Foundry USA unexpectedly mined eight Bitcoin blocks in a row, a streak that stood out on explorers’ and social feeds. Controlling roughly a 3rd of the community’s hashrate, the pool’s run was unlikely however nonetheless doable.

Abstract

- Foundry USA mined eight Bitcoin blocks straight, from heights 910,500 to 910,507, in a run that grabbed crypto feeds.

- With roughly 36% of the community’s hashrate and a few 30% share of lively pool exercise, the percentages of this streak had been round 1 in 12,000 — however nonetheless throughout the realm of likelihood.

- The run reveals how a couple of massive swimming pools can briefly seize a number of blocks in a row, underlining ongoing centralization considerations in Bitcoin mining.

A uncommon streak of eight consecutive Bitcoin (BTC) blocks — from heights 910,500 to 910,507 — briefly drew consideration throughout feeds and block explorers. The repeated look of a single miner made the sample exhausting to disregard. The consecutive blocks had been placing: one mining pool, Foundry USA, appeared throughout eight entries in a row, the sample that was so clear and straightforward to note, that it shortly turned the main focus of consideration.

Measurement issues

As of late 2024, Foundry USA managed roughly 36.5% of the Bitcoin community’s complete hashrate, translating to about 280 exahashes per second (EH/s). This dominance positions Foundry USA as the biggest mining pool globally, surpassing opponents like Chinese language Antpool and Luxor Pool.

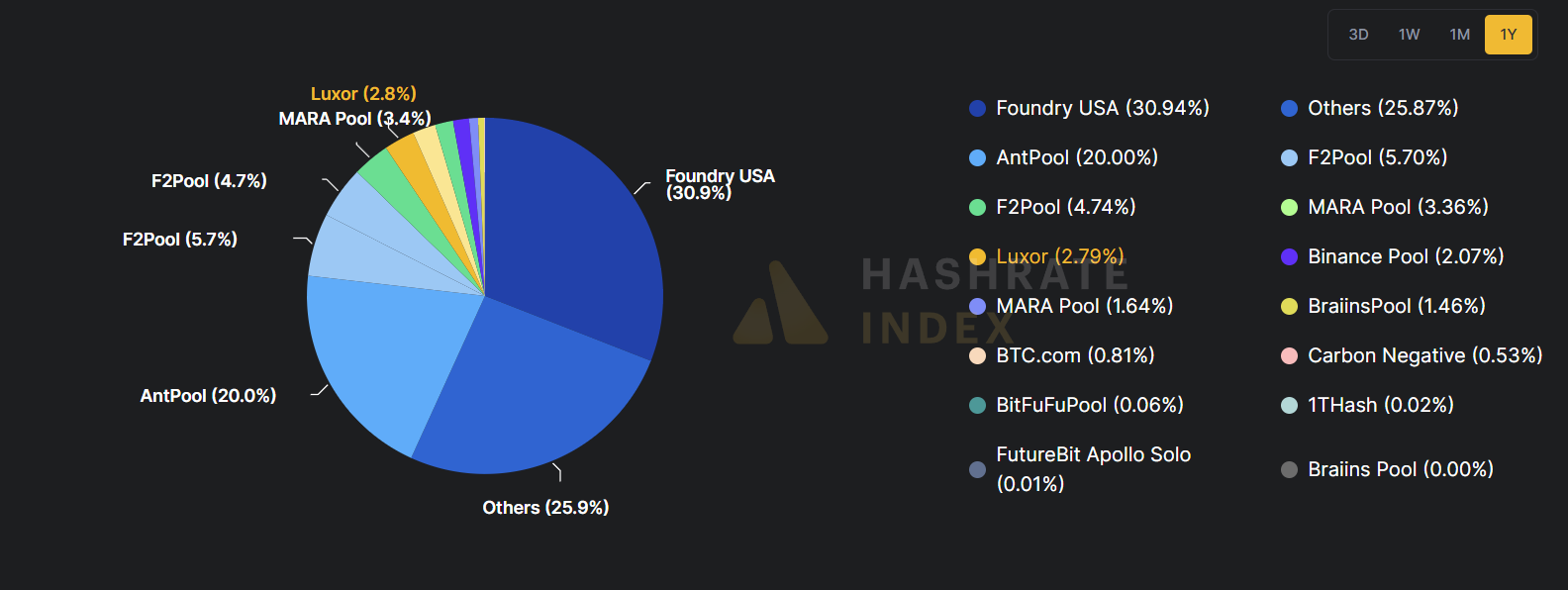

Mining swimming pools by their share | Supply: Hashrate Index

As of press time, Foundry USA is reported to be one of many largest public mining swimming pools, showing on most trackers with roughly a 31% share of reported pool exercise, per knowledge from Hashrate Index. That reported slice meant Foundry USA was plausibly discovering about three out of each 10 blocks on common in that interval. The pool’s relative scale is the fundamental factual context that frames the streak as notable fairly than inexplicable.

- A fast calculation utilizing a ~30% pool share reveals the percentages of the identical pool mining eight consecutive blocks are roughly 0.008%, or about 1 in 12,000.

In different phrases, the streak was uncommon however not unprecedented. It appeared like a fortunate roll of the cube for an enormous pool, not a takeover of the community.

Low-fee backdrop

The run occurred amid reviews and block-explorer snapshots displaying unusually low transaction charges and plenty of calmly crammed blocks in current moments. Payment charges had been usually reported in low single digits of satoshis per digital byte, and quite a few current blocks carried a comparatively small variety of transactions.

You may additionally like: Bitcoin miners might discover higher returns in AI than crypto, Novogratz’s Galaxy Digital suggests

In that surroundings, miner income leaned closely on the fastened subsidy fairly than on charges, and any miner that occurred to seize a number of consecutive blocks would repeatedly acquire the identical normal subsidy whereas including little additional payment earnings for every block.

Every of the eight blocks carried the acquainted structural parts recorded throughout all mined blocks:

- a header;

- a coinbase reward;

- and no matter transactions occurred to be included.

The notable element within the public report was merely the repeated attribution to a single pool throughout successive heights. That repetition, seen in explorers and mempool logs, produced the clear knowledge level that circulated: a contiguous vary of blocks credited to Foundry.

Historic parallels

There have been precedents for sharp public reactions when single swimming pools approached massive fractions of hashing energy.

Earlier episodes in Bitcoin’s historical past drew comparable consideration when outstanding swimming pools dominated a big share of reported capability. These moments prompted public scrutiny and generally fast responses from operators and the broader group. The chain continued to report its blocks in the identical approach by means of these episodes, leaving the general public report as the first proof.

Seeing the identical pool listed for eight blocks in a row appeared placing as a result of it gives the look of concentrated energy. That sample made some fear about centralization, despite the fact that the mathematics confirmed it was throughout the regular vary for an enormous pool.

Foundry USA simply mined eight blocks consecutively. That is extraordinarily alarming! Even many Bitcoiners I do know are beginning to panic.

I’ve been warning folks for years: Bitcoin is dangerously centralized. A tiny group of miners and insiders dominate each the community and its worth,… pic.twitter.com/OOYo17X9Rn

— Jacob King (@JacobKinge) August 18, 2025

The episode settles into the bigger movement of anomalies and a spotlight cycles that repeatedly move by means of the house. As CoinMetrics options engineer Parker Merritt wrote earlier, Bitcoin mining pool centralization stays a “top-of-mind concern within the Bitcoin group,” as even at face worth, the overwhelming majority of mining rewards “being funneled to only two swimming pools (Foundry & AntPool) elevates danger components like censorship and community disruption.”

Learn extra: Bitcoin mining faces surging energy calls for and record-low charges