-

Bitcoin’s bullish momentum halted, falling 7% as geopolitical tensions rise.

-

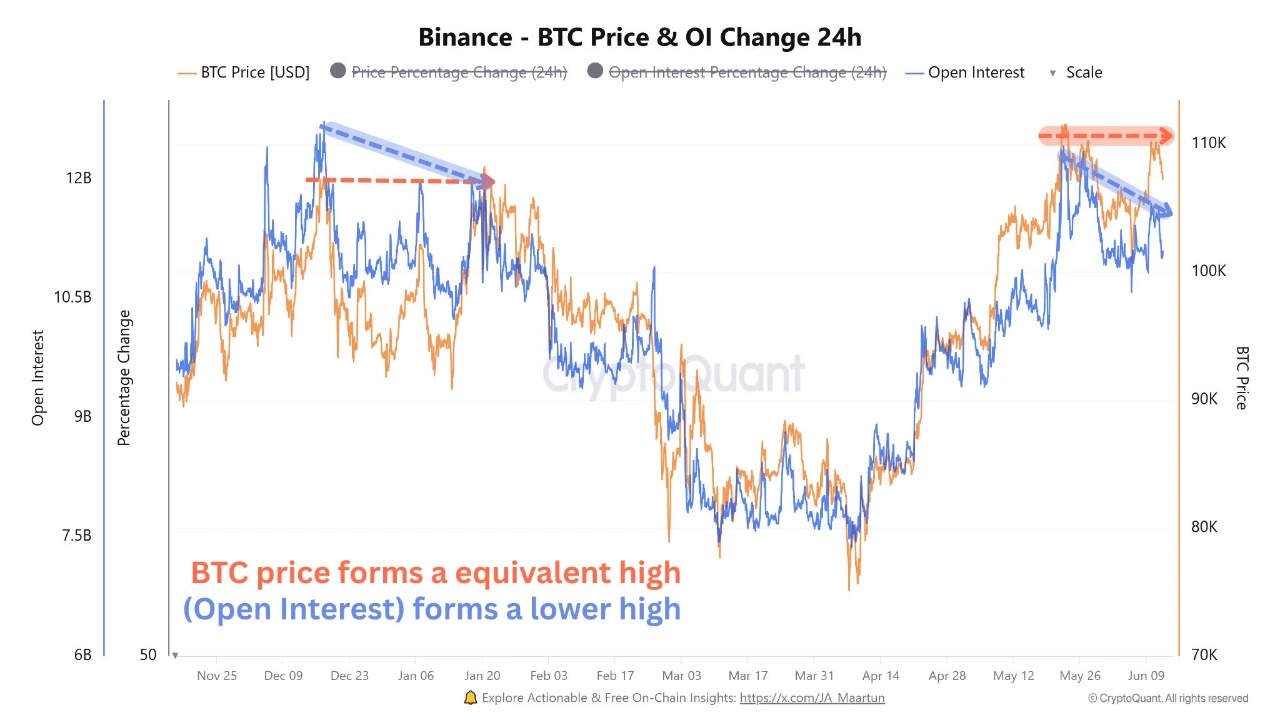

Divergence between Bitcoin worth and Binance’s Open Curiosity signifies cautious investor sentiment.

-

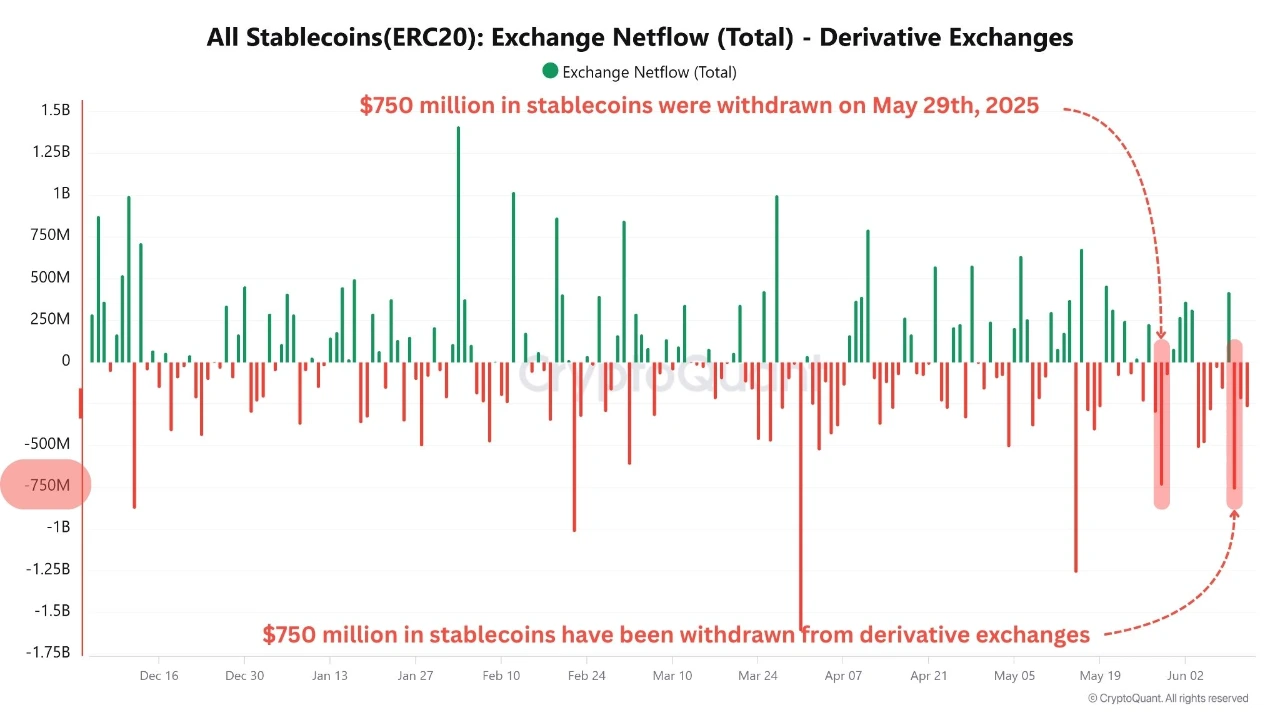

In the meantime, spinoff exchanges witnessed vital withdrawals of over $750 million in stablecoins from derivatives exchanges.

Up to now 72 hours, the Bitcoin worth bullish momentum witnessed a short-term halt, attributable to a rise in bearish stress involving worsening geopolitical circumstances. Consequently, Bitcoin worth suffered a lack of 7%, because it fell in need of bullish power to surpass the benchmark $112,000 ATH.

Furthermore, the leveraged lengthy positions had been unwound, which additional amplified draw back momentum for prime crypto and altcoins.

Equally, latest on-chain metrics spotlight that spinoff exchanges noticed vital withdrawals of stablecoins. The place these withdrawals are coupled with a notable divergence between BTC worth and Binance’s Open Curiosity.

These converging indicators strongly point out a cautious outlook for Bitcoin within the quick quick time period.

BTC Jumped From Cliff – Down 7%: What Precisely Occurred?

The worldwide uncertainty has elevated just lately, which has affected the monetary sector, together with cryptocurrencies. This occurred as Donald Trump plans to place unilateral tariffs within the subsequent two weeks.

Alongside the pessimism surrounding Trump’s tariffs, the Israel-Iran Battle additionally escalated additional, which has triggered aggressive promoting.

The sudden spike in promote quantity carefully aligns with Israel’s sudden army strike on Iran early Friday (June 13), which despatched shockwaves by international markets.

Crypto is considered a high-risk asset and faces quick liquidation stress. The place merchants dumped BTC in anticipation of broader market turmoil.

What DOes This Divergence Between Bitcoin Value and Binance Open Curiosity Means For Traders?

Current insights from CryptoQuant reveal a notable divergence between Bitcoin’s worth and Binance’s Open Curiosity (OI).

Because the Bitcoin worth neared its all-time excessive of $110,000- which was final seen in late Might, the OI did not match the height ranges. That is clearly indicating a weakening curiosity in futures buying and selling regardless of robust long-term BTC worth momentum.

This case suggests a cautious sentiment amongst buyers, highlighting potential shifts in market dynamics.

Ought to Traders Be Alarmed As Large Stablecoin Withdrawals Occurred from Spinoff Exchanges

In keeping with CryptoQuant charts, over $750 million in stablecoins have been withdrawn from derivatives exchanges. This vital motion mirrors an analogous withdrawal on Might 29, 2025, additionally round $750 million.

Such synchronized outflows typically point out capital rotation or adjustments in dealer conduct. When these happen close to market highs, they could sign hedging or de-risking actions.

At present, Bitcoin worth is struggling close to the important thing psychological degree of $110,000, and final three days 7% decline has made the scenario extra dangerous for market individuals.

Due to this fact, amid the geopolitical chaos, the absence of affirmation from Binance OI, together with repeated massive stablecoin outflows, will increase the probability of a short-term pullback. If the $101,000 assist space is breached, BTC worth may drop to the assist zone round $96,000.

The short-term scenario urges market individuals to “DYOR” and may keep away from “FOMO” primarily based future selections.