By James Van Straten (All occasions ET until indicated in any other case)

Bitcoin

This raises the query of how a lot additional it would drop. Within the context of a unbroken bull market, double-digit corrections usually are not uncommon, with the most important drawdown reaching 30% since this cycle started in January 2023.

One technical issue to regulate is the CME Bitcoin Futures hole between $114,355 and $115,670. These gaps usually happen when worth motion occurs outdoors of the CME’s buying and selling hours, typically over weekends, and so they typically get stuffed later as the value revisits these ranges.

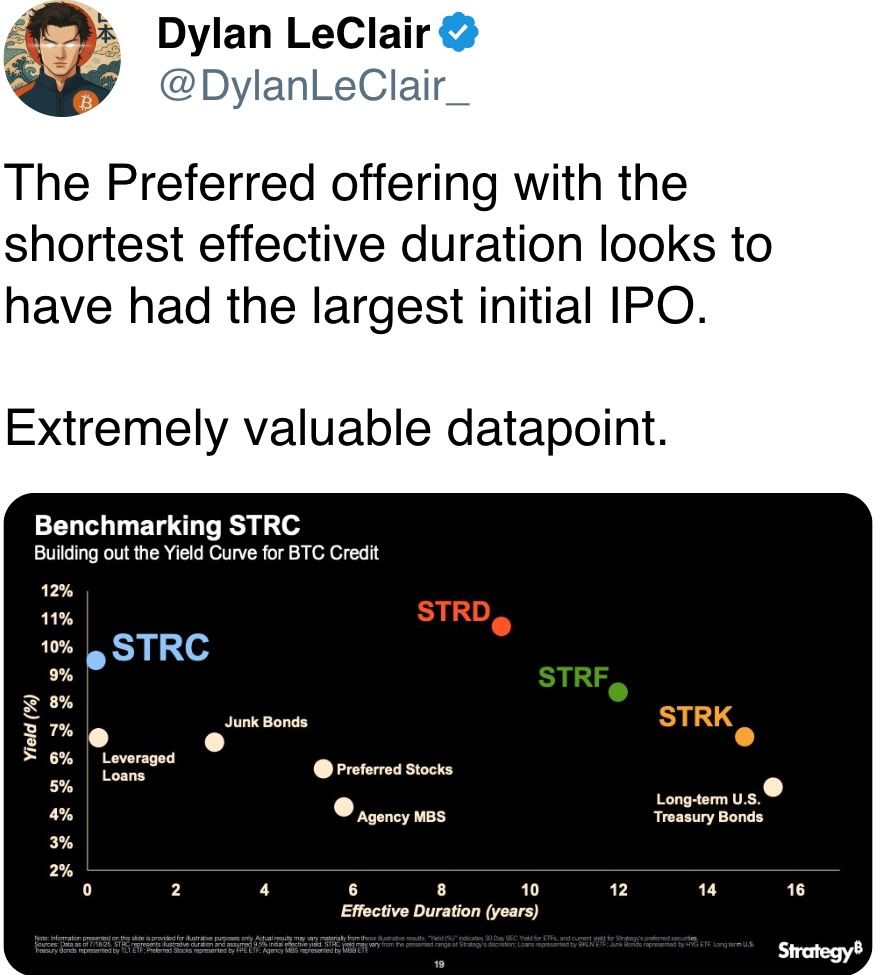

In different information, Technique (MSTR) reportedly quadrupled the scale of its Stretch (STRC) perpetual most well-liked inventory sale. Analyst Brian Brookshire notes the providing contains 28 million STRC shares. At $90 a pop, that totals over $2.5 billion and potential demand for some 21,500 BTC given a worth of $115,000.

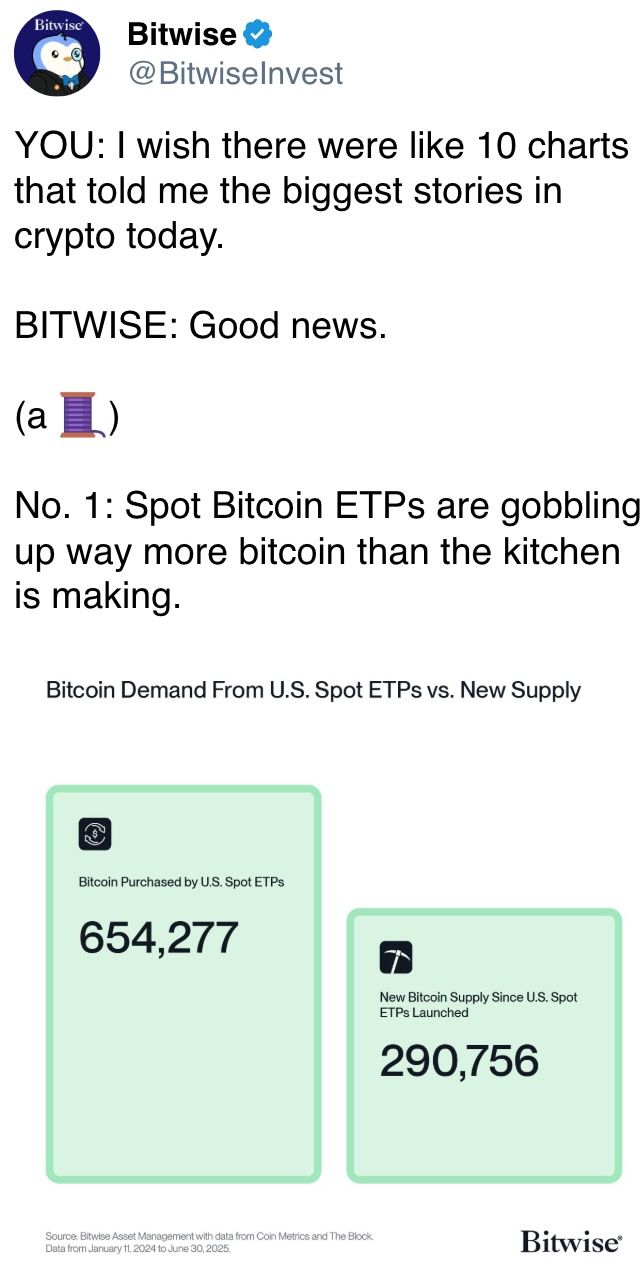

Meantime, demand already appears to be outstripping provide, in accordance with on-chain knowledge from Glassnode. Since early this month, greater than 210,000 BTC has been bought by long-term holders (those that’ve owned their BTC for longer than 155 days) and about 250,000 BTC purchased by short-term holders, the information reveals.

With the month-end only a week away, bitcoin is about 8% increased than firstly. That is in step with its historic development. On common, the most important cryptocurrency has returned about 7% in July since 2013.

Ether (ETH), for its half, has surged over 46% and is presently buying and selling close to $3,725. That is the third time it is topped 40% since November. Apparently, in all the opposite months, it fell.

August is usually quieter, which frequently ends in decrease market liquidity. Keep alert!

What to Watch

- Crypto

- July 28: Starknet (STRK), an Ethereum layer-2 validity rollup (zk-rollup), launches v0.14.0 on mainnet.

- July 31, 12 p.m.: A stay webinar that includes Bitwise CIO Matt Hougan and Bitzenship founder Aleesandro Palombo discussing bitcoin’s potential as the subsequent world reserve forex amid de-dollarization traits. Registration hyperlink.

- Aug. 1: The Helium Community (HNT), now operating on Solana, undergoes its halving occasion, chopping annual new token issuance to 7.5 million HNT.

- Aug. 1: Hong Kong’s Stablecoins Ordinance takes impact, introducing a licensing regime to control stablecoin actions within the metropolis.

- Aug. 15: File date for the subsequent FTX distribution to holders of allowed Class 5 Buyer Entitlement, Class 6 Basic Unsecured and Comfort Claims who meet pre-distribution necessities.

- Macro

- July 25, 8:30 a.m.: The U.S. Census Bureau releases June manufactured sturdy items orders knowledge.

- Sturdy Items Orders MoM Est. -10.8% vs. Prev. 16.4%

- Sturdy Items Orders Ex Protection MoM Prev. 15.5%

- Sturdy Items Orders Ex Transportation MoM Est. 0.1% vs. Prev. 0.5%

- July 28, 8 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases June unemployment charge knowledge.

- Aug. 1, 12:01 a.m.: New U.S. tariffs take impact on imports from buying and selling companions that failed to succeed in agreements by the July 9 deadline. These elevated duties may vary from 10% to as excessive as 70%, impacting a variety of products.

- July 25, 8:30 a.m.: The U.S. Census Bureau releases June manufactured sturdy items orders knowledge.

-

Earnings (Estimates primarily based on FactSet knowledge)

- July 29: PayPal Holdings (PYPL), pre-market, $1.30

- July 30: Robinhood Markets (HOOD), post-market, $0.31

- July 31: Coinbase International (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Sequans Communications (SQNS), pre-market

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Coincheck Group (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Occasions

- Governance votes & calls

- Aavegotchi DAO is voting on a proposal to promote its treasury of round 16 million GHST for round 3.2 million USDC to VC agency Rongming Funding , dissolve the DAO and distribute funds to lively members. The VC agency goals to scale Aavegotchi globally whereas Pixelcraft retains IP possession. Voting ends July 25.

- Lido DAO is voting on a brand new system that lets validator exits be triggered robotically by the execution layer, not simply by node operators. It contains instruments for various authorization pathways, emergency controls, and constructed‑in limits to forestall misuse. The replace is predicted to make staking extra decentralized, safer and extra responsive. Voting ends July 28.

- GnosisDAO is voting on a proposal to offer $30 million a yr, paid quarterly, to Gnosis Ltd., now a non-profit, to maintain its 150‑particular person workforce constructing essential Gnosis Chain infrastructure, merchandise (like Gnosis Pay and Circles), enterprise growth and operations. Voting ends July 28.

- Aavegotchi DAO is voting on funding three new options for the official decentralized utility: a Wearable Lendings UI, Gotchis Batch Lending and a BRS Optimizer. Voting ends July 29.

- NEAR Protocol is voting on probably decreasing NEAR’s inflation from 5% to 2.5%. Two-thirds of validators should approval the proposal for it to move, and if that’s the case it could possibly be applied by late Q3. Voting ends Aug. 1.

- July 25: MEXC, Ethena and TON to host an X Areas session on “Stablecoin for You & Me.”

- July 29, 10 a.m.: Ether.fi to host a bi-quarterly analyst name.

- Unlocks

- July 28: Jupiter to unlock 1.78% of its circulating provide value $28.77 million.

- July 31: Optimism to unlock 1.79% of its circulating provide value $22.08 million.

- Aug. 1: Sui to unlock 1.27% of its circulating provide value $162.78 million.

- Aug. 2: Ethena to unlock 0.64% of its circulating provide value $22.29 million.

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating provide value $13.38 million.

- Aug. 12: Aptos to unlock 1.73% of its circulating provide value $53.27 million.

- Token Launches

- July 25: 5ireChain (5IRE), Aperture Finance , Ertha , Gummy , Pip , and Teleport System Token (TST) to be delisted from Bybit.

Conferences

The CoinDesk Coverage & Regulation convention (previously generally known as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that permits basic counsels, compliance officers and regulatory executives to satisfy with public officers liable for crypto laws and regulatory oversight. House is restricted. Use code CDB10 for 10% off your registration by Aug. 31.

- July 25: Blockchain Summit International (Montevideo, Uruguay)

- July 28-29: TWS Convention 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Uncommon EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh Metropolis, Vietnam)

Token Speak

By Shaurya Malwa

- WWE legend Hulk Hogan died Thursday following a cardiac arrest, triggering a wave of tribute posts for the wrestler and a near-instant surge of branded memecoins on Ethereum and Solana.

- The newly launched Wrapped ETH token “Hulkamania (HULK)” pumped over 122,000% inside hours of deployment, peaking at $0.001335 and briefly hitting a seven-figure market cap, in accordance with DEXTools.

- On Solana, a memecoin named HULKAMANIA (HULK) — launched in June 2024 — surged over 2,000% in 24 hours, buying and selling close to $0.0006146 with a revived market cap of $500,000.

- Regardless of the rally, the Solana-based HULK continues to be far under its $18.8 million all-time excessive from final yr, which adopted a now-deleted promotional tweet from Hogan’s official X account.

- Hogan, on the time, claimed the submit wasn’t made by him.

- None of the present HULK tokens are formally affiliated with Hogan’s property or model and a number of copycat variations have already vanished from the DEX panorama, suggesting they’re seemingly rug pulls and honeypots.

- Hogan joins a rising listing of celebrities whose posthumous memecoins see fast speculative inflows, typically fueled by nostalgia, shock and social media virality earlier than liquidity drains as quick because it arrives.

- It is value remembering that tribute memecoins provide no legitimacy, no roadmap and no protections regardless of typically being the fastest-moving tokens on DEX platforms throughout news-driven spikes.

Derivatives Positioning

- Open curiosity (OI) for bitcoin throughout high derivatives venues stays in any respect time highs.

- In keeping with Velo, OI presently sits at $34.1 billion. Binance nonetheless leads with $14.2 billion open curiosity adopted by Bybit at $9.5 billion.

- Three-month annualized foundation for BTC is at 6.3%, dropping off from 9% earlier within the week.

- By way of perpetual volumes, ETH volumes presently exceed BTC volumes at 140.6 billion versus 121.4 billion respectively, as per Coinglass.

- Bitcoin put-call quantity presently stands at 44,600 contracts, with calls accounting for 52% of the whole, in accordance with Velo. Choices OI for bitcoin is just below all time highs at $83.5 billion, in accordance with Coinglass.

- Ether, then again, presently has 196,400 put-call contract quantity with 54% being calls. Open curiosity is presently at $9.6 billion, under the March 2024 all-time excessive of $14.8 billion.

- Funding charge APRs for BTC are muted throughout most venues besides Hyperliquid, the place the speed presently is at 90% annualized funding. That is nicely above altcoins akin to SOL and HYPE, which presently present an annualized funding of 10% and 32%, respectively, as per Coinglass.

Market Actions

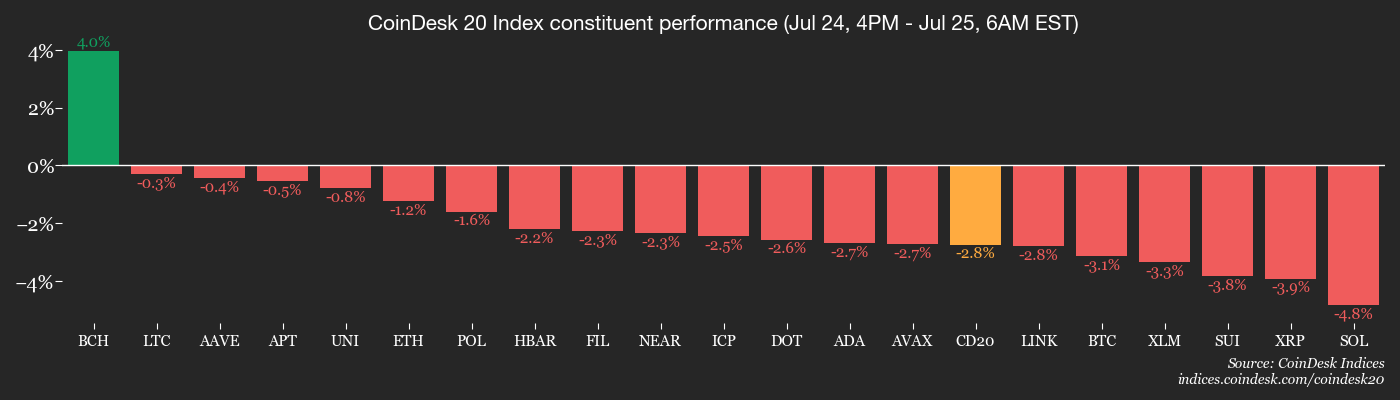

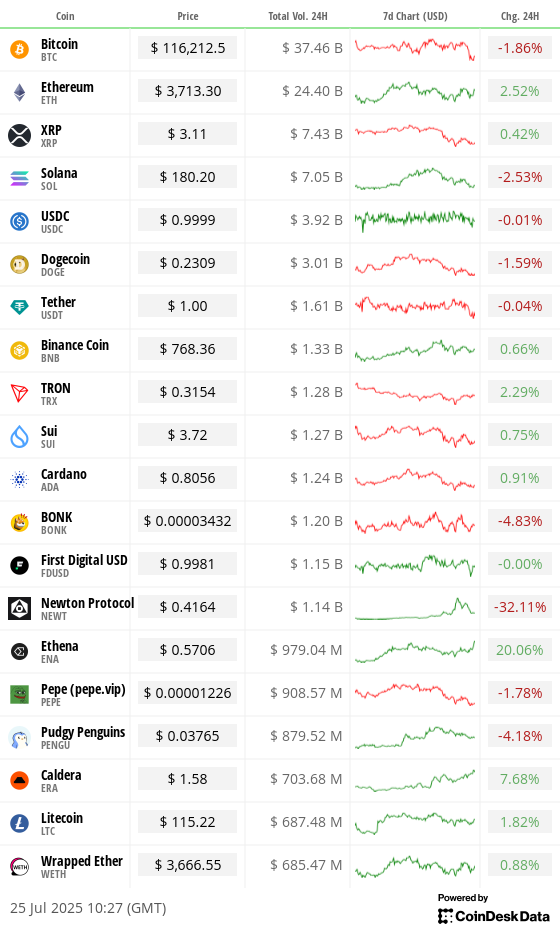

- BTC is down 2.39% from 4 p.m. ET Thursday at $115,912.54 (24hrs: -1.99%)

- ETH is down 0.41% at $3,721.30 (24hrs: +2.54%)

- CoinDesk 20 is down 1.94% at 3,940.10 (24hrs: +0.64%)

- Ether CESR Composite Staking Price is up 1 bp at 2.96%

- BTC funding charge is at 0.0367% (40.1865% annualized) on KuCoin

- DXY is up 0.32% at 97.68

- Gold futures are down 0.72% at $3,349.30

- Silver futures are down 0.34% at $39.09

- Nikkei 225 closed down 0.88% at 41,456.23

- Cling Seng closed down 1.09% at 25,388.35

- FTSE is down 0.29% at 9,112.22

- Euro Stoxx 50 is down 0.15% at 5,347.34

- DJIA closed on Thursday down 0.70% at 44,693.91

- S&P 500 closed unchanged at 6,363.35

- Nasdaq Composite closed up 0.18% at 21,057.96

- S&P/TSX Composite closed down 0.16% at 27,372.26

- S&P 40 Latin America closed down 0.44% at 2,627.58

- U.S. 10-12 months Treasury charge is up 1.2 bps at 4.42%

- E-mini S&P 500 futures are unchanged at 6,407.00

- E-mini Nasdaq-100 futures are unchanged at 23,374.00

- E-mini Dow Jones Industrial Common Index are up 0.13% at 44,956.00

Bitcoin Stats

- BTC Dominance: 61.46% (-0.58%)

- Ether-bitcoin ratio: 0.03184 (1.65%)

- Hashrate (seven-day transferring common): 914 EH/s

- Hashprice (spot): $59.04

- Complete charges: 9.82 BTC / $1,166,840

- CME Futures Open Curiosity: 147,320 BTC

- BTC priced in gold: 34.4 oz.

- BTC vs gold market cap: 9.66%

Technical Evaluation

- Ethena’s ENA has been one of many strongest performers available in the market, following the announcement of StablecoinX, a SPAC that has raised $360 million to accumulate ENA as treasury holdings.

- On the every day timeframe, ENA has damaged its downtrend and retested the earlier resistance at $0.45.

- This bullish narrative is additional supported by the confluence of reclaiming Monday’s low and the 50-day exponential transferring common on the weekly chart.

Crypto Equities

- Technique (MSTR): closed on Thursday at $414.92 (+0.55%), -2.44% at $404.79 in pre-market

- Coinbase International (COIN): closed at $396.7 (-0.28%), -1.75% at $389.74

- Circle (CRCL): closed at $193.08 (-4.61%), -0.64% at $191.84

- Galaxy Digital (GLXY): closed at $31.89 (+2.77%), -4.2% at $30.55

- MARA Holdings (MARA): closed at $17.26 (-1.76%), -2.95% at $16.75

- Riot Platforms (RIOT): closed at $14.69 (+2.44%), -2.59% at $14.31

- Core Scientific (CORZ): closed at $13.69 (+1.48%), unchanged in pre-market

- CleanSpark (CLSK): closed at $12.34 (-0.88%), -2.35% at $12.05

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.11 (-0.84%)

- Semler Scientific (SMLR): closed at $38.89 (-1.09%), -3.57% at $37.5

- Exodus Motion (EXOD): closed at $33.61 (-1.75%), +3.01% at $34.62

- SharpLink Gaming (SBET): closed at $23.32 (-9.65%), +2.44% at $23.89

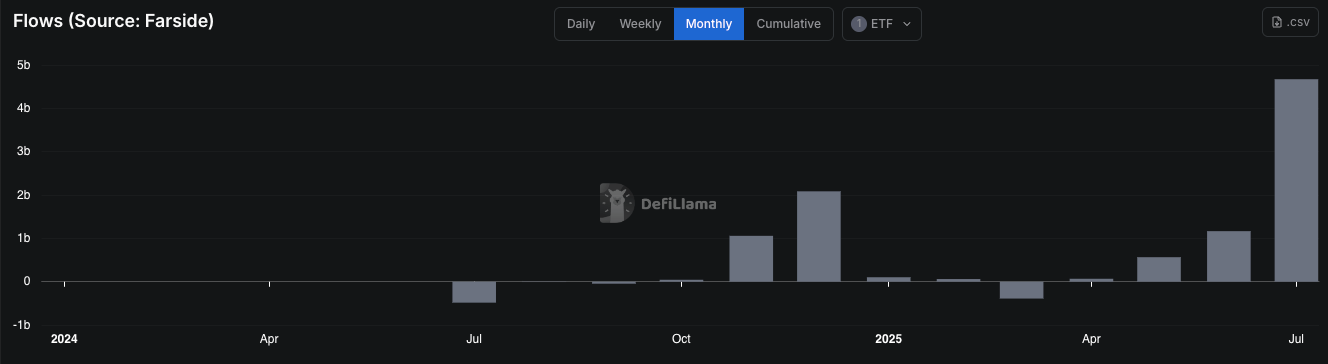

ETF Flows

Spot BTC ETFs

- Day by day internet flows: $226.7 million

- Cumulative internet flows: $54.67 billion

- Complete BTC holdings ~1.29 million

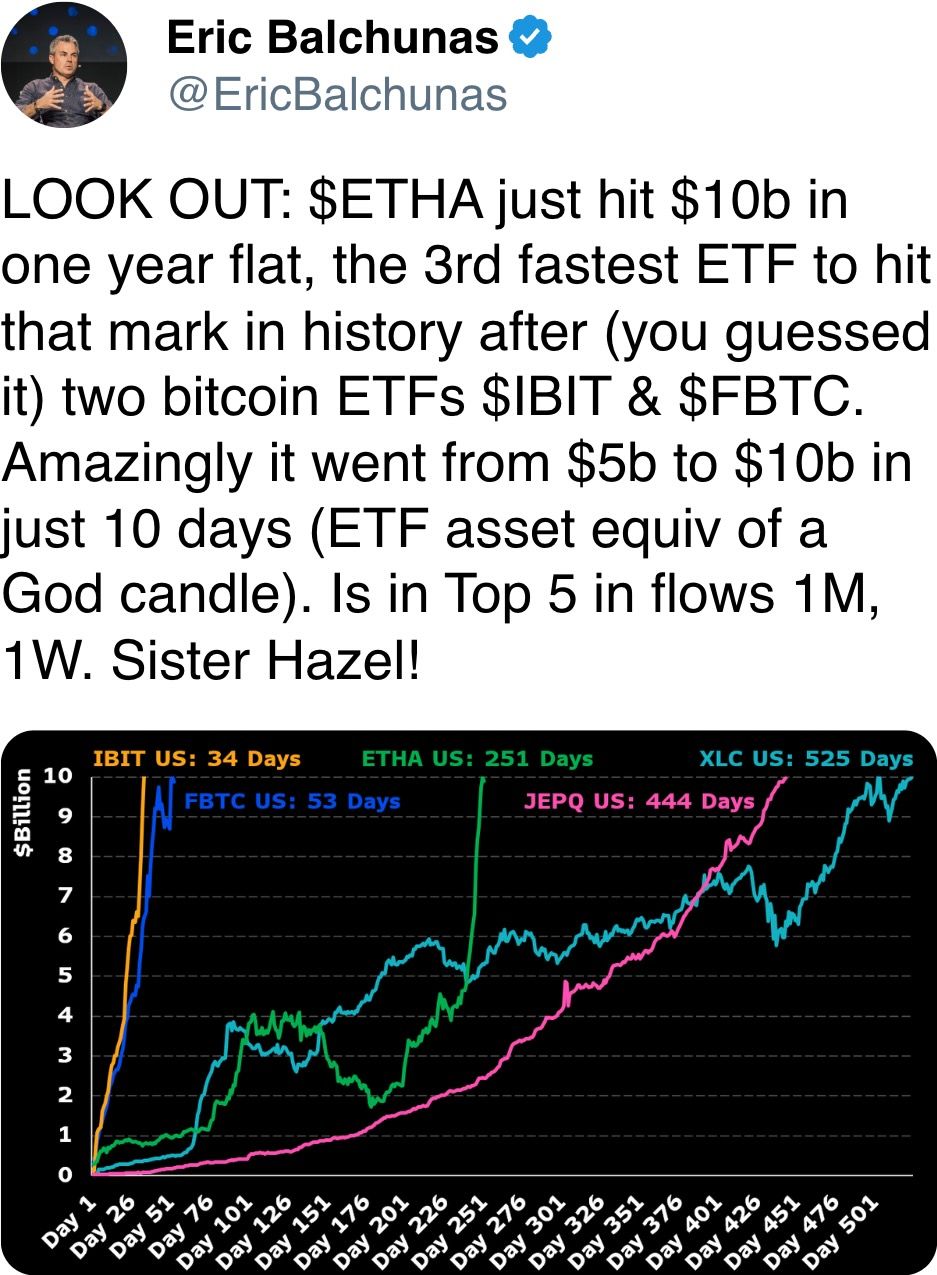

Spot ETH ETFs

- Day by day internet flows: $231.2 million

- Cumulative internet flows: $8.9 billion

- Complete ETH holdings ~5.34 million

Supply: Farside Buyers

In a single day Flows

Chart of the Day

- Spot ether ETFs within the U.S. have recorded $4.67 billion in internet inflows in July alone, surpassing the whole cumulative internet inflows of $4.23 billion amassed from inception by June.

Whereas You Have been Sleeping

- Trump’s Tariffs Are Being Picked Up by Company America (The Wall Avenue Journal): American corporations are largely delaying worth hikes and absorbing tariff prices for now as international sellers provide restricted reduction and President Trump’s commerce offers add uncertainty over who finally pays.

- Iran Begins New Talks At this time Over Its Nuclear Program. Right here’s What to Know. (The New York Instances): European officers resumed talks with Iran in Istanbul, warning they’ll restore suspended U.N. sanctions by the tip of subsequent month if Tehran doesn’t reengage with the U.S. and curb uranium enrichment.

- Bitcoin to Hit $135K by 12 months-Finish in Base-Case Forecast, $199K in Bullish State of affairs: Citi (CoinDesk): Within the financial institution’s most bearish setup, the forecast drops to $64,000.

- Corporations Load Up on Area of interest Crypto Tokens to Enhance Share Costs (Monetary Instances): Some public corporations are turning to altcoin treasuries to distinguish and enhance valuation. Analysts say this speculative development presents no long-term answer for companies already dealing with monetary misery.

- Volmex’s Bitcoin and Ether Volatility Futures High $10M Quantity Since Debut as Merchants Look Past Value (CoinDesk): Merchants are utilizing these just lately launched merchandise on the decentralized platform to precise views on market turbulence with out taking a directional stance on BTC/ETH costs or managing complicated possibility methods.

- Digital Belongings Agency OSL Raises $300 Million to Develop Crypto Enterprise Worldwide (Bloomberg): As Hong Kong awaits its stablecoin regulation taking impact Aug. 1, the CFO of certainly one of its earliest licensed exchanges says the brand new funding will assist a broader push into abroad digital asset markets.

Within the Ether