The day after President Trump publicly confirmed U.S. airstrikes on Iranian navy installations, bitcoin confirmed indicators of investor hesitancy regardless of holding above key assist at $102,000. As of June 22, 2025, bitcoin is buying and selling at $102,700 to $102,810, giving it a market capitalization of $2.04 trillion and 24-hour commerce quantity totaling $31.32 billion. Value motion remained risky inside the $100,945 to $103,939 intraday vary, highlighting a market balancing between geopolitical threat and technical boundaries.

Bitcoin

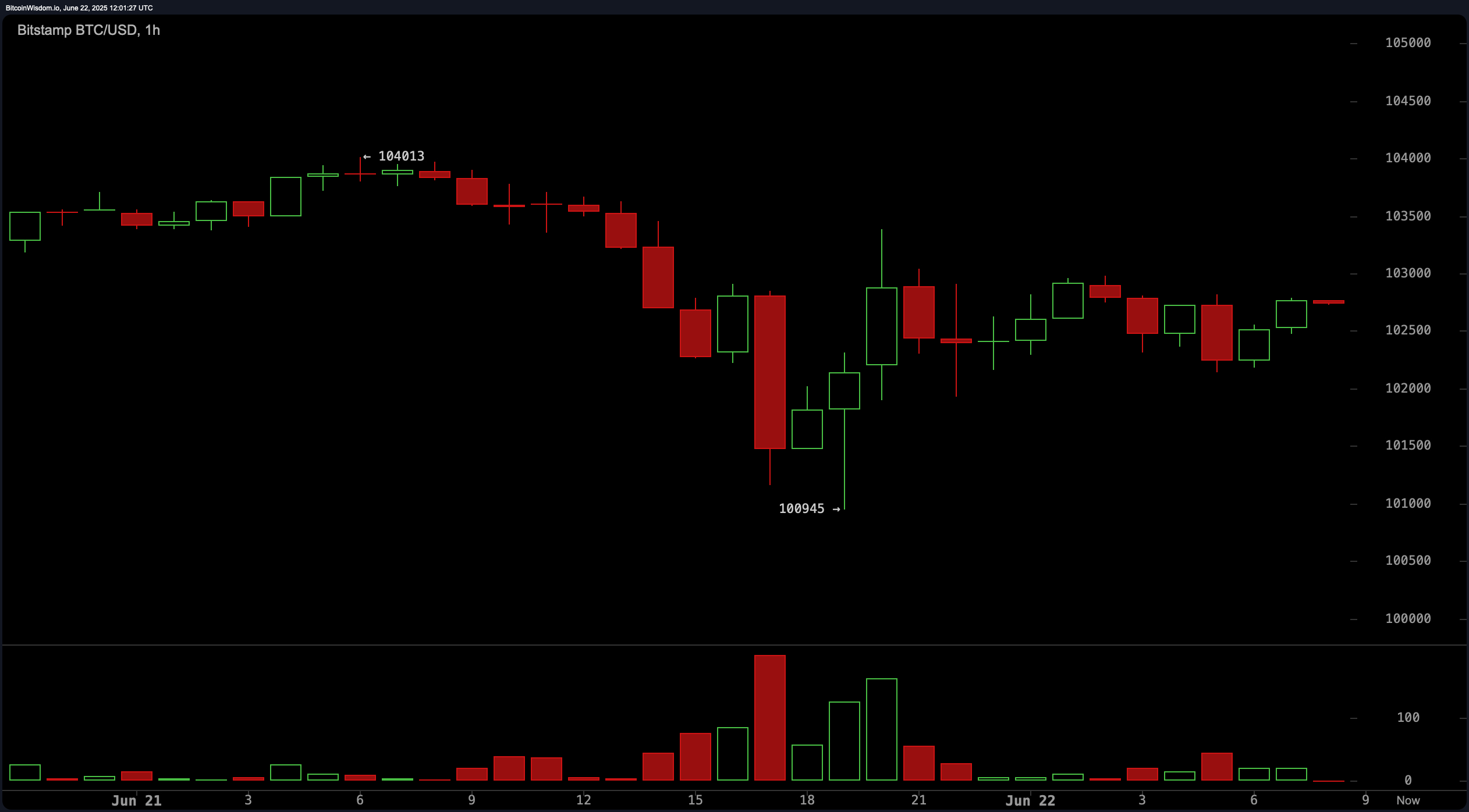

On the 1-hour chart, bitcoin is making an attempt to stabilize following a drop to $100,945, with a visual consolidation sample hinting at a double backside formation. The neckline close to $103,000 is important—any breakout above this stage, significantly on rising quantity, may goal the $104,000 to $104,500 vary. Nevertheless, if the assist at $100,945 fails to carry, draw back targets between $98,500 and $99,000 turn into possible. Quantity has picked up on inexperienced candles, suggesting short-term shopping for curiosity, but it surely lacks the conviction typical of a bullish reversal.

BTC/USD 1-hour chart on Sunday, June 22, 2025, by way of Bitstamp.

The 4-hour BTC/USD chart reinforces the prevailing short-term downtrend, with assist once more emphasised at $100,945 and resistance forming close to $104,000 to $105,000. The latest sell-off featured a pointy quantity spike, hinting at both retail panic or institutional exit. Whereas some shopping for has emerged, follow-through has been weak. A retest of $100,945 with diminished quantity may supply a swing lengthy alternative, however failure to carry that zone possible triggers a renewed bearish leg.

BTC/USD 4-hour chart on Sunday, June 22, 2025, by way of Bitstamp.

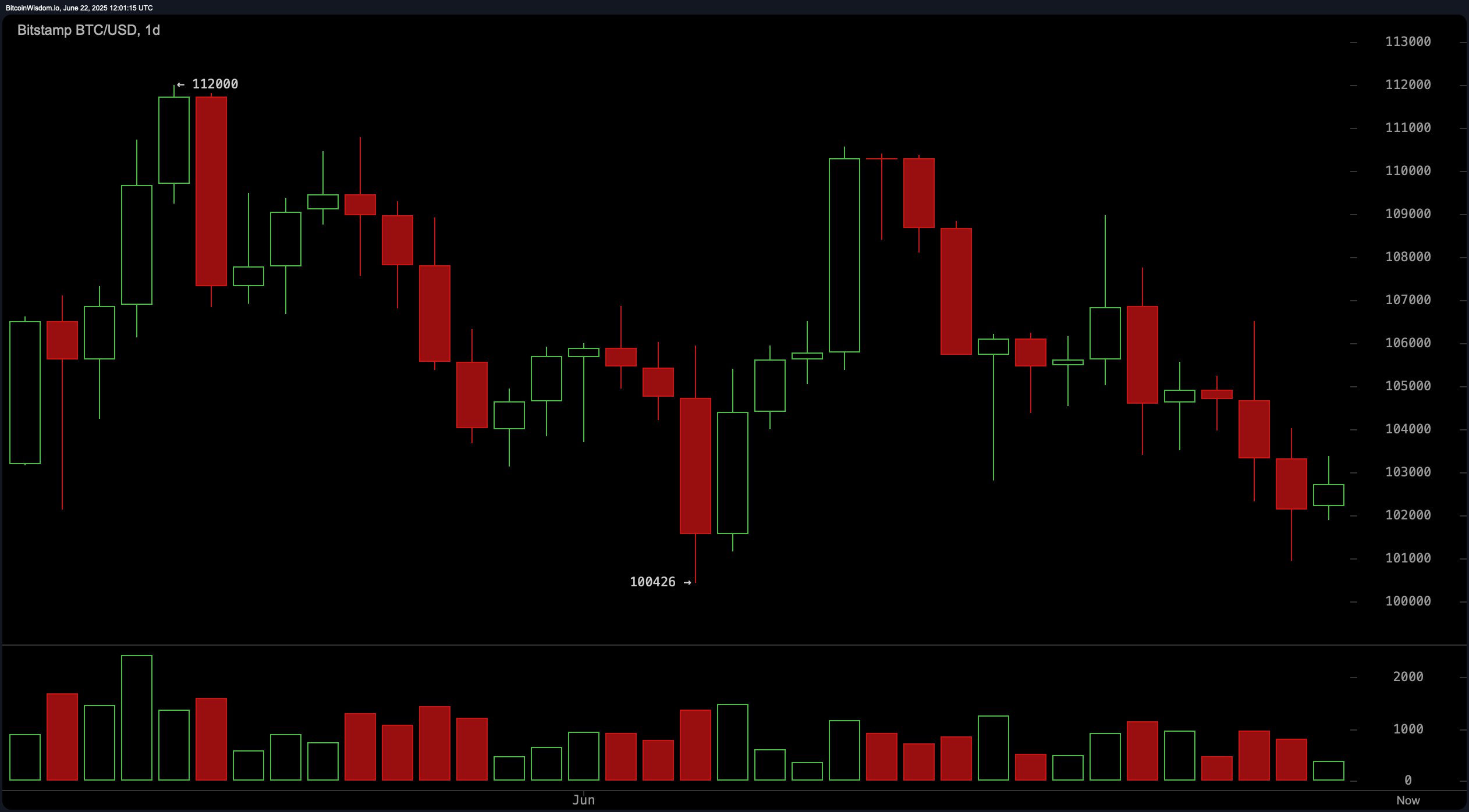

On the day by day timeframe, bitcoin stays in a bearish posture with a transparent descending development channel and up to date crimson candles dominating after a short-lived rally. Resistance round $112,000 stays distant, whereas near-term assist holds simply above $100,400. The construction suggests a decrease excessive–decrease low configuration, sometimes related to a continuation of the downtrend. A bullish reversal close to $100,000 to $101,000 may very well be legitimate if supported by a reversal sample corresponding to a hammer or bullish engulfing, confirmed by rising quantity. With out such affirmation, a break under $100,000 opens the door to a transfer towards $96,000 to $98,000.

BTC/USD 1-day chart on Sunday, June 22, 2025, by way of Bitstamp.

Oscillator indicators current a combined image, including to the general uncertainty. The relative energy index (RSI) sits at 43, signaling impartial momentum. The Stochastic indicator is at 14, additionally impartial, whereas the commodity channel index (CCI) at −125 suggests a possible shopping for alternative. Momentum at −2,980 equally leans towards purchase, whereas the shifting common convergence divergence (MACD) at −368 signifies a bearish sign. The Superior oscillator stays destructive at −2,492 with a impartial stance, reflecting indecision amongst market individuals.

Shifting averages (MAs) are overwhelmingly bearish on the quick to mid-term scales. The exponential shifting common (EMA) and easy shifting common (SMA) values for the 10-, 20-, 30-, and 50-periods are all aligned in promote territory, suggesting continued draw back strain. Nevertheless, longer-term averages such because the EMA (100) at $99,223 and SMA (100) at $95,675 are presently in purchase territory, offering some structural assist beneath present worth ranges. Equally, the EMA (200) and SMA (200) at $93,586 and $95,956 respectively counsel a broader uptrend stays intact. Till short-term sentiment shifts, merchants ought to train warning and watch for clearer indicators earlier than positioning for bigger strikes.

Bull Verdict:

If the $100,945 assist continues to carry and a sustained breakout above $103,000 materializes with robust quantity, bitcoin might mount a short-term restoration. The affirmation of a double backside and potential exhaustion of promoting strain on a number of timeframes may catalyze a reduction rally, particularly if traders search alternate options amid rising geopolitical tensions.

Bear Verdict:

Regardless of the technical setups for a bounce, bitcoin stays susceptible to additional losses given the prevailing bearish momentum and lack of quantity affirmation. The dominance of promote indicators throughout short- and mid-term shifting averages and oscillators underlines persistent weak spot. The geopolitical shock of U.S. airstrikes on Iran introduces elevated systemic threat; if this spirals into wider battle or market panic, bitcoin might break under $100,000, triggering a slide towards $96,000 or decrease within the close to time period.