Bitcoin

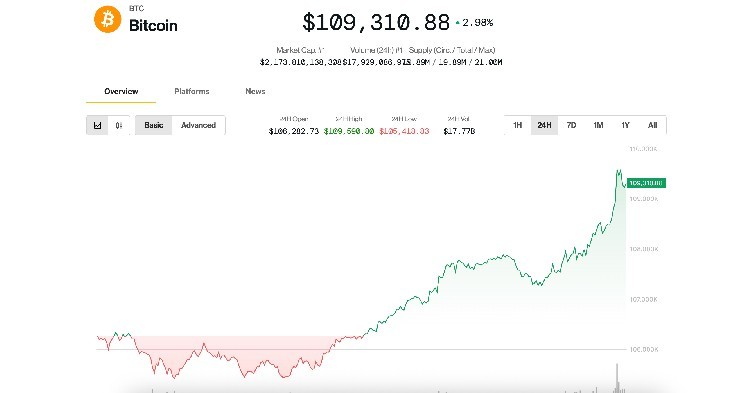

is bouncing onerous in the direction of $110,000 on Wednesday, shrugging off Tuesday’s temporary risk-off wave that dragged the worth under $106,000.

Lately, the most important crypto traded at its strongest worth since June 11, round $109,500, up 3.5% over the previous 24 hours.

The motion got here as Donald Trump introduced a commerce take care of Vietnam, serving to threat property throughout the board. The Nasdaq at noon is forward 0.8%.

Beneath the deal, the U.S. will impose a 20% tariff on items from Vietnam and a 40% levy on transshipped items—merchandise routed by way of Vietnam on their approach to the U.S. U.S. exports, in flip, will face no tariffs when getting into the Vietnamese market.

Boosting crypto sentiment particularly may very well be the debut of the REX-Osprey Solana + Staking ETF (SSK), the primary such crypto staking product accessible within the U.S.

“Quantity in $SSK now at $20M, which is actually sturdy, prime 1% for a brand new launch,” wrote Bloomberg analyst Eric Balchunas a short time in the past. Balchunas famous that SOLZ — a futures-based SOL ETF that opened for enterprise in March — did simply $1 million of quantity on its first day of commerce.

July may very well be massive (in both route)

July is shaping as much as be a probably risky month for bitcoin, pushed by Trump administration’s insurance policies, based on Vetle Lunde, head of analysis at K33.

Trump is predicted to signal a controversial expansionary funds invoice dubbed the “Huge Stunning Invoice” by Friday. The invoice, which may widen the U.S. deficit by $3.3 trillion, is seen by some as bullish for scarce property like BTC, Lunde stated.

One other key date looming is the July 9 tariff deadline, which may see extra aggressive commerce posturing from Trump.

Thirdly, July 22 is the ultimate deadline for motion on long-awaited crypto government order, with potential updates on the U.S. Strategic Bitcoin Reserve.

“July is crowded with latent Trump volatility,” Lunde stated. Nonetheless, crypto markets are comparatively calm with out extreme froth, he famous.

“There are few causes to anticipate a large broad deleveraging of the crypto market, as crypto-leverage stays contained,” he stated. “This favors sustaining spot publicity and staying affected person as we progress right into a interval well-known for its seasonal apathy.”