Bitcoin’s provide on exchanges has fallen to its lowest stage, elevating expectations for a possible spike in volatility.

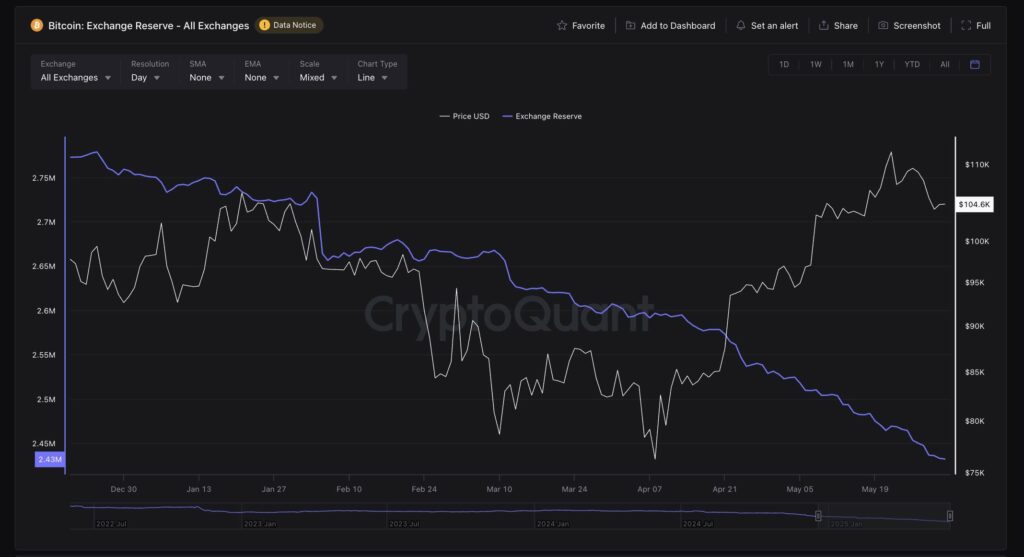

In line with knowledge from CryptoQuant, the whole quantity of Bitcoin (BTC) held throughout all centralized exchanges decreased to only beneath 2.5 million BTC as of late Might 2025. This regular drop has been accompanied by a powerful value rally, with Bitcoin most just lately reaching a brand new all-time excessive above $111,500.

The info signifies a big divergence between trade reserves and costs. Whereas the amount of Bitcoin held on exchanges has been declining, its worth has elevated. On the CryptoQuant chart, that is illustrated by a white line transferring upward for value, and a blue line sloping downward for reserves.

Bitcoin value vs. trade reserves. Credit score: CryptoQuant

Traditionally, a declining provide of Bitcoin on exchanges has pushed up costs, significantly when demand is excessive. That is seen by many analysts as a sign that the market could also be about to enter a brand new section, the place sharper strikes in both course are fueled by restricted provide.

You may also like: Bitcoin value goal: $113k in sight if uncommon harmonic sample completes

Institutional accumulation seems to be taking part in a significant position within the present market construction. Giant holders, together with wallets with between 1,000 and 10,000 BTC, have been steadily accumulating, with a lot of the BTC being despatched to chilly storage.

Technique added 7,390 BTC in Might, bringing its complete holdings to 576,230 BTC, roughly 2.75% of complete provide, acquired at a median value of $69,726. Different public firms, together with GameStop and Japan-based Metaplanet, have additionally been actively including to their holdings.

In the meantime, spot Bitcoin exchange-traded funds introduced in $5.23 billion in inflows over the previous month, based on SoSoValue knowledge. A number of governments are following swimsuit. The UAE and Pakistan have stepped up their accumulation efforts, whereas U.S. lawmakers are discussing the creation of a nationwide Bitcoin reserve.

From a technical perspective, Bitcoin seems to be in a wait-and-see section. Momentum indicators are combined. The relative power index stands at 52, displaying impartial momentum, whereas the transferring common convergence divergenc has turned barely bearish. Brief-term transferring averages point out some downward stress however the longer-term outlook stays intact.

Bitcoin value evaluation. Credit score: crypto.information

Bitcoin is buying and selling nicely above the 200-day EMA and SMA, that are each on an upward pattern. The rally could proceed towards $110,000 or larger if Bitcoin is ready to recuperate its short-term transferring common of round $106,000. Nevertheless, a decline towards $98,000 and even $94,000 is feasible whether it is unable to take care of assist.

Learn extra: Bitcoin value pulls again as analysts tout $1m–$2.4m potential