The cryptocurrency’s value noticed a gradual appreciation all through the Easter weekend, topping $88K on Monday, whereas the greenback fell to a three-year low.

BTC Is Hovering Whereas the Greenback’s Freefall Continues

President Donald Trump’s aggressive tariffs and his threats to fireside Federal Reserve Chairman Jerome Powell, have left conventional markets cautious, with overseas buyers fleeing U.S. belongings, which has weakened the buck, however bitcoin ( BTC) and bodily gold, seem to have emerged as secure havens.

Overview of Market Metrics

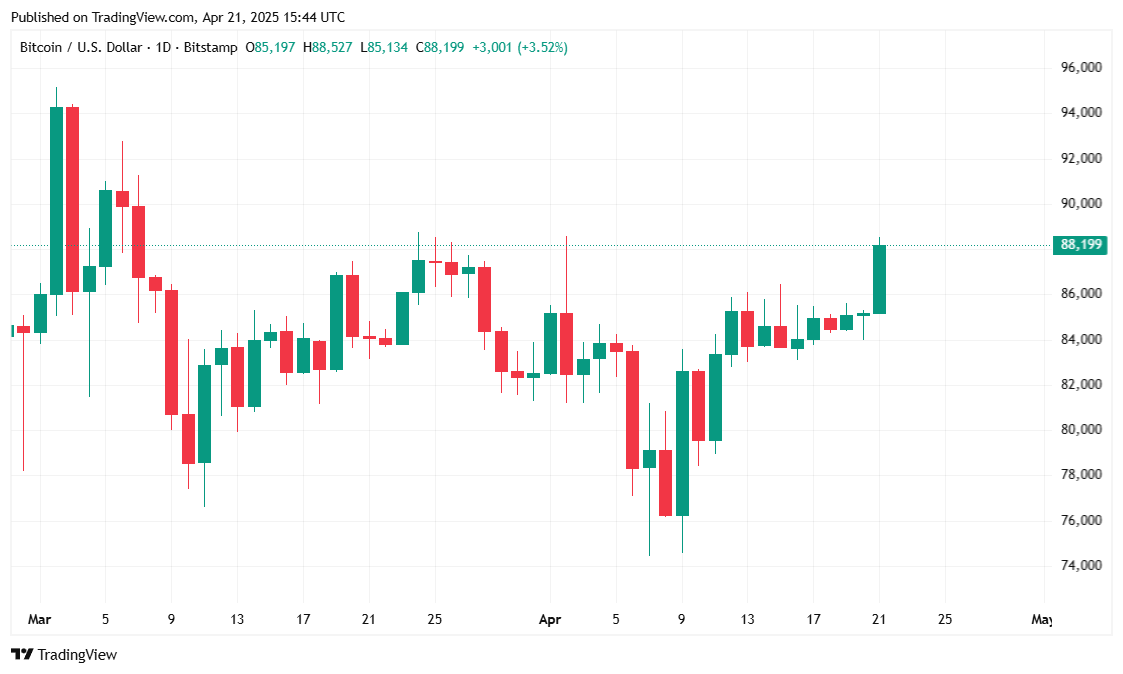

Bitcoin kicked off the week with sturdy momentum, climbing 4.48% over the previous 24 hours to achieve $88,260.09 on the time of reporting. The digital asset traded in a variety between $84,281.02 and $88,460.10 as investor sentiment continued to enhance. Over the previous 7 days, BTC has gained 5.08%, supported by regular shopping for and broader market optimism.

( BTC value / Buying and selling View)

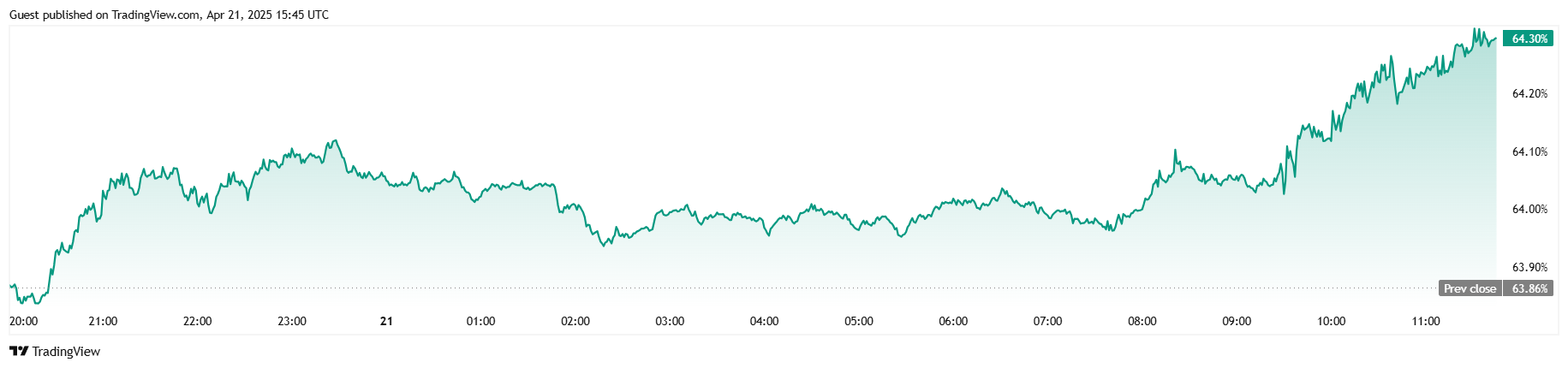

Buying and selling quantity soared to $34.41 billion, marking a 133.17% enhance in comparison with the day gone by, a leap largely attributed to the everyday post-weekend surge. Bitcoin’s market capitalization additionally noticed a wholesome rise, up by 4.15% to $1.74 trillion. In the meantime, BTC dominance climbed to 64.30%, gaining 0.67% and reinforcing bitcoin’s management function within the crypto market.

( BTC dominance / Buying and selling View)

Coinglass knowledge exhibits that open curiosity in bitcoin futures rose considerably: up 11.45% to $61.89 billion, suggesting heightened investor engagement and bullish sentiment. Regardless of the surge, general liquidations remained minimal at $460,490, with $276,400 from shorts and $184,090 from longs. The comparatively low liquidation quantity highlights the market’s orderly nature, even with rising costs and buying and selling exercise.

Trump’s Powerful Discuss Tanks Greenback

Trump touted the lower-than-expected inflation numbers launched by the Bureau of Labor Statistics on April 10, and on Monday, known as Powell “a serious loser” for not chopping rates of interest to spur the slowing U.S. economic system.

“There can virtually be no inflation, however there could be a slowing of the economic system, except Mr. Too Late, a serious loser, lowers rates of interest now,” Trump posted on Reality Social. “Europe has already ‘lowered’ seven instances. Powell has at all times been ‘To Late,’” the president added.

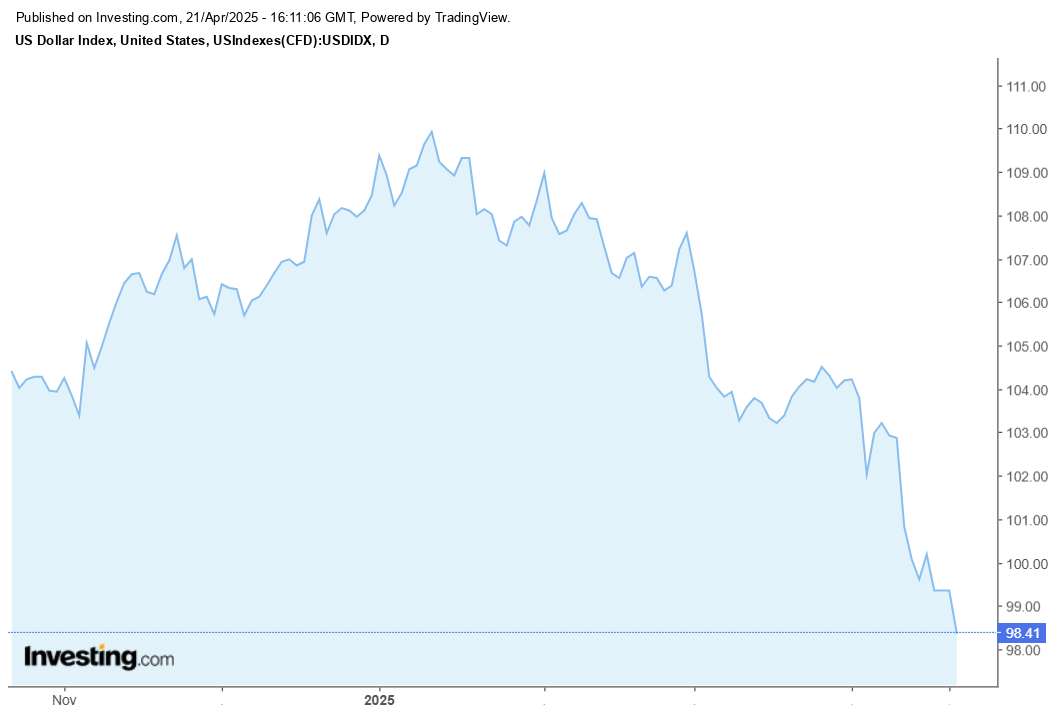

Final week, Trump threatened to fireside Powell, bringing the query of Fed independence into focus. The president’s robust commerce insurance policies and his pictures at Powell, have resulted in an exodus of overseas buyers, sending the U.S. Greenback Index (DXY) to a 3-year low, gold to an all-time excessive, and bitcoin to $88K.

(The U.S. Greenback Index which tracks the energy of the greenback towards a basket of foreign currency, fell to a 3-year low on Monday / Investing.com)

If the development continues, the buck dangers ceding its world dominance to the cryptocurrency, which was designed particularly as an antidote to reckless fiat coverage.