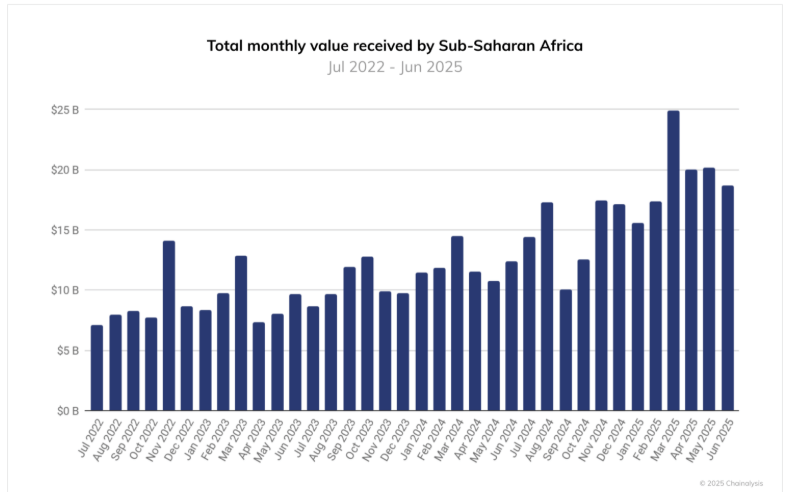

Sub-Saharan Africa noticed a serious spike in crypto exercise in March, reaching $25 billion in month-to-month on-chain quantity—pushed largely by Nigeria’s centralized change utilization.

Nigeria Fuels Sub-Saharan Africa’s Crypto Development

In March, Sub-Saharan Africa (SSA) noticed a pointy surge in cryptocurrency utilization, with month-to-month on-chain quantity reaching practically $25 billion, its highest because the starting of the 12 months. Based on the blockchain safety agency Chainalysis, this spike in exercise defied a downward pattern that was prevailing in different areas on the time.

Within the two months that adopted, nonetheless, the SSA area’s complete month-to-month worth obtained dropped to roughly $20 billion. The area’s quantity has remained above $15 billion because the starting of the 12 months. As anticipated, centralized change exercise in Nigeria accounted for a disproportionate share of the $25 billion.

“The surge was pushed largely by centralized change exercise in Nigeria, the place a sudden forex devaluation prompted elevated crypto adoption,” the Chainalysis report states. “Such devaluations sometimes drive volumes greater in two methods: extra customers transfer into crypto to hedge towards inflation, and current purchases seem bigger in native forex phrases because it takes extra fiat to purchase the identical quantity of crypto.”

General, the SSA area obtained over $205 billion in on-chain worth between July 2024 and June 2025, a roughly 52% improve from the earlier 12 months. This progress makes SSA the third-fastest-growing area on this planet, simply behind Asia-Pacific (APAC) and Latin America.

Bitcoin and Stablecoins Dominate

Throughout the identical interval, bitcoin ( BTC) dominated fiat-based crypto purchases within the area, accounting for 89% in Nigeria and 74% in South Africa—far above the 51% seen in USD-based markets. Based on Chainalysis, this pattern displays BTC’s function as each a retailer of worth and a main gateway to crypto, particularly in areas with forex volatility and restricted funding choices.

“Conversely, USDT adoption can also be extra pronounced in Nigeria than in USD markets, accounting for 7% of purchases versus simply 5% within the USD cohort,” the report added.

Chike Okonkwo, advertising and marketing supervisor on the crypto change YDPay, attributed BTC’s dominance in Nigeria to 2 realities: belief and accessibility. Okonkwo additionally defined why Nigerians are significantly eager on bitcoin and stablecoins like USDT.

“Nigerians are very pragmatic of their adoption of crypto. Bitcoin is most well-liked as a result of it’s globally acknowledged, liquid, and has confirmed its resilience over time,” Okonkwo defined. “Stablecoins, however, attraction to customers who need dollar-denominated financial savings with out the hurdles of restricted or restricted FX entry. This pattern highlights what issues most to Nigerians: safety from inflation, quick entry to worth, and reliability.”

Based on Okonkwo, ethereum (ETH) and different altcoins are largely seen as extra appropriate for buying and selling as a method of producing additional revenue.