Bitcoin traded beneath $110,000 on Sept. 26 amid bearish sentiment and ETF outflows, however analysts see potential for restoration if macro situations enhance.

Analyst Views on the Bearish/Bullish Consequence

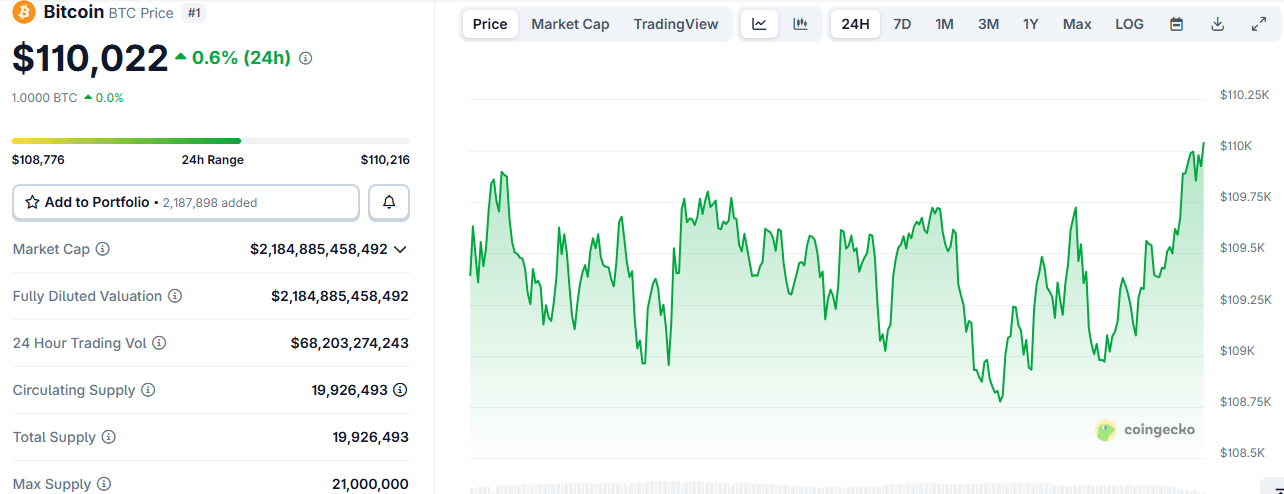

On Sept. 26, bitcoin ( BTC) continued to commerce beneath $110,000 as bearish sentiment swept throughout the cryptocurrency market. In accordance with Coingecko knowledge, the highest crypto asset dipped beneath $109,000 at the least 3 times through the day, with $109,724 marking its intraday excessive.

The highest cryptocurrency’s decline—which introduced its weekly losses to just about 6%—mixed with marginal losses from high-cap altcoins comparable to XRP and BNB, dragged the full crypto market capitalization down 0.8% to $3.85 trillion. Since Sept. 18, when BTC almost reached $118,000, the crypto asset has fallen 7.5%, and a few analysts count on additional draw back within the coming weeks.

BTC’s temporary plunge beneath $109,000 has been interpreted by some market watchers as an indication of overheating and a possible shift right into a slowdown part. Supporting this view, Arthur Azizov, founder and investor at B2 Ventures, pointed to exchange-traded fund (ETF) flows, which he mentioned went down by 50% over the previous week. Azizov additionally pointed to the Worry and Greed Index, which he mentioned is at its lowest degree since spring. He warned of a doable additional decline earlier than BTC resumes its rally.

“Technically, the $108,000–$108,500 zone is vital to observe. In July, consolidation right here triggered a rally to $123,000, and in late August it preceded a surge to $117,000. This time, nonetheless, bears are eyeing the $90,000–$95,000 degree,” he mentioned.

Market Liquidation and Structural Demand

Different analysts argue that BTC’s worth motion this month aligns with historic patterns. Bitcoin sometimes underperforms in September, reserving stronger performances for October, and 2025 seems to be no exception. Analyst Cryptobirb additionally warned that the so-called “September Curse” tends to accentuate towards the top of the month.

As reported by Bitcoin.com Information, the market downturn on Sept. 22 triggered the liquidation of $1.7 billion in leveraged positions—the biggest single-day wipeout to date this 12 months. As proven by Coinglass knowledge, one other $1 billion in leveraged bets was erased on Sept. 25, with lengthy positions accounting for almost all.

In the meantime, Gadi Chait, head of funding at Xapo Financial institution, mentioned structural demand traits recommend BTC’s pullback is “extra of a tactical pause than a pattern reversal.” He added that cryptocurrency’s present consolidation displays a maturing market digesting latest volatility and one that would rally if macroeconomic uncertainty clears.

“Institutional sentiment has been blended: after $977 million in Bitcoin ETF inflows final week, we noticed a pointy reversal with $363 million in outflows on Sept. 22—probably profit-taking—earlier than stabilizing at impartial the next day. This exhibits institutional demand stays sturdy however delicate to coverage shifts and leveraged place unwinding,” Chait mentioned.

As of 1:20 p.m. EST, Bitcoin ( BTC) had climbed above $110,000 and appeared poised for additional features.