Bitcoin has skilled notable volatility just lately, with the crypto king falling to $112,500 twice this month. Whereas this worth motion might seem regarding, it’s vital to grasp the dynamics behind the decline.

This drop is basically pushed by leveraged positions and is unlikely to final lengthy, given the broader market circumstances.

Bitcoin Traders Are Not Behind The Decline

Futures market exercise closely influences the market sentiment round Bitcoin, whereas on-chain revenue and loss-taking have remained comparatively muted through the current ATH (all-time excessive) formation and subsequent correction.

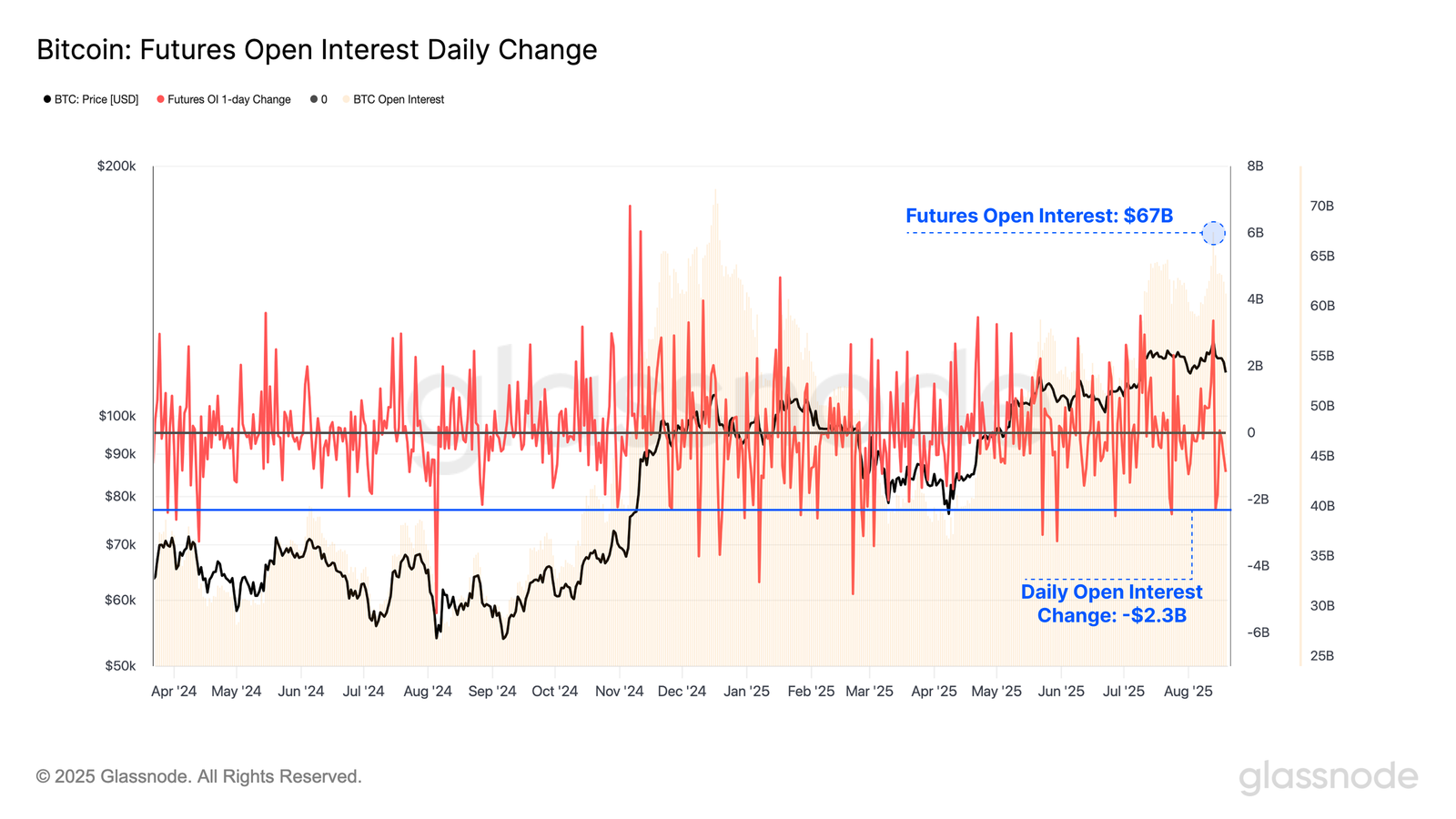

Open curiosity in Bitcoin futures contracts stays excessive at $67 billion, indicating a excessive degree of leverage out there. Leverage, whereas a strong device for revenue, can exacerbate worth swings, as we’ve seen in current market actions.

Notably, through the current sell-off, over $2.3 billion in open curiosity was worn out. This represents one of many largest nominal declines, with solely 23 buying and selling days recording a bigger drop. Such a big unwind highlights the speculative nature of the market, the place even modest worth actions can set off the contraction of leveraged positions.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Bitcoin Futures OI Change. Supply: Glassnode

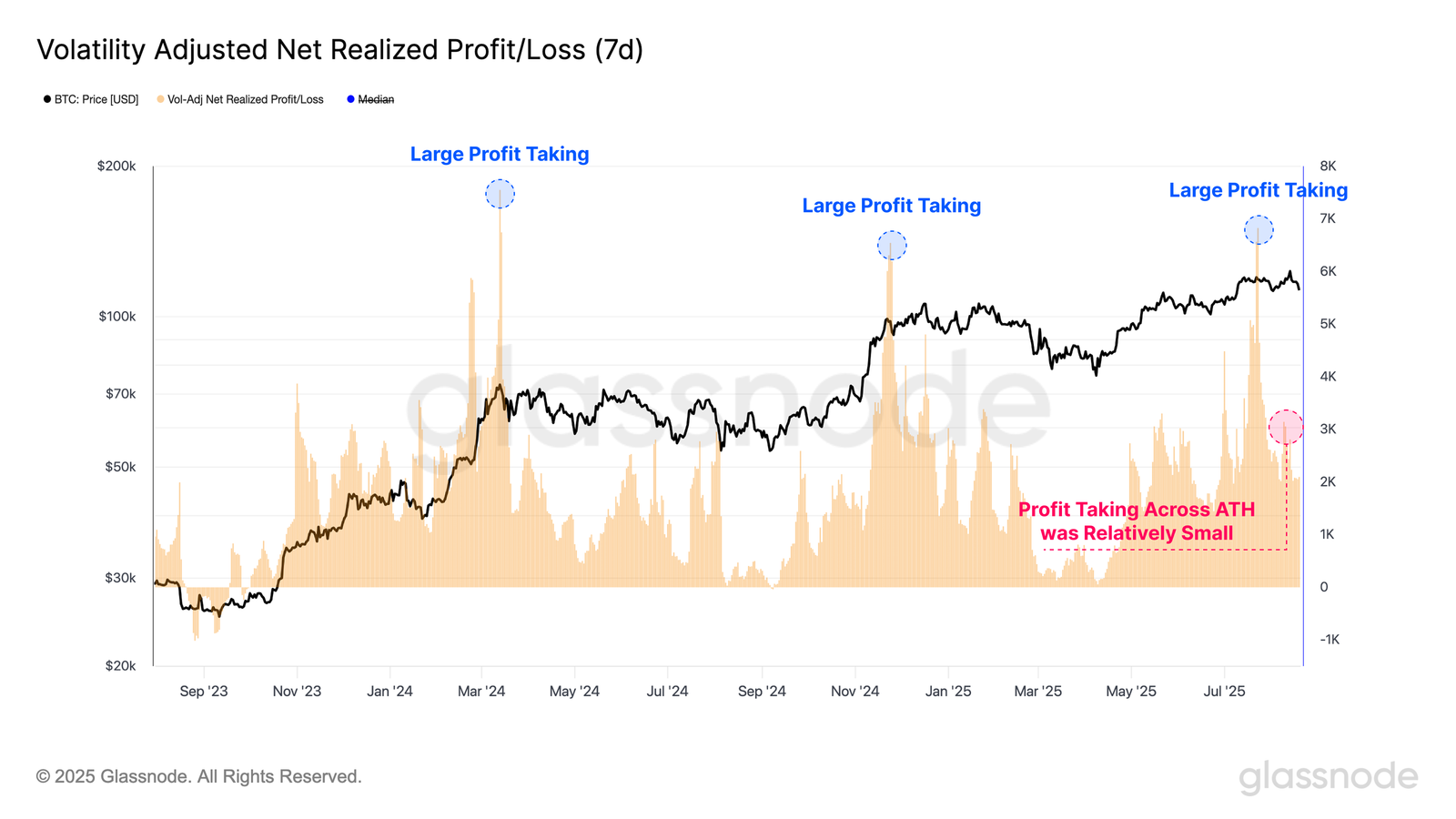

That is additional backed by the truth that, in current weeks, the Volatility-Adjusted Internet Realized Revenue/Loss metric signifies softened profit-taking exercise. In earlier breakout situations, comparable to through the $70,000 and $100,000 worth ranges in 2024, substantial profit-taking volumes signaled sturdy investor exercise.

At these factors, the market absorbed the promoting stress from current BTC holders. Nevertheless, the most recent all-time excessive try at $122,000 this July noticed decrease profit-taking volumes, suggesting a change in market habits.

One interpretation of this dynamic is that the market struggled to maintain upward momentum, regardless of a softer sell-off from present holders. This lack of sturdy profit-taking might level to weaker demand to soak up provide, which might clarify the present market consolidation and restricted motion regardless of reaching new worth ranges.

Bitcoin Volatility Adjusted Internet Realized Revenue/Loss. Supply: Glassnode

BTC Value Bounces Again

Bitcoin’s worth is presently at $114,200, after bouncing off the help degree of $112,526 for the second time this yr. This restoration is predicted to proceed, because the decline outcomes primarily from leverage-related sell-offs. A bounce again is probably going, given the relative energy of Bitcoin’s help at $112,526.

If Bitcoin efficiently breaches and flips the $115,000 mark into help, the cryptocurrency might rise towards $117,261. Sustaining this help degree is essential for a continuation of the bullish development, doubtlessly paving the best way for a transfer towards $120,000.

Bitcoin Value Evaluation. Supply: TradingView

Nevertheless, if Bitcoin fails to breach $115,000 or if buyers transfer in direction of additional promoting, the worth might drop under $112,526. Such a transfer might take Bitcoin all the way down to $110,000 or decrease. This is able to invalidate the present bullish thesis and signaling a possible longer-term bearish part for the cryptocurrency.

The submit Bitcoin Value Fall – Leverage-Pushed Decline, Gained’t Final Lengthy appeared first on BeInCrypto.