Bitcoin enters mid-2025 consolidating slightly below all-time highs, navigating a turbulent 12 months marked by deep macro and geopolitical volatility. The 12 months started with US President Donald Trump’s renewed tariff insurance policies, which rattled world commerce relationships and pressured threat property. Rising US Treasury yields quickly adopted, elevating issues of systemic fragility as inflationary stress collided with tightening liquidity. Most just lately, the outbreak of direct battle between Israel and Iran has escalated concern throughout monetary markets, prompting a shift towards secure havens like gold.

Amid this backdrop, Bitcoin has remained resilient, at present consolidating above the $100,000 mark after peaking at $112,000 earlier within the 12 months. Whereas some buyers concern elevated promoting stress because of world instability, others consider the present construction factors to power relatively than weak spot. In response to prime analyst Ted Pillows, nothing has essentially modified for BTC. His technical perspective argues that Bitcoin continues to be mirroring gold’s long-term trajectory and stays on the right track for one more breakout within the coming weeks.

With inflation dangers nonetheless current, fiat issues rising, and capital rotating towards scarce property, many are watching Bitcoin not as a speculative play, however as a macro hedge. A breakout above $112K might set off the subsequent explosive transfer.

Bitcoin Volatility Spikes As Macro Strain Builds

Bitcoin is holding agency above $103,000 regardless of failing to interrupt the $112,000 all-time excessive final week. The rejection led to a pointy 6% correction, with bears trying to power the worth under key demand zones. But, regardless of intense macro stress and escalating geopolitical threat, Bitcoin stays structurally intact. The battle between Israel and Iran has despatched shockwaves by world markets, pushing safe-haven property like oil and gold greater whereas equities waver. Bitcoin, typically seen as digital gold, has surprisingly proven power amid the chaos.

The upcoming week might be pivotal for BTC. If tensions worsen and conventional markets slide additional, Bitcoin’s conduct will check its evolving function as a macro hedge. Buyers are watching intently to see whether or not capital continues to rotate into BTC throughout risk-off situations.

Ted Pillows stays optimistic. His technical evaluation means that nothing has structurally modified for Bitcoin. In response to his view, BTC is monitoring intently with gold’s historic breakout patterns, implying that the digital asset is merely consolidating earlier than one other leg up. Pillow’s long-term outlook sees Bitcoin concentrating on $160,000–$180,000 by the cycle prime.

BTC Consolidates Under Resistance

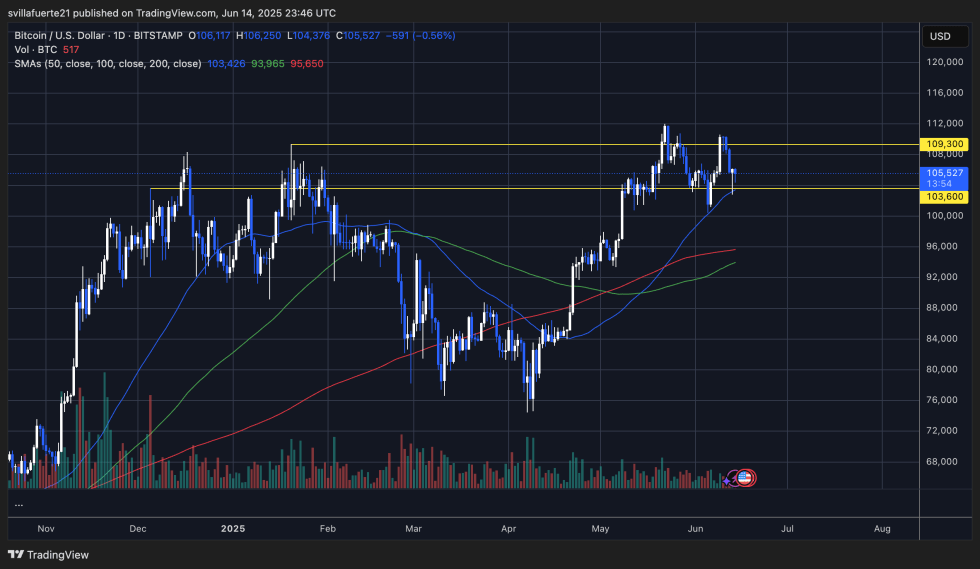

Bitcoin is at present buying and selling at $105,527 after a failed try to interrupt by the $112,000 stage earlier this month. The chart reveals a transparent rejection from that all-time excessive space, pushing value again into the $103,600–$109,300 vary. This zone stays the first battleground between bulls and bears.

The 50-day transferring common, at present round $103,426, is appearing as dynamic assist, whereas the 200-day MA close to $95,650 stays a broader trendline for longer-term holders. Quantity has barely decreased through the current drop, which might point out that the sell-off lacks robust conviction from market individuals.

If BTC holds the $103,600 stage—a earlier resistance now flipped assist—it might set the stage for one more push towards $109,300. A breakout above that stage would doubtless open the door for value discovery above $112,000. Nevertheless, if Bitcoin fails to carry the $103,600 space, it dangers falling again into the $97,000–$100,000 area the place earlier demand was examined in Might.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.