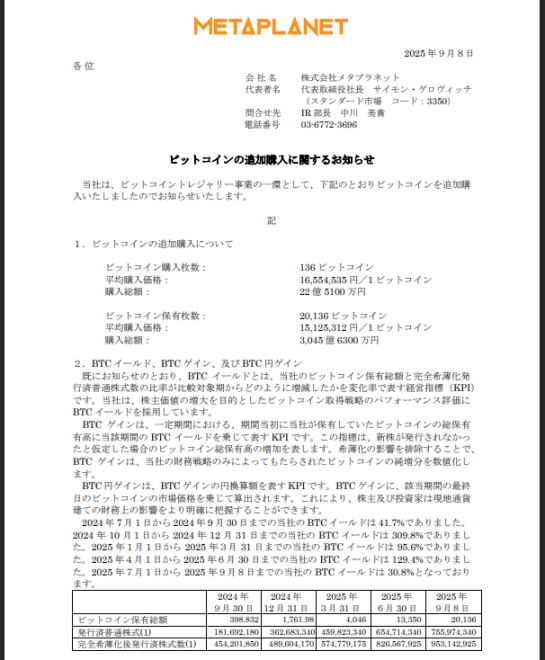

Metaplanet Inc. moved once more into the Bitcoin zone as a part of its treasury plan, shopping for 136 Bitcoin for about $15.2 million at a median value of $111,783 per coin.

In response to the corporate, that brings its whole holdings to twenty,136 cash. The acquisition retains Metaplanet among the many bigger company holders of the crypto.

Metaplanet Expands Bitcoin Stack

The corporate reported the contemporary purchase on Monday. Primarily based on experiences, Metaplanet now sits because the sixth-largest company holder of Bitcoin.

On the time of the acquisition, Bitcoin traded round $111,580, placing the brand new items near present market ranges. The transfer underscores how some companies are turning components of their stability sheets into crypto publicity relatively than sticking solely to their core companies.

Market Response Was Cool

Shares of Metaplanet didn’t climb after the disclosure. They fell 2.3% in Tokyo commerce on Monday and had been buying and selling close to a four-month low, extending almost a 20% rout from the prior week.

Studies present the inventory slide has tracked a drop in Bitcoin’s value after profit-taking adopted August’s report highs. Traders seem skittish when an organization’s share value is tied tightly to a unstable asset.

*Metaplanet Acquires Extra 136 $BTC, Whole Holdings Attain 20,136 BTC* pic.twitter.com/c41t6bJg1L

— Metaplanet Inc. (@Metaplanet_JP) September 8, 2025

Traders Weigh ETFs Versus Direct Publicity

A part of the pushback comes from alternate options. Trade-traded funds now give retail and institutional traders direct bitcoin publicity with out proudly owning an organization whose core enterprise could not replicate the crypto guess.

Technique, previously MicroStrategy, stays the most important company holder with 636,505 cash. Technique logged almost a 15% loss in August as Bitcoin pulled again, displaying how a agency’s valuation can swing with crypto costs.

Questions have been raised about whether or not holding Bitcoin on an organization stability sheet nonetheless gives the identical attraction it as soon as did.

Valuation And Volatility Issues Persist

Metaplanet’s market worth — round $5 billion, primarily based on current buying and selling — has drawn scrutiny as a result of it exceeds the present market worth of the bitcoin on its books.

Critics warn that tying an organization’s shares to Bitcoin could make the inventory extra susceptible to crypto’s swings. New gamers, together with Metaplanet and Gamestop, tried to repeat the technique and have met combined outcomes thus far.

Market Crowding Might Restrict Future Features

Analysts additionally level to crowding: many firms chasing the identical story may blunt future upside for treasury-play shares if contemporary consumers cease displaying up.

Technique achieved huge beneficial properties after late-2023 purchases, funded partially by means of giant share and debt issuances. That path could also be tougher to repeat now that extra funding routes exist.

For now, Metaplanet retains including to its bitcoin pile whereas its shares stay underneath strain. Studies recommend the subsequent strikes by each Bitcoin and markets will determine whether or not that guess seems good or dangerous in hindsight.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.