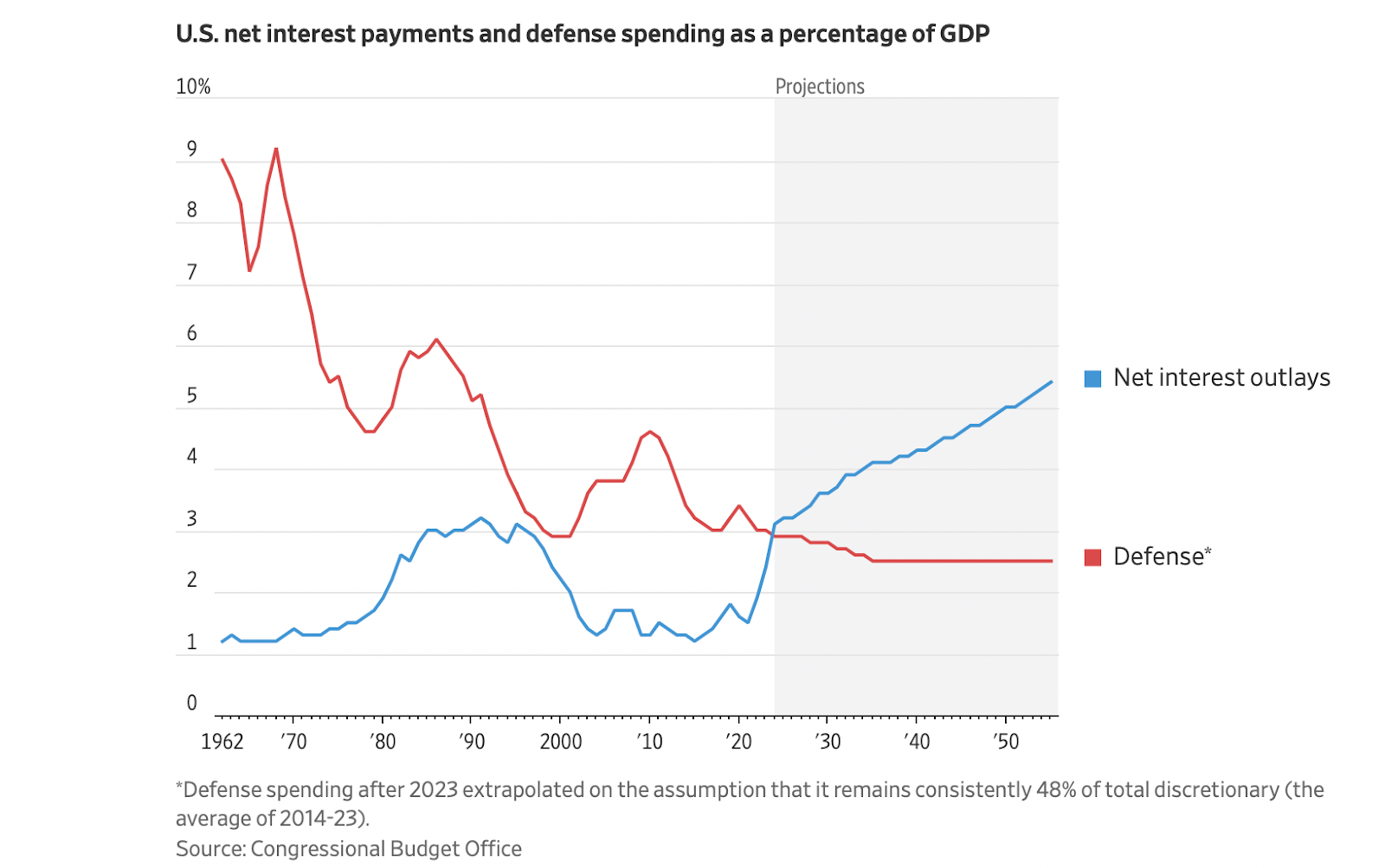

Now, with federal debt at 120% of GDP, the US spends extra on curiosity funds than it does on protection:

The fast-rising blue line above might now be the most important budgetary downside.

This places the Fed in a bind as a result of elevating rates of interest to encourage fiscal sanity would solely exacerbate the issue it desires lawmakers to deal with.

The Fed may danger it, after all.

But when fee hikes drive the deficit even greater, who blinks first: the Fed or the White Home?

Earlier than answering, contemplate that 73% of federal spending is now non-discretionary, vs. simply 45% within the Eighties.

To imagine the Fed can win a showdown over deficits is to imagine Congress will make vital cuts to non-discretionary spending like Social Safety and Medicare.

This appears, effectively, unbelievable.

Now, particularly, with a president who seems wholly unperturbed by the nation’s rising indebtedness.

This will likely come from his expertise as an over-indebted actual property developer within the Nineteen Nineties.

“I figured it was the financial institution’s downside, not mine,” Trump later wrote of not having the ability to service his money owed. “What the hell did I care? I really informed one financial institution, ‘I informed you you shouldn’t have loaned me that cash. I informed you that goddamn deal was no good.’”

Now, as president, when Trump tells Powell that rates of interest needs to be decrease, what he’s actually saying is that the nationwide debt is the Fed’s downside, not his.

He’s not improper.

“When curiosity funds on the debt rise and first surpluses are politically off the desk,” David Beckworth writes, “one thing else has to present. That one thing is extra debt, more cash creation, or each.”

Sure, the Fed may run the Volcker/Greenspan playbook and threaten Congress with greater rates of interest.

However Powell presumably is aware of that following by way of would solely exacerbate an issue that may finally be the Fed’s to repair — and pull ahead the time by which it’s pressured to repair it.

“If debt ranges are too excessive and rising,” Beckworth explains, “it turns into the Fed’s job to accommodate — by suppressing rates of interest or monetizing debt.”

That, and never President Trump, he warns, is the true existential risk to the Fed: “When the central financial institution is pressured to accommodate fiscal wants, it loses its financial independence.”

Beckworth stays hopeful that it may not come to that.

And possibly it received’t. We’ve simply seen how unpopular inflation is, so possibly if we get one other bout of it, voters will power lawmakers to deal with the deficit.

However he despairs that the concentrate on Trump’s calls for for decrease rates of interest is a distraction: “What we’re witnessing is much less about Trump himself and extra in regards to the rising and unavoidable fiscal calls for being positioned on the Fed.”