Following one other rejection on the $120,000 stage, Bitcoin (BTC) is starting to point out indicators of cooling off – doubtlessly setting the stage for one more rally within the second half of the yr. Some analysts now predict that BTC’s subsequent prime may method $150,000.

Bitcoin’s Present Overheating Part Quick-Lived

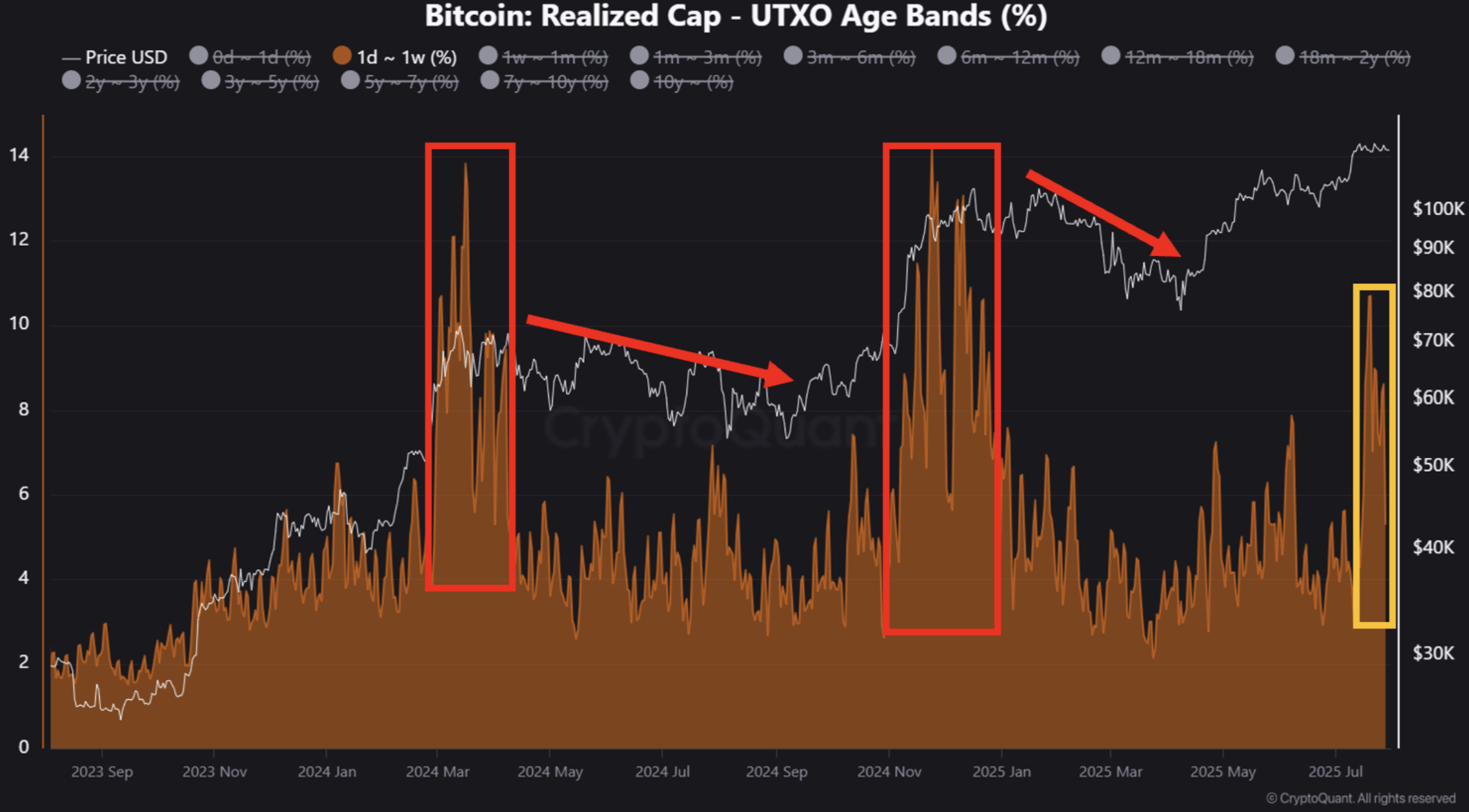

In keeping with a CryptoQuant Quicktake submit by contributor Crypto Dan, Bitcoin is at the moment getting into a cooling-off interval after a short-term overheating part. The warning indicators are most evident within the cohort of BTC held for sooner or later to at least one week.

Crypto Dan shared the next chart exhibiting that this short-term holding cohort is now recording successively decrease spikes, suggesting that overheated market circumstances are easing.

The analyst in contrast the present surroundings to earlier overheating phases seen between March-October 2024 and January-April 2025. In each cases, the overheating lasted longer and was extra intense (proven in pink bins).

In distinction, the present overheating circumstances (proven in yellow field) present shorter extent and period in comparison with the aforementioned two cases. The analyst added:

Additionally, for the reason that current value improve was comparatively modest, we might even see a milder and shorter correction within the quick time period. Nevertheless, it’s vital to stay affected person and look ahead to a possible uptrend within the second half of 2025.

The rise in BTC’s value throughout the newest rally noticed the digital asset surge from round $108,000 on July 1 to a brand new all-time excessive (ATH) of $123,128 on July 13, earlier than stabilizing across the $117,500 mark on the time of writing.

Is BTC Making ready For Its Subsequent Large Transfer?

As Bitcoin consolidates, a number of analysts counsel the highest cryptocurrency could also be gearing up for a serious transfer – more likely to the upside. Veteran crypto analyst Titan of Crypto famous that Bitcoin is at the moment “in a strain cooker.”

Titan of Crypto shared the next chart, highlighting that Bollinger Bands are tightening whereas volatility is shrinking. On the identical time, the Relative Power Index (RSI) is compressing – typically a precursor to a breakout.

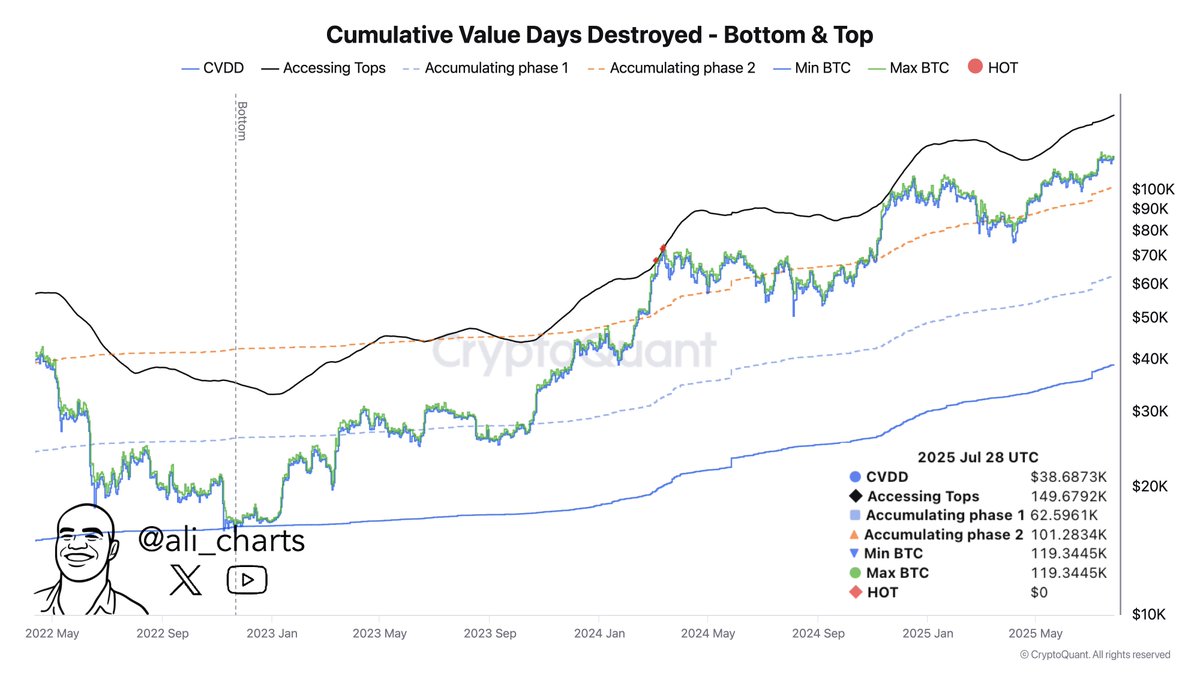

Fellow analyst Ali Martinez added that BTC’s subsequent prime may attain $149,679, based mostly on the Cumulative Worth Days Destroyed (CVD) metric. For context, the CVD metric measures whether or not consumers or sellers are dominating buying and selling quantity over time.

That stated, some warning indicators linger. Lately, Bitcoin change reserves reached a one-month excessive, suggesting that some holders could also be making ready to promote – doubtlessly placing strain on the present bullish pattern. At press time, BTC trades at $117,546, down 0.4% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and TradingView.com