Bitcoin’s derivatives market motion confirmed robust engagement this weekend as futures open curiosity surged previous $82 billion, whereas choices exercise mirrored a slight bullish tilt.

Bitcoin Derivatives Market Expands as Spot Value Consolidates

Throughout the morning buying and selling periods, bitcoin was buying and selling at $117,860 in spot markets, with an intraday vary between $116,956 and $118,493. Futures exercise remained the point of interest of derivatives buying and selling, with open curiosity (OI) totaling 699,620 BTC, or about $82.44 billion in notional worth.

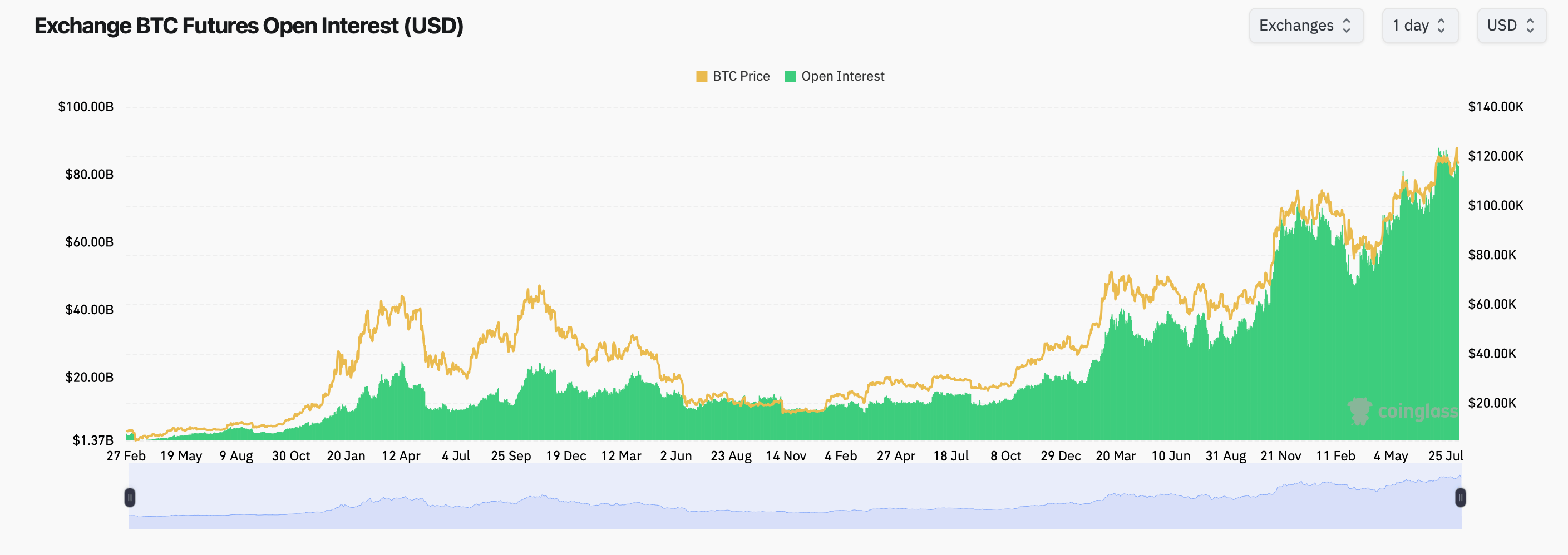

Bitcoin futures open curiosity, in keeping with coinglass.com stats on Aug. 16, 2025.

CME Group continued to guide the market with $17.1 billion in open curiosity, accounting for 20.7% of complete positioning. Binance adopted with $15.07 billion, whereas Bybit held $9.66 billion. Amongst notable adjustments, Gate’s futures open curiosity rose sharply over the previous day, climbing greater than 21%, whereas Binance and OKX noticed declines of two.4% and 4.5%, respectively.

The broader development exhibits regular development in futures publicity, with CoinGlass knowledge indicating a robust correlation between bitcoin’s spot value and the rising stage of open curiosity. The present trajectory locations mixture futures exercise close to all-time highs, highlighting elevated participation from each institutional and retail merchants.

On the choices facet, Deribit remained the dominant venue, with the biggest open curiosity concentrated in December 2025 contracts. The one largest place was the $140,000 name expiring Dec. 26, with greater than 10,800 BTC in open contracts. Different high-interest strikes embody $200,000 calls and $95,000 places.

Total, choices open curiosity stood at 407,278 BTC, with calls representing 61.4% of excellent contracts in contrast with 38.6% for places. Nonetheless, buying and selling quantity over the previous 24 hours leaned barely bearish, with places making up 53.9% of exercise. The divergence suggests buyers are positioning for potential upside over the long run, whereas hedging near-term draw back danger.