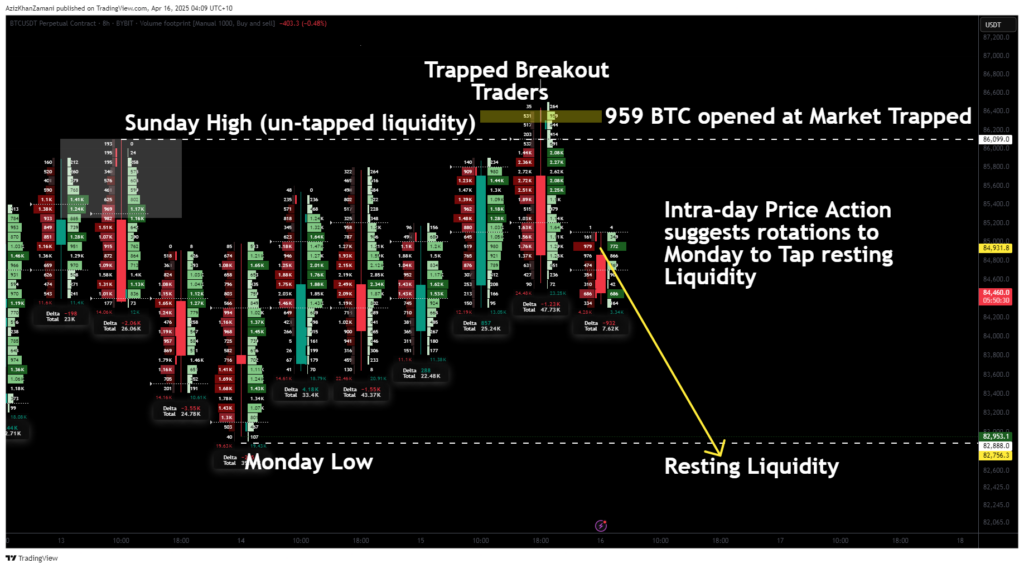

Bitcoin might have printed an area prime close to $86,500 after a swing failure sample swept upside liquidity. Order move information confirms that aggressive lengthy entries had been trapped on the highs, with worth now concentrating on resting liquidity decrease, significantly across the Monday low at $82,888.

All eyes are actually on Bitcoin’s (BTC) Monday low at $82,888, a key liquidity pool that is still untouched. This zone might act as the following goal in Bitcoin’s intraday deviation from liquidity pocket to liquidity pocket. A lot of these strikes sometimes lure breakout merchants, making a momentum shift in the other way.

With order move confirming important lengthy publicity now underwater, the trail of least resistance has shifted to the draw back, concentrating on the untapped liquidity beneath.

Key factors coated on this article:

- Swing failure sample trapped lengthy positions at current highs

- Order move chart exhibits 959 BTC in market orders opened on the prime

- Value now concentrating on the Monday low at $82,888 for liquidity sweep

Supply: TradingView

Sunday’s excessive acted as a magnet for worth, with liquidity constructed up from quick merchants anticipating a reversal. As soon as worth broke above this stage, it failed to carry, making a swing failure sample—a trademark setup the place worth takes out a key excessive, traps longs, and reverses with pressure.

That is the place the order move chart gives vital perception. When zooming in, you’ll be able to clearly see that 959 BTC price of market orders had been opened instantly after Bitcoin took out the Sunday excessive. These positions had been entered on the native prime and are actually instantly underwater, forming the lure dynamic that always fuels aggressive strikes in the other way. This creates the basic chain response of stop-losses and untimely closes, pushing worth decrease.

You may additionally like: Bitdeer to extend US mining as tariff pause opens commerce window: report

With these lengthy positions now trapped, the market is looking the following pool of liquidity, which lies on the Monday low. The $82,888 stage is a logical magnet for worth motion and aligns with intraday liquidity concept—worth will hunt down the cleanest ranges that haven’t but been tapped.

If that low is swept, it might produce a bullish swing failure to the draw back—mirroring the identical sample we’ve simply seen on the highs. This could full a short-term vary rotation and arrange the following transfer larger throughout the present construction.

What to anticipate within the native worth motion.

It’s now essential to look at for worth to brush the Monday low at $82,888. If a swing failure sample varieties at that stage, it presents a high-probability lengthy entry, concentrating on the mid-range or highs. Till then, draw back stays favored. As at all times, worth motion needs to be used with discretion and correct administration.

Learn extra: Shares, crypto eye features as buyers ponder subsequent tariff strikes