Bitcoin’s value is present process a market correction. On Tuesday, it retreated to $107,000 after briefly breaking above $111,000 the day gone by.

On-chain information analysts now establish the present value vary as a vital inflection level. This level will decide whether or not the asset maintains its bullish development or faces a average, medium-term correction.

A Vital Juncture for Bullish Momentum

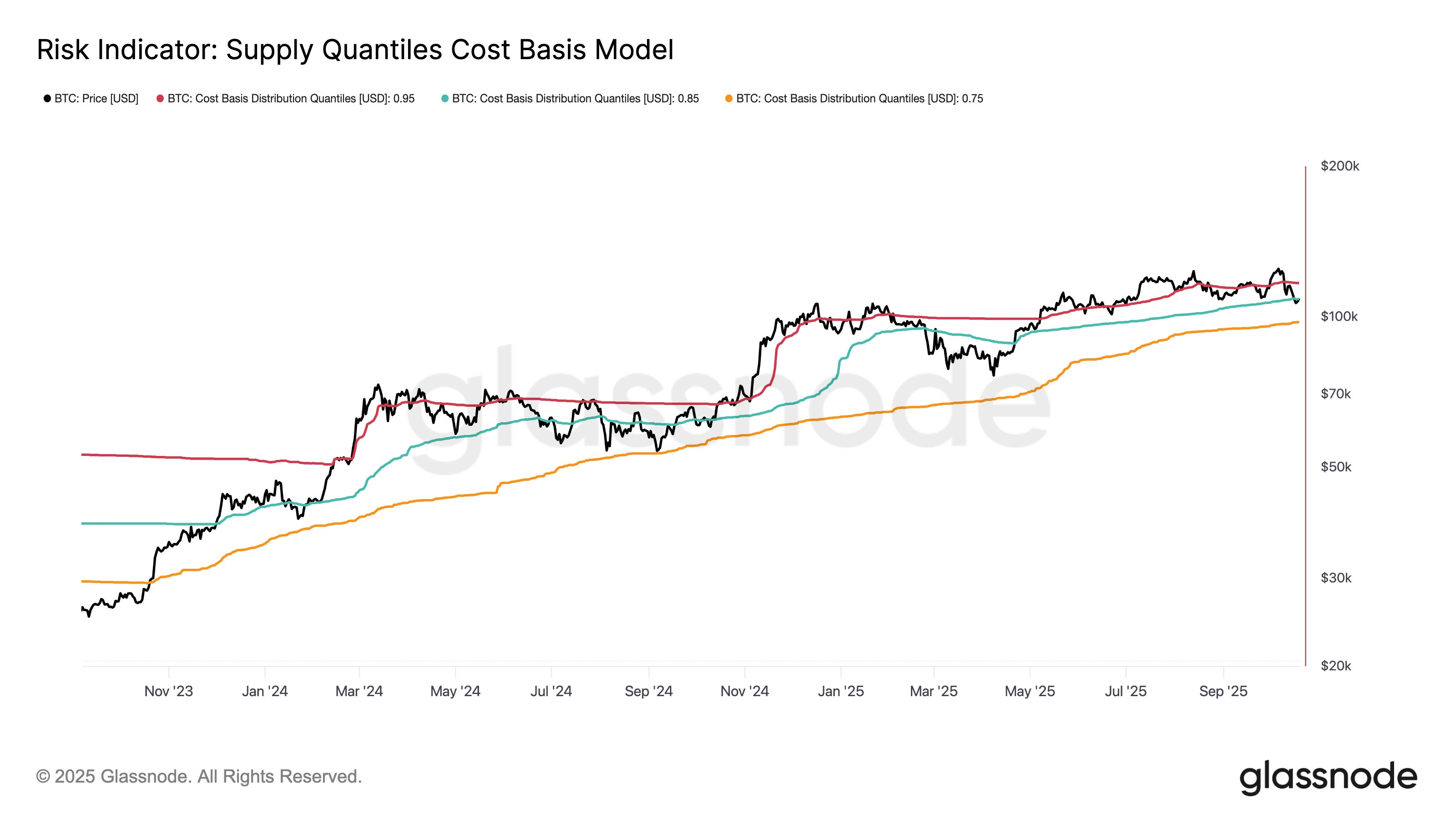

On-chain information evaluation platform Glassnode highlighted this example by sharing its Price Foundation Distribution Quantile Mannequin chart on X.

This mannequin analyzes the distribution of Bitcoin buyers’ acquisition prices to evaluate the probability of profit-taking on the present value stage. In contrast to conventional technical evaluation, this software makes use of precise blockchain information to establish accumulation patterns, providing a extra exact view of institutional help and resistance zones.

The chart options a number of quantile strains, such because the 0.95 line (Purple). This line represents the common value paid by the highest 5% of Bitcoin holders—these with the very best price foundation.

Danger Indicator: Provide Quantiles Price Foundation Mannequin. Supply: Glassnode

When the Bitcoin value strikes above this 0.95 line, it alerts an overheated market and a high-risk zone the place revenue realization (promoting) will possible enhance. Conversely, when the value drops under the 0.95 line, the market enters a development transition or equilibrium state. That is exactly the place Bitcoin landed after the October 10 flash crash.

The Pivot Level: The 0.85 Quantile

The present value stage is hovering close to the 0.85 quantile boundary. It is a type of key help. A sustained break under this line is usually interpreted as an expanded danger of a medium-term correction.

Glassnode cautioned, “If patrons can maintain this zone, momentum can rebuild from right here. However lose it once more, and the market possible revisits decrease territory. It is a pivotal space to look at.”

Derivatives Merchants Place for Additional Draw back

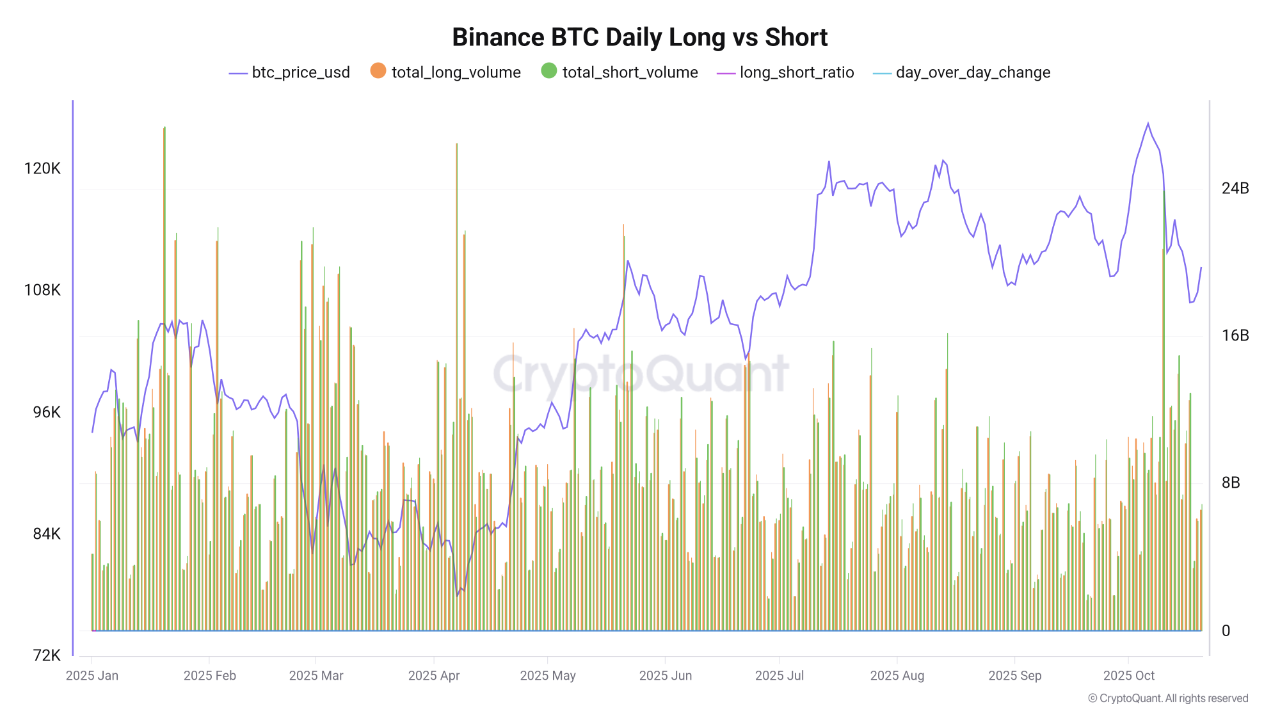

Investor sentiment on Binance, the biggest cryptocurrency derivatives platform by quantity, additionally leans towards anticipating additional changes.

Arab Chain, an analyst at CryptoQuant, famous, “October noticed a rise in Bitcoin futures buying and selling quantity on Binance, with sellers dominating most days till yesterday.”

Binance BTC Each day Lengthy vs Brief. Supply: CryptoQuant

Binance Bitcoin futures positions are at the moment barely tilted towards the sell-side, shifting from a close to 50:50 steadiness. The present lengthy/brief ratio sits at 0.955, and the Day-over-Day Change (DOC) of -0.063 alerts a deceleration of optimistic momentum.

Arab Chain concluded, “Total, the present information displays a fragile steadiness between patrons and sellers, barely tilted in favor of promoting stress. If this development continues, it might pave the best way for additional corrections until the market exhibits renewed shopping for exercise or stronger institutional demand within the coming days.”

The submit Bitcoin Hits Key Assist; Analysts Warn of Deeper Correction appeared first on BeInCrypto.