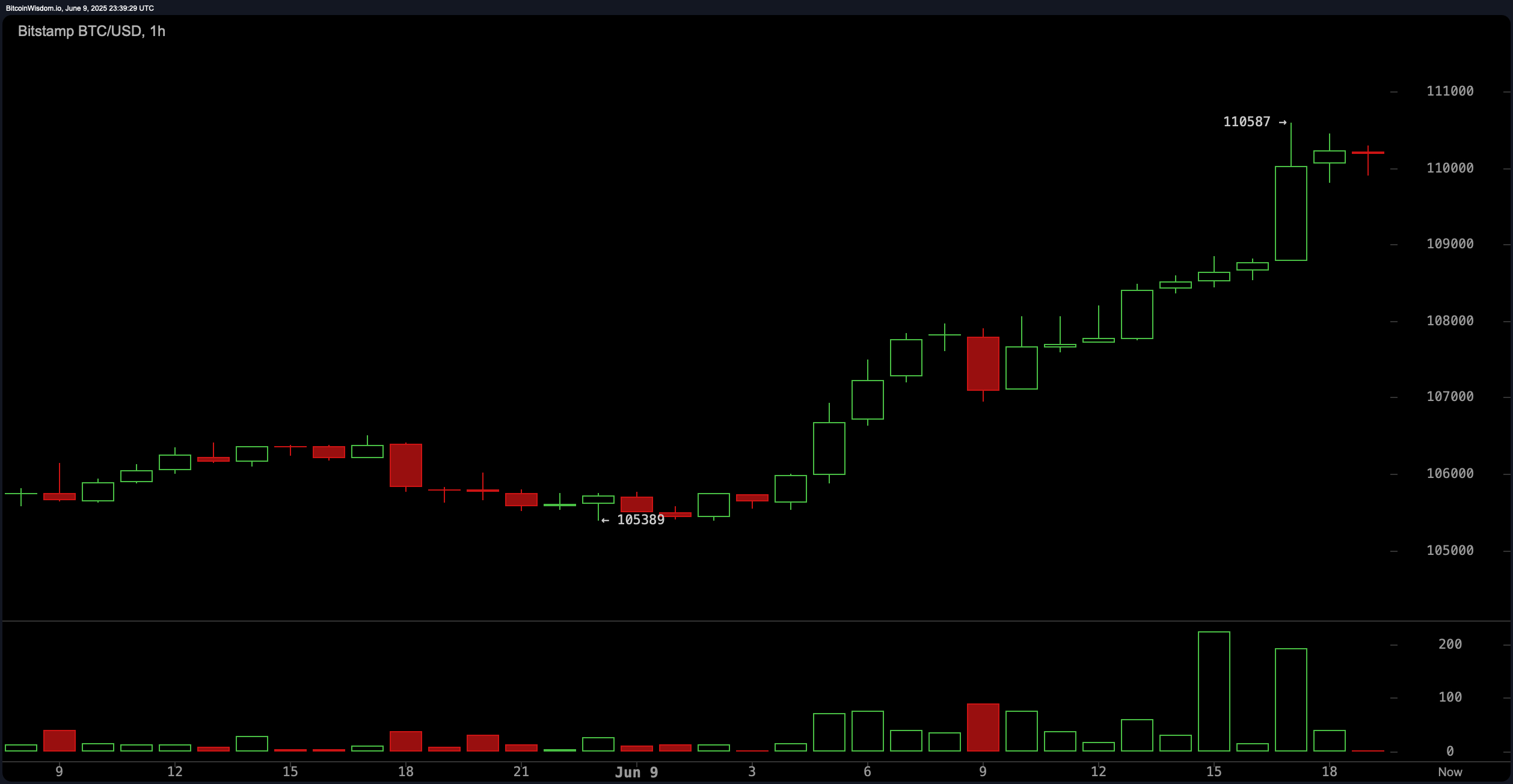

The worth of bitcoin barreled previous the $110,000 mark, notching an intraday peak of $110,587 per coin. With that transfer, the highest digital foreign money now instructions a market cap of $2.19 trillion—taking on 63.8% of the $3.44 trillion crypto economic system. On the time of writing, at 7:30 p.m. Japanese time, bitcoin is altering fingers for $110,077.

Bitcoin Bulls Cost Forward as Choices Market Tilts to Greater Altitudes

On Monday, the crypto economic system’s total market capitalization climbed 3.85%, whereas bitcoin (BTC) tacked on 4.1% over the earlier 24 hours. Different main tokens joined the rally: ethereum ( ETH) bounced greater than 6%, and dogecoin ( DOGE) rose 5.6%. World commerce quantity additionally picked up velocity, hitting $119 billion—a 42.95% leap in comparison with the day earlier than.

BTC/USD 1-hour chart on June 9, 2025.

Bitcoin futures open curiosity is on hearth, totaling 696,450 BTC, or $76.69 billion at press time. CME leads the best way with 151,010 BTC in OI—valued at over $16.6 billion—and claims a 21.68% share, an indication of serious institutional exercise. Binance isn’t far behind, reporting 117,180 BTC ($12.9 billion) for a 16.82% slice. Each platforms noticed noticeable 24-hour positive factors in OI: CME with a 4.21% elevate, and Binance rising 4.42%, suggesting contemporary positioning on the lengthy facet or renewed hedging.

The choices scene stays tilted towards calls, with 62.38% of all open curiosity—230,925.8 BTC—stacked in name contracts. Places make up the remaining 37.62%, or 139,250.36 BTC. The 24-hour buying and selling quantity mirrors this, with 62.97% (23,817.55 BTC) centered on calls and simply 37.03% on places. That skew hints at continued urge for food for upward strikes, seemingly fueled by merchants bracing for extra positive factors or aiming at bullish breakouts into late June.

In terms of open curiosity, merchants are eyeing daring bets: far out-of-the-money calls dominate the board. The most important positions are the $140,000-call expiring Sept. 26 and the $120,000-call expiring June 27. These strike costs recommend assured—if aggressive—hypothesis. On the flip facet, the biggest put in play is the $85,000 strike for June 27, pointing to some cautious draw back safety within the close to time period.