Bitcoin (BTC) continues to expertise an intensive value correction shedding over 7% of its market worth within the final month. The flagship cryptocurrency has struggled to regain its bullish kind after setting a brand new all-time excessive resulting in speculations of a possible market prime. Apparently, widespread market analyst and the host of The Wolf of All Streets Podcast, Scott Melker has just lately shared a market growth that helps such bearish notions.

Bitcoin Set For 26% Crash?

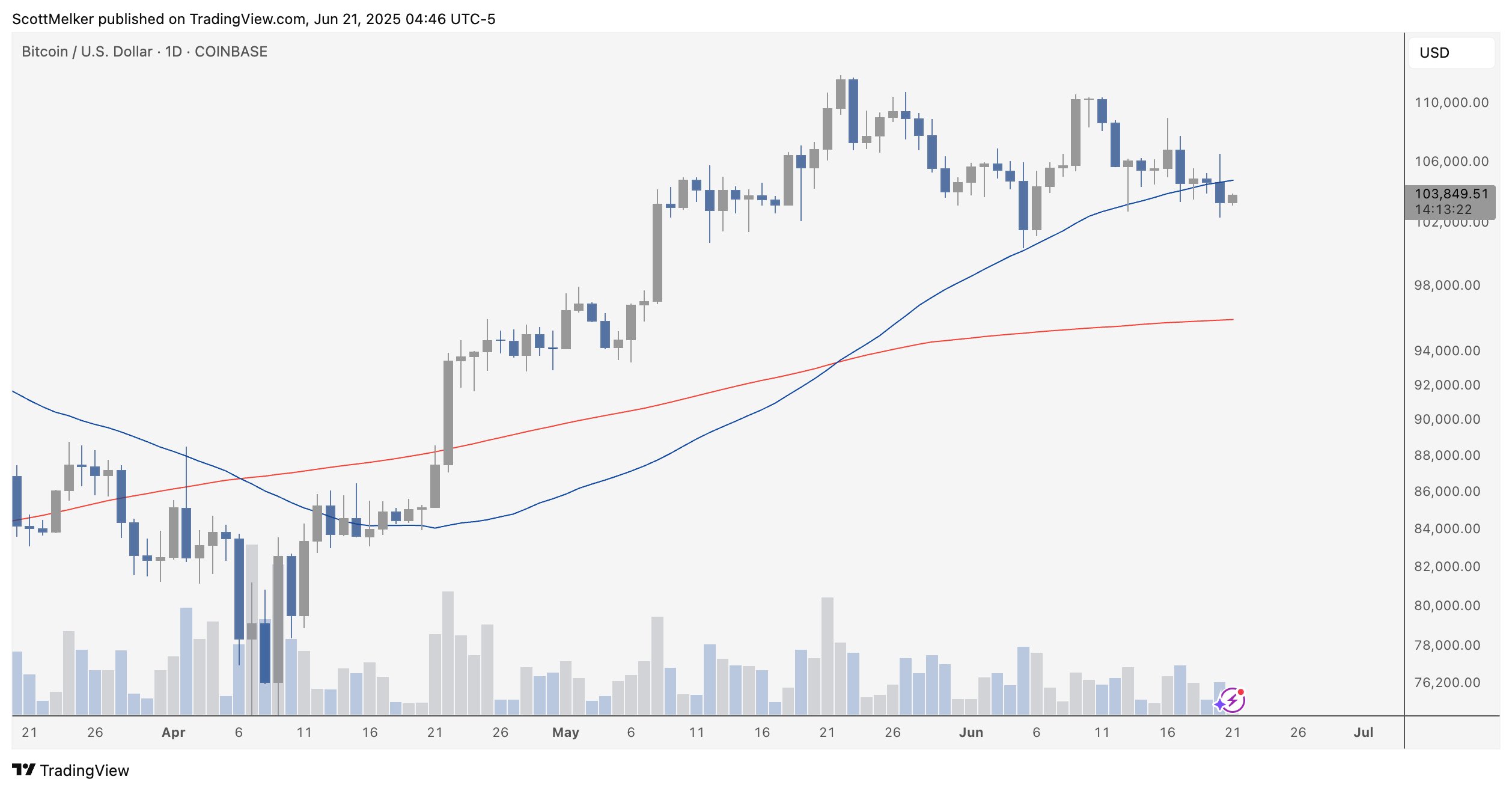

In an X publish on June 21, Scott Melker shares a cautionary perception on the Bitcoin market hinting at a bearish long-term outlook. The season analyst stories that information from TradingView reveals that Bitcoin’s has now closed beneath the 50-day shifting common (50 MA) on the every day buying and selling chart, a growth that final occurred two months in the past when Bitcoin traded round $84,000.

The 50MA is a generally used technical indicator that represents the common closing value of an asset over the previous 50 days. As a lagging indicator, it helps merchants determine the prevailing market pattern. When the worth stays above the 50 MA, it sometimes alerts a bullish pattern, whereas a transfer beneath the 50 MA could point out bearish momentum or a possible pattern reversal.

Apparently, Melker notes that Bitcoin final misplaced the 50 MA as a help zone in early February buying and selling round $100,000. Nonetheless, the lack of this value ground triggered an immense promoting stress forcing Bitcoin into extended market correction to succeed in market low of $74,000 in April.

Amidst the present market uncertainty, the current every day value shut beneath 50 MA strengthens bearish sentiments suggesting Bitcoin is due for an additional potential 26% crash. In that case, buyers might anticipate a draw back goal of round $76,200. To invalidate such bearish projections, Bitcoin should proceed to carry above the $100,000 resistance stage, fueling the possibilities to retest the present all-time excessive, and maybe re-enter value discovery mode.

Bitcoin Value Overview

At press time, Bitcoin is buying and selling at $102,889 after a 1.43% decline within the final day. In tandem, the asset’s every day buying and selling quantity has crashed by 29.30% and is presently valued at $35.15 billion. With a market cap of $2.02 trillion, the “digital gold” continues to rank as the most important cryptocurrency and fifth largest asset on the earth.

Nonetheless, in accordance with distinguished market analyst Ali Martinez, Bitcoin may very well be slipping into bearish territory as equally predicted by Scott Melker. Primarily based on insights from the MVRV pricing bands, if the market lose the present help at $102,000, it opens the door to a possible decline towards $82,000.

Featured picture from Pexels, chart from Tradingview