After hitting a brand new all-time excessive simply final Thursday, Bitcoin’s value has plummeted by over $10,000 in per week.

A brand new evaluation suggests the sharp correction stems from a key issue: a slowdown in demand throughout the Bitcoin market.

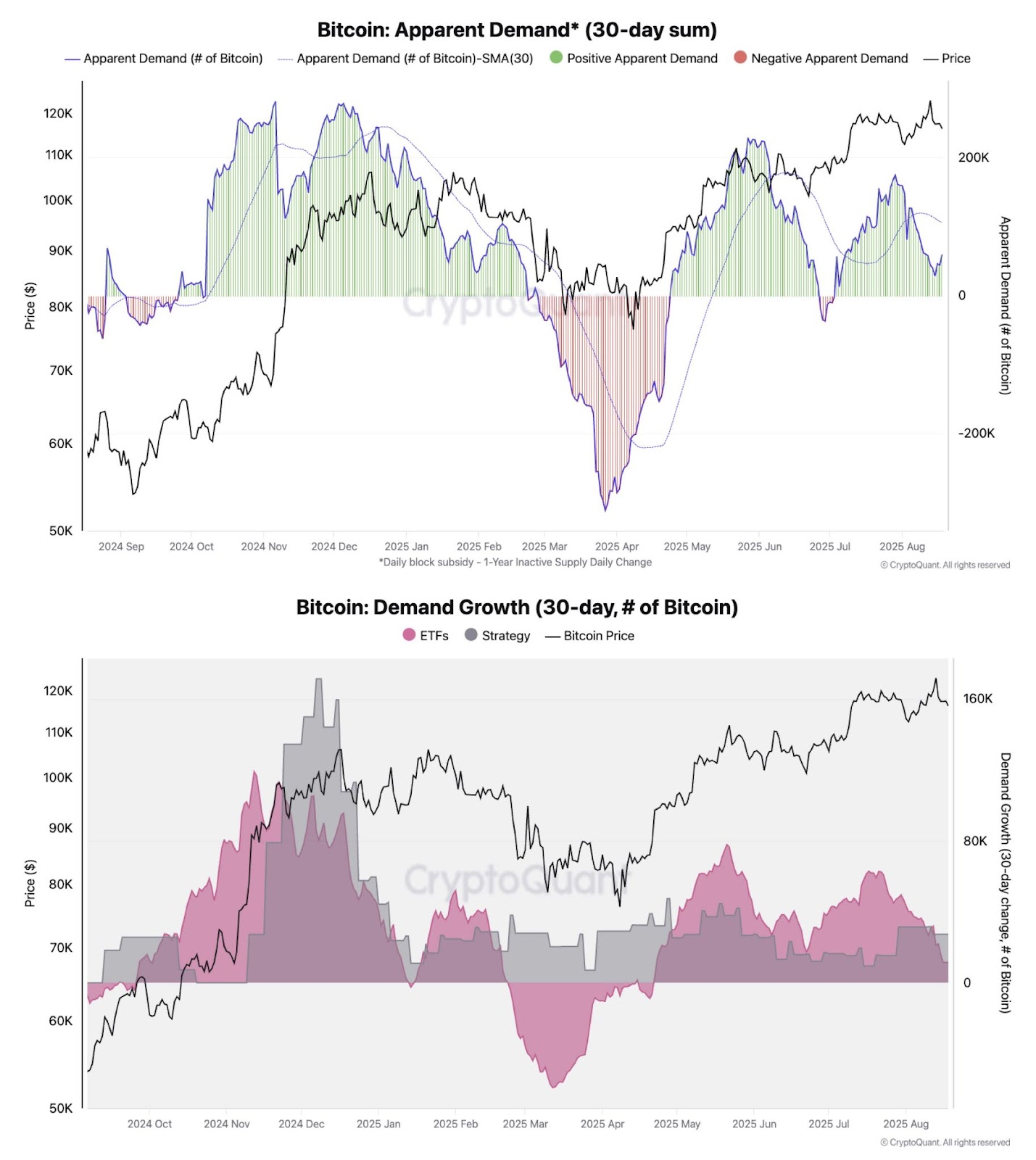

Bitcoin Demand Slowing Down

Julio Moreno, head of analysis at on-chain platform CryptoQuant, shared this view in an X submit on Wednesday. He said, “Bitcoin’s total demand progress slowdown, together with purchases from ETFs and Technique, is behind the present value pause/correction.”

Bitcoin’s value had briefly bottomed out on August 1st, when considerations a few recession flared up after a weak US non-farm payrolls report. That very same day, US spot Bitcoin ETFs noticed $812 million in internet outflows, based on Soso Worth information.

Each day Internet Inflows/Outflows of U.S. Spot Bitcoin ETFs. Supply: SoSo Worth

Nevertheless, from August 6, when the worth rally started, the ETFs recorded seven consecutive days of internet inflows. This pattern reversed final Thursday with the July Producer Value Index’s launch, returning to internet outflows. The outflow quantity wasn’t very giant, but Bitcoin’s value dropped sharply as compared.

Moreno defined that on-chain demand metrics mirror this precise sample. He argues that this correction isn’t because of the sudden actions of a single entity like an ETF or MicroStrategy, however quite a widespread decline in demand amongst most market individuals.

For instance, CryptoQuant’s Obvious Demand metric confirmed a studying of 147.3703K on August 1, the same value degree. Nevertheless, on August 20, the identical metric had almost halved to 64.787K.

Bitcoin: Obvious Demand & Bitcoin: Demand Progress. Supply: CryptoQuant

Whereas Bitcoin’s value surged after which returned to its place to begin over the previous 15 days, market demand primarily dropped by half. This means that if market sentiment doesn’t get better, Bitcoin may face additional corrections.

The market doubtless wants a macroeconomic catalyst to spice up total demand, akin to renewed expectations of a Fed fee reduce. In line with CME’s FedWatch information, market individuals anticipate two fee cuts this 12 months, with an 86% likelihood of a 25 foundation level reduce on the September FOMC assembly.

For comparability, final Thursday, when Bitcoin’s value approached $124,000, the market priced in three fee cuts this 12 months and a 98% likelihood of a reduce in September.

The submit Bitcoin Sluggish Demand Blamed for $10K Plunge In a Week appeared first on BeInCrypto.