Retail Bitcoin merchants made themselves heard at this time, inflicting $700 million in crypto liquidations. The value of BTC fell by round $4,000 as on-chain exercise spiked, though establishments stored shopping for.

Whether or not or not BTC retains dropping or recovers quickly, we have to take note of these dynamics. Company liquidity may be very influential available in the market, but it surely’s not the ultimate arbiter of value.

Bitcoin Causes Shock Liquidations

When Bitcoin hit two successive all-time highs earlier this week, it brought about slightly consternation in the neighborhood. This happened regardless of an absence of retail exercise, with institutional buyers powering the expansion.

Crucially, these companies continued making enormous purchases whereas BTC’s worth was inflated.

In different phrases, there have been fears that these inflows may profoundly alter market cycles. Arthur Hayes even proclaimed that the four-year cycle was lifeless and that international institutional liquidity would decide token costs now.

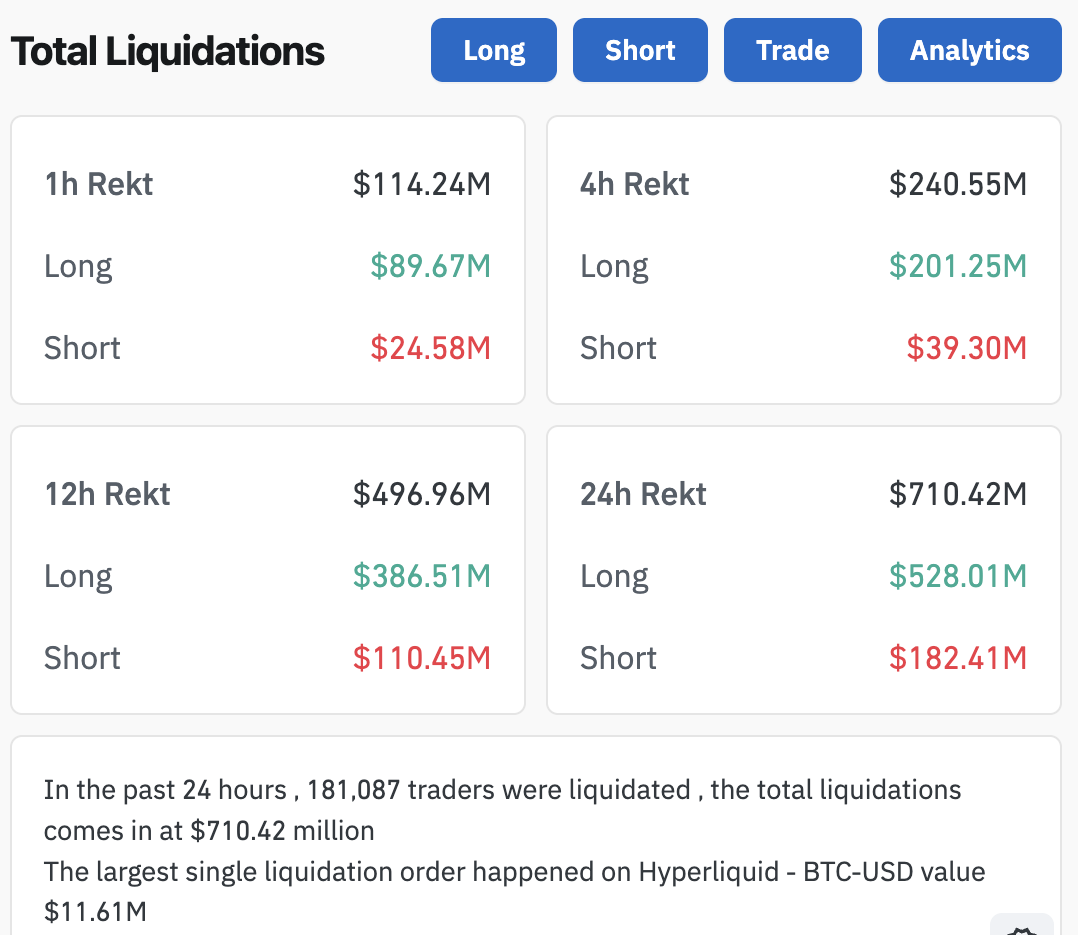

Right this moment, nevertheless, these issues appear much less severe. Bitcoin fell round $4,000 within the final 24 hours, spawning a frenzy of crypto liquidations. Over $114 million in complete quick positions have been eradicated in a single hour:

Bitcoin Drops Trigger Liquidations. Supply: CoinGlass

Retail Merchants’ Affect

Just a few key elements recommend that retail Bitcoin merchants brought about all these liquidations. For one factor, ETF issuers continued shopping for BTC at elevated charges, and the merchandise are seeing enormous inflows. In the meantime, BTC’s on-chain buying and selling exercise has spiked between 4% and 5%, exhibiting that exercise is stirring awake.

Analysts have already recognized a few of the probably causes for Bitcoin’s retreat to $120,000, which triggered these liquidations. They appear like fairly commonplace value actions; long-term merchants are taking earnings, holder accumulation charges sparked low confidence, and many others.

Moreover, there are even indicators that BTC may rebound within the close to future.

This, too, presents a helpful alternative to assemble helpful market information. These new structural forces are very {powerful}, however they aren’t omnipotent.

Retail exercise nonetheless spurred a serious Bitcoin value dump, inflicting a cascade of liquidations. What new narratives can assist clarify this habits and allow correct predictions?

Whether or not Bitcoin retains going up or down, these questions must be on the forefront of merchants’ minds. These establishments are apparently going to maintain stockpiling Bitcoin both method.

The submit $100 Million Misplaced in One Hour: Bitcoin Drops Spark Rampaging Liquidations appeared first on BeInCrypto.