Bitcoin is holding close to $112,100, up about 1% previously week. The transfer from $107,200 to $112,100 reveals September kicked off with some reduction after August’s over 6% drop. Merchants welcomed the bounce, however the greater image nonetheless leans damaging.

Bitcoin is down about 9% month-on-month, and contemporary alerts counsel the bears aren’t executed but. The query is straightforward: can Bitcoin defend $112,000, or will the development roll again over?

Lengthy-Time period Holders Are Chopping Again Whereas Whales Return To Exchanges

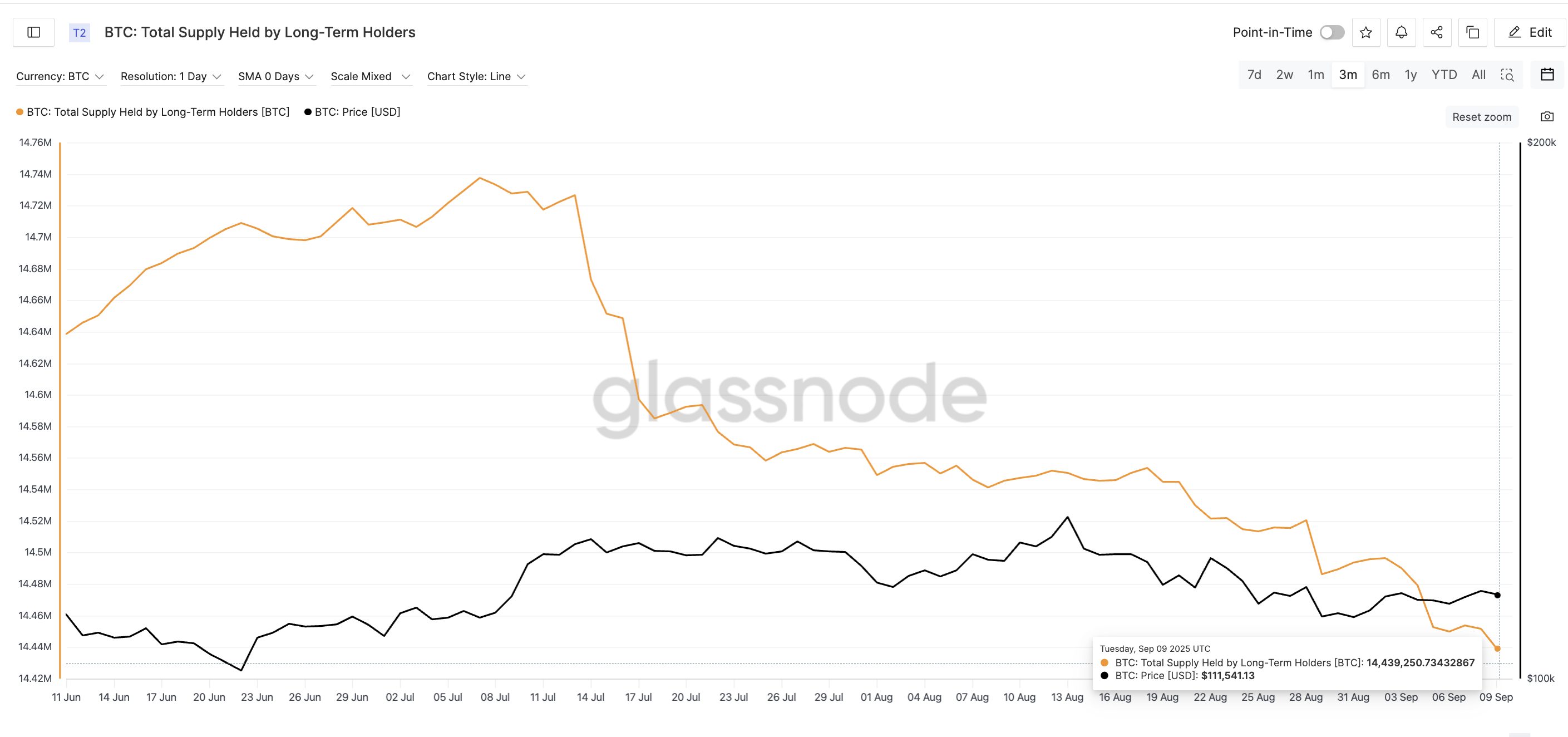

The primary warning signal comes from long-term holders. These wallets normally construct conviction and barely promote into weak point. However that image has modified since mid-July.

On July 13, they held 14.72 million BTC. By early September, that quantity had slid to 14.43 million BTC, the bottom in three months.

Roughly 290,000 BTC, leaving sturdy fingers, will not be a small determine; it reveals that even affected person holders are lowering danger or promoting into every worth rebound.

Bitcoin Lengthy-Time period Holders Dropping Provide: Glassnode

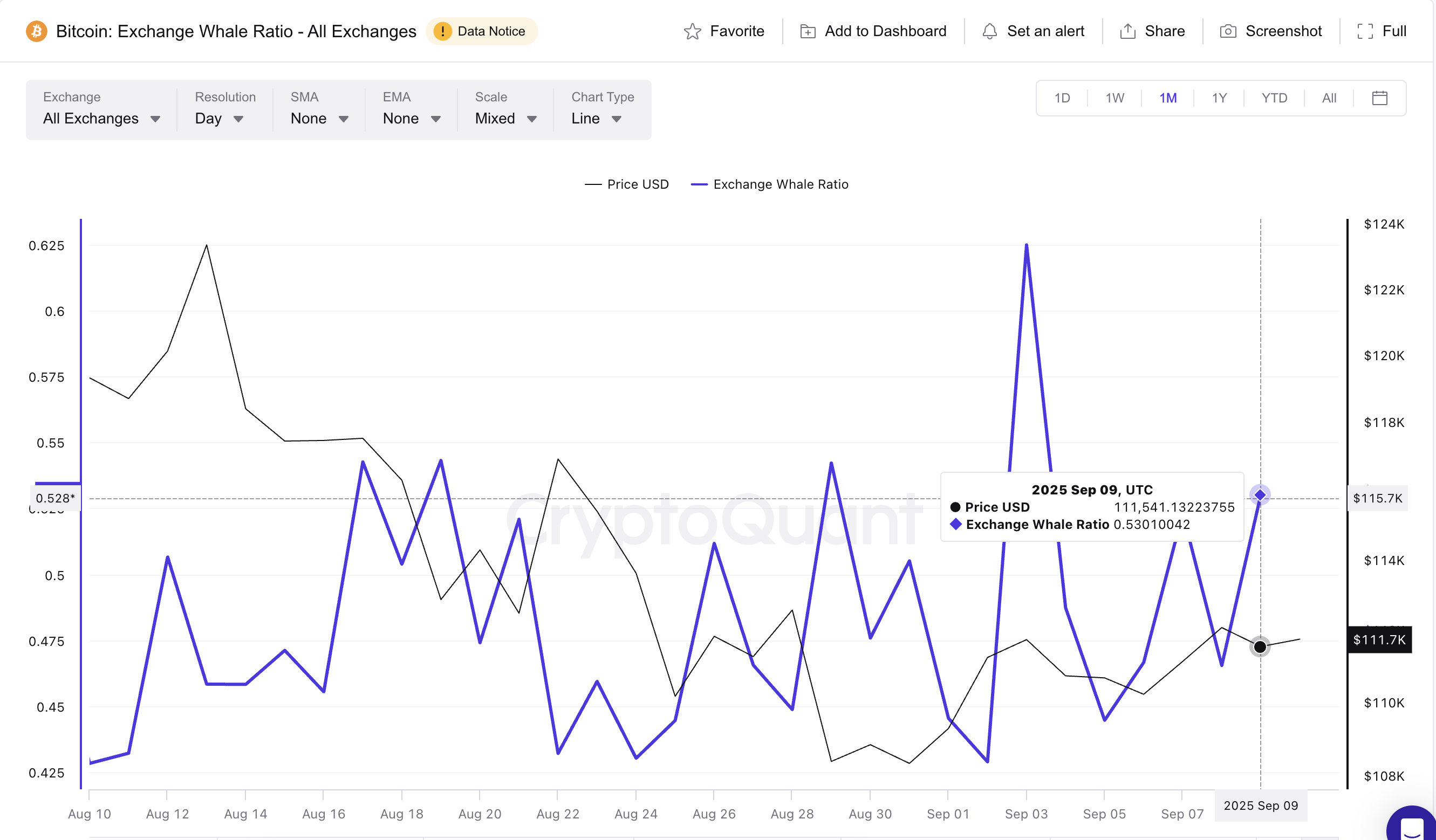

In the meantime, whales are again within the highlight. The change whale ratio — which tracks how a lot of the inflows come from the ten largest wallets — has climbed from 0.44 on September 5 to 0.53 at press time.

The final time it hit related ranges, on August 21, Bitcoin dropped from $116,900 to $108,300 throughout the subsequent few days.

Bitcoin Whales Maintain Pushing BTC To Exchanges: CryptoQuant

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

The month-to-month Trade Whale ratio chart additionally highlights one thing attention-grabbing. It reveals that whales haven’t let up over the previous 30 days, shifting BTC to exchanges even on the smallest of worth rises. The a number of native indicator peaks can validate this.

Put collectively, long-term holders trimming their stash and whales pushing cash onto exchanges repeatedly will not be a bullish combine. It alerts that offer is being readied in case costs weaken additional.

Bearish Divergence On The Bitcoin Worth Chart Backs The Case

The on-chain information strains up with the Bitcoin worth chart. Between August 28 and September 8, Bitcoin’s worth made decrease highs, whereas the Relative Energy Index (RSI) — a gauge of shopping for momentum — printed greater highs. This mismatch known as a hidden bearish divergence.

Bitcoin Worth Evaluation: TradingView

In different phrases, momentum appears to be like prefer it’s bettering, however the worth motion fails to comply with. That always units up the subsequent leg decrease.

For merchants, the sample normally warns of development continuation to the draw back, which might imply an extension of BTC’s month-on-month downtrend, because it’s down nearly 9% in that timeframe.

The important thing stage to defend for the Bitcoin worth is $110,500. If that cracks, led by the bearish divergence and promoting strain, the door opens to $107,200, and if strain builds, even $103,500 might come again into play.

Then again, a detailed above $113,500 would invalidate the RSI-led bearishness and provides the bulls again management.

The publish Bitcoin Worth at Danger Regardless of September Bounce — 3 Warning Indicators Emerge for BTC appeared first on BeInCrypto.