Bitcoin’s sharp sell-off this week has sparked issues throughout the market, with many pointing to escalating tensions between Israel and Iran as the first catalyst.

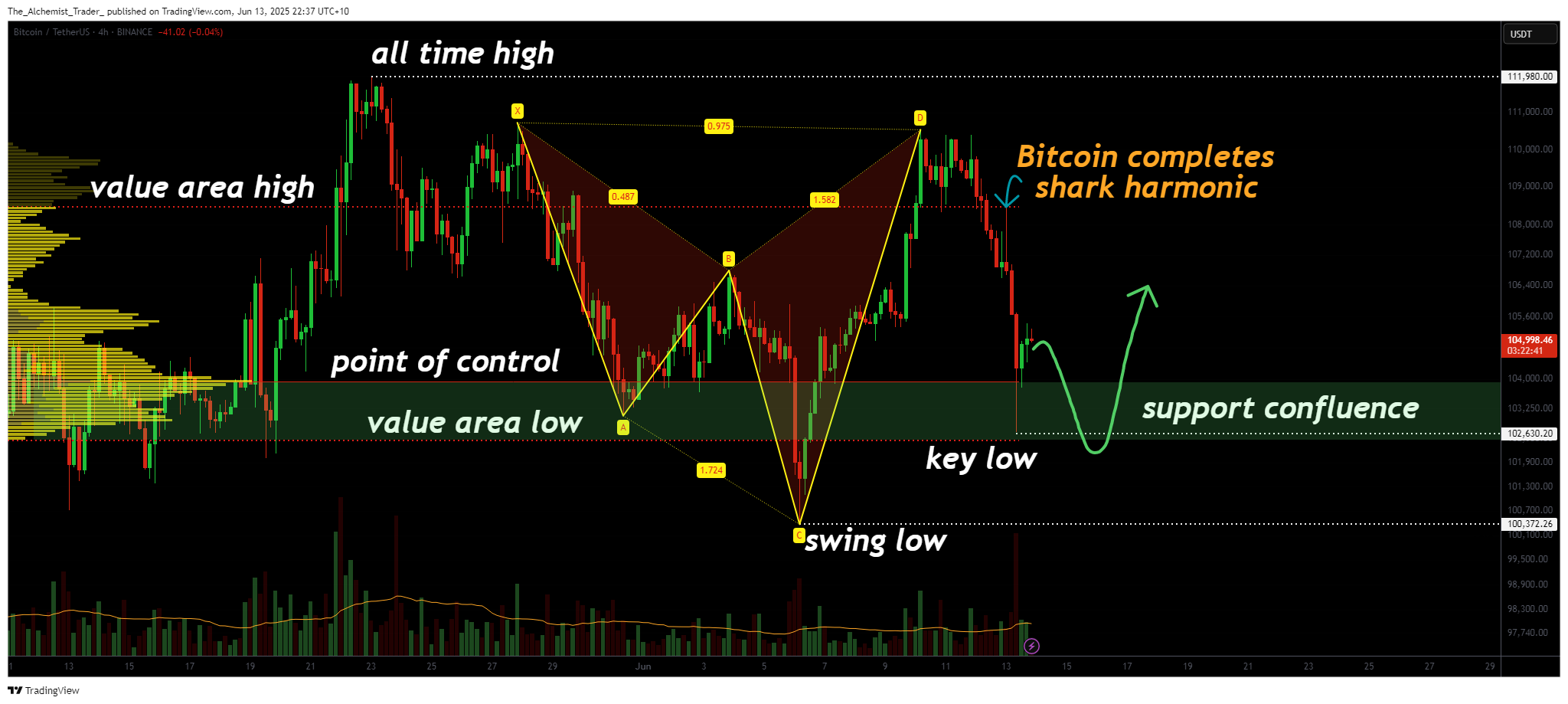

Whereas macro headlines triggered panic promoting, the charts had already laid out the roadmap. A bearish shark harmonic sample, coupled with a breakdown from key quantity ranges, steered {that a} corrective transfer was extremely possible. Notably, Bitcoin (BTC) was consolidating close to the worth space excessive earlier this week when tensions within the Center East started escalating.

As information of a navy confrontation between Israel and Iran broke, world danger sentiment weakened, resulting in widespread liquidation throughout crypto markets. Nevertheless, beneath the floor, technical construction had already proven indicators of exhaustion. As predicted on June 10 on this evaluation article, a shark harmonic sample hinted at a full market rotation, which in the end performed out in textbook trend.

Key technical factors

- Bearish Shark Harmonic Accomplished: Sample projected a retracement from VAH to VAL.

- Breakdown of Worth Space Excessive: Confirmed technical weak spot and led to an impulsive sell-off.

- Information of Israel-Iran Tensions Added Volatility: Macro uncertainty accelerated the transfer however didn’t provoke it.

- Worth Space Low and Key Low Now in Focus: Worth has tapped into robust assist — a potential bounce zone.

BTCUSDT (4H) Chart, Supply: TradingView

The transfer started with worth consolidating above the worth space excessive (VAH), a stage that had acted as resistance all through latest buying and selling classes. The affirmation of the shark harmonic got here when Bitcoin misplaced the VAH, triggering a technical breakdown. From there, worth moved shortly towards the purpose of management after which into the worth space low, finishing the harmonic construction.

Whereas the drop coincided with rising geopolitical pressure, notably the creating navy standoff between Israel and Iran, it’s vital to notice that this was not a random crash. The technical construction had already forecast a bearish growth, and the information merely added velocity and volatility to a transfer that was already in movement.

You may also like: Is it the time to purchase Bitcoin? $170,000 setup appears to be like like “a ticking time bomb”

Worth has now depraved into the VAL, establishing a key swing low. This stage is a vital assist space. Holding above it might set off a aid rally or perhaps a full rotation again towards the VAH, supplied short-term worth motion confirms stability.

What to anticipate within the coming worth motion

If Bitcoin holds above the worth space low and builds assist right here, a restoration towards the POC and VAH is technically affordable.

Nevertheless, if this key swing low is misplaced with momentum, additional draw back could unfold. Whereas the information shook the market, the chart had already warned, and this drop could in the end function one other long-term shopping for alternative inside Bitcoin’s broader development.

Learn extra: Walmart and Amazon eye dollar-pegged stablecoins to chop cost prices: report