Bitcoin’s four-day drop to $104,000 triggered what analysts name a “defensive rotation” amongst crypto traders, however onchain knowledge suggests the correction was a wholesome reset slightly than the beginning of a broader market crash.

Bitcoin (BTC) skilled a four-day crash final week, falling from $115,000 final Tuesday to a four-month low of $104,000 by Friday, a stage final seen in June, TradingView knowledge exhibits.

Regardless of the steep decline, analysts mentioned the correction flushed out extra leverage, prompting traders to shift from chasing beneficial properties to defending capital. In a report Tuesday, blockchain analytics agency Glassnode mentioned short-term Bitcoin holder provide has risen, signaling that “speculative capital” is taking a bigger share of the market.

BTC/USD, 1-day chart, Supply: Cointelegraph/TradingView

“Onchain, the short-term holder provide share continues to rise, suggesting that speculative capital is changing into extra dominant,” Glassnode mentioned, including:

“This mixture of alerts factors to a market shifting into safety mode, with merchants prioritizing capital preservation over directional bets.”

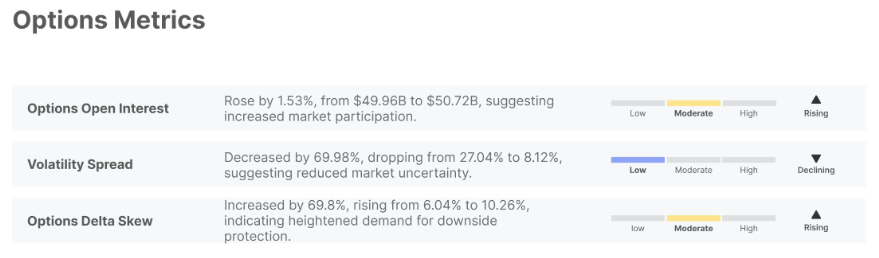

Bitcoin weekly choices metrics adjustments. Supply: Glasnode

In the meantime, Bitcoin’s open curiosity fell by about 30%, signaling that the crypto market is “far much less susceptible to a different liquidation cascade,” mentioned Glassnode in a Tuesday X publish.

Associated: Elon Musk touts Bitcoin as energy-based and inflation-proof, not like ‘faux fiat’

Bitcoin’s rise to $0.2 million spells “laborious time” for “paper hand” traders: Samson Mow

Glassnode’s report comes amid a interval of rising uncertainty associated to the continuation of the cryptocurrency market cycle.

“This $0.1M to $0.2M vary is a tough time for these with weak conviction to HODL Bitcoin,” Jan3 CEO, Samson Mow, wrote in a Monday X publish, including:

“They’re unsure as a result of the “cycle” didn’t occur like earlier than, and likewise as a result of different property like gold are rallying.”

Mow predicted that Bitcoin “will add a zero quickly sufficient,” however warned that “paper palms” traders with weak conviction shouldn’t get shaken out by the momentary correction.

Supply: Samson Mow

Associated: DeFi booming as $11B Bitcoin whale stirs ‘Uptober’ hopes: Finance Redefined

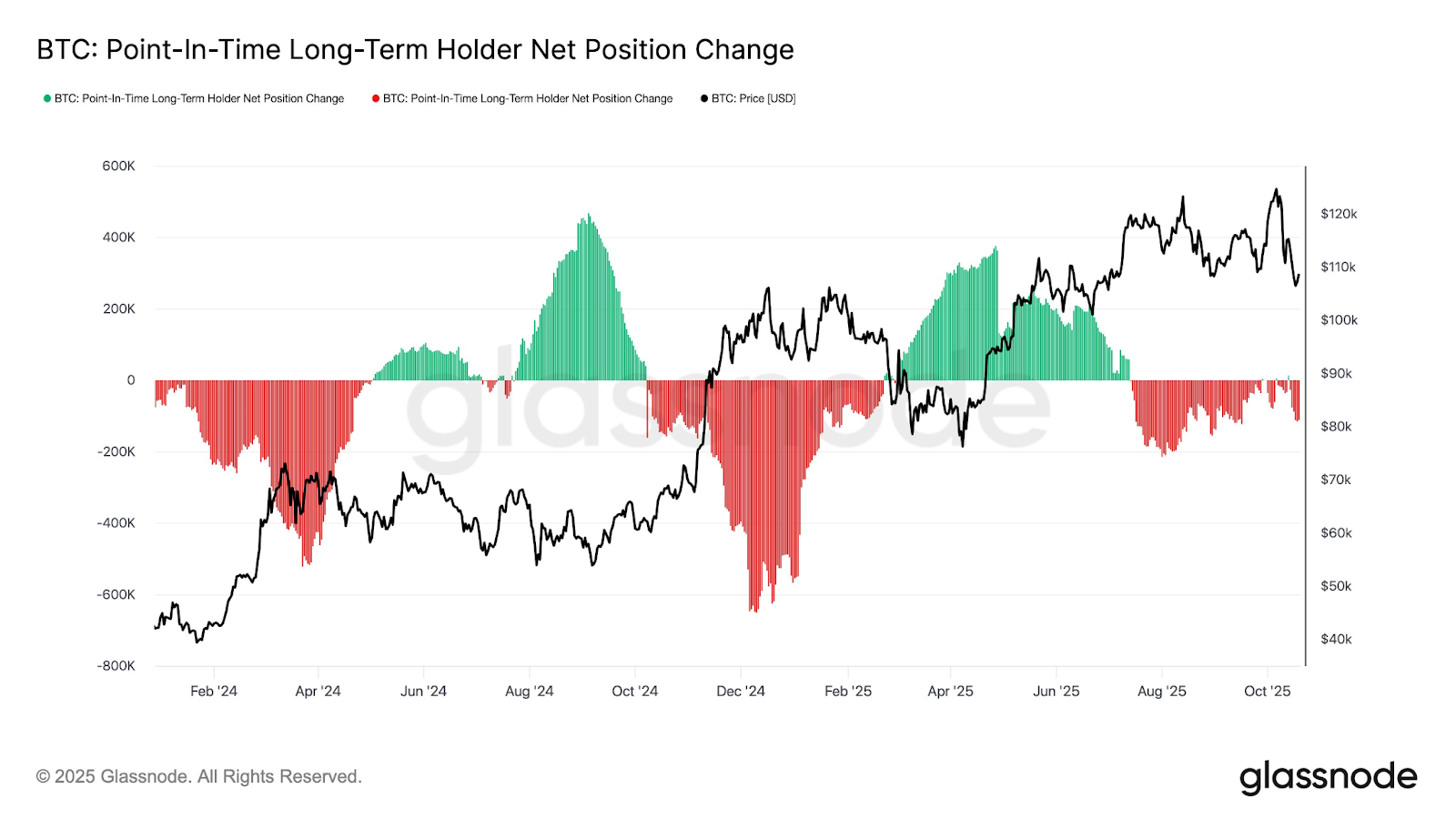

In the meantime, long-term Bitcoin holders proceed promoting to institutional traders, in response to Glassnode analyst Chris Beamish.

Supply: Chris Beamish

Digital asset treasuries (DATs) and exchange-traded funds (ETFs) have absorbed an “unbelievable quantity” of the long-term holder provide, however Bitcoin’s upside will stay restricted till this cohort stops promoting, the analyst wrote in a Monday X publish.

Nevertheless, Bitcoin ETFs have additionally been hit by the political turmoil surrounding President Donald Trump’s renewed tariff threats towards China.

On Monday, the Bitcoin ETFs recorded $40 million price of internet outflows, marking their fourth consecutive day of promoting, Cointelegraph reported.

Journal: Bitcoin is ‘humorous web cash’ throughout a disaster: Tezos co-founder