Bitcoin is coming into what analyst Rekt Capital calls the ‘banana zone,’ the parabolic section of its market cycle. That is the stage the place costs sometimes rise sharply, however with smaller pullbacks than earlier within the cycle.

How Are Bitcoin Cycles Structured?

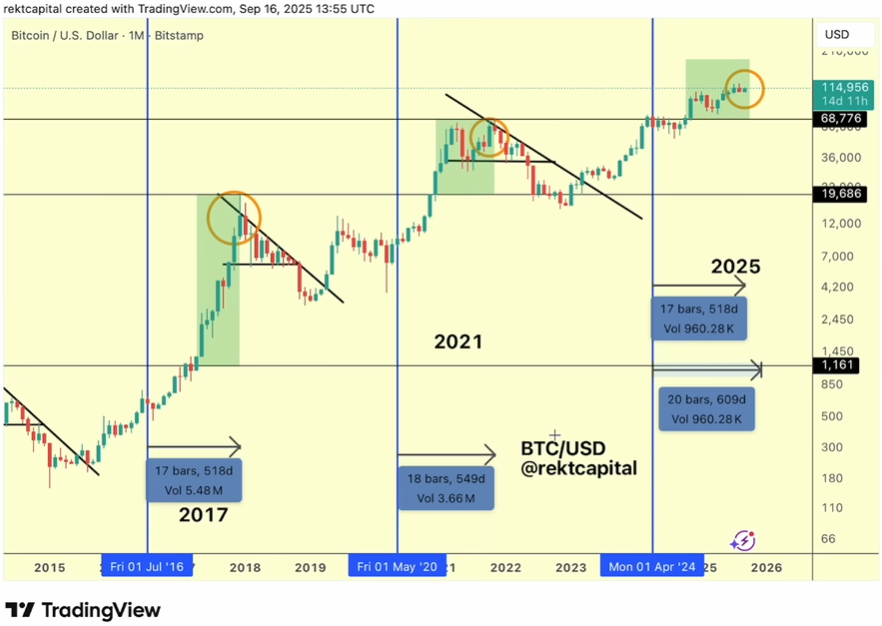

Each Bitcoin cycle has a couple of essential phases. After a halving, the market often sees three most important worth discovery uptrends, every adopted by corrective pullbacks. Within the present cycle:

- Pullbacks have gotten shallower: Early corrections dropped as a lot as 33%, then 31%, and the most recent retracement is simply 13%.

- Uptrends are smaller however regular: The primary uptrend lasted about seven weeks. The second uptrend achieved roughly 20–25% of the primary, exhibiting diminishing returns.

- Worth clustering happens after breakouts: In contrast to earlier cycles the place Bitcoin surged rapidly after a breakout, this cycle exhibits intervals of sideways consolidation earlier than shifting greater.

Associated: Fed’s First Fee Lower of 2025 Lifts DeFi: Ondo, Hyperliquid, and Uniswap Stand Out

When May Bitcoin Attain Its Peak?

These patterns present that Bitcoin’s subsequent uptrend should still produce new all-time highs, however the transfer is probably not as parabolic as previous cycles. Taking a look at historic information:

- In 2017, Bitcoin peaked 518 days after the halving.

- In 2021, the height occurred 550 days after the halving.

Supply: RektCapital

Present observations present a slight extension, presumably including 30–60 days to the cycle. This locations the potential peak between mid-October and mid-November 2025.

How Is Worth Reacting Now?

Bitcoin’s worth has reacted positively after the latest charge resolution, exhibiting a transparent try to maneuver greater. The market skilled some preliminary volatility, however assist ranges round $113,500 to $114,900 have held agency.

What does this assist zone point out?

This zone has repeatedly prevented the worth from dropping additional, and present worth motion exhibits that the bullish construction stays intact.

What are the near-term targets?

Within the quick time period, Bitcoin is testing greater ranges whereas staying inside an outlined upward channel. If the worth can push previous $118,500 after which type a better low, it might imply additional positive aspects towards the subsequent goal zone.

The fast upside ranges to observe are between $117,600 and $118,500.

Associated: Bitcoin (BTC) Worth Prediction For September 19

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be liable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.