Bitcoin (BTC) treasury firms are dealing with a fairly important state of affairs as their market premium over underlying BTC holdings erodes amid falling volatility and a pointy slowdown in new purchases.

Notably, month-to-month BTC purchases by these firms have crashed by 97% since November 2024, reflecting a extremely cautious market method in current months. Nevertheless, current information from CryptoQuant suggests the necessity for a direct change in technique.

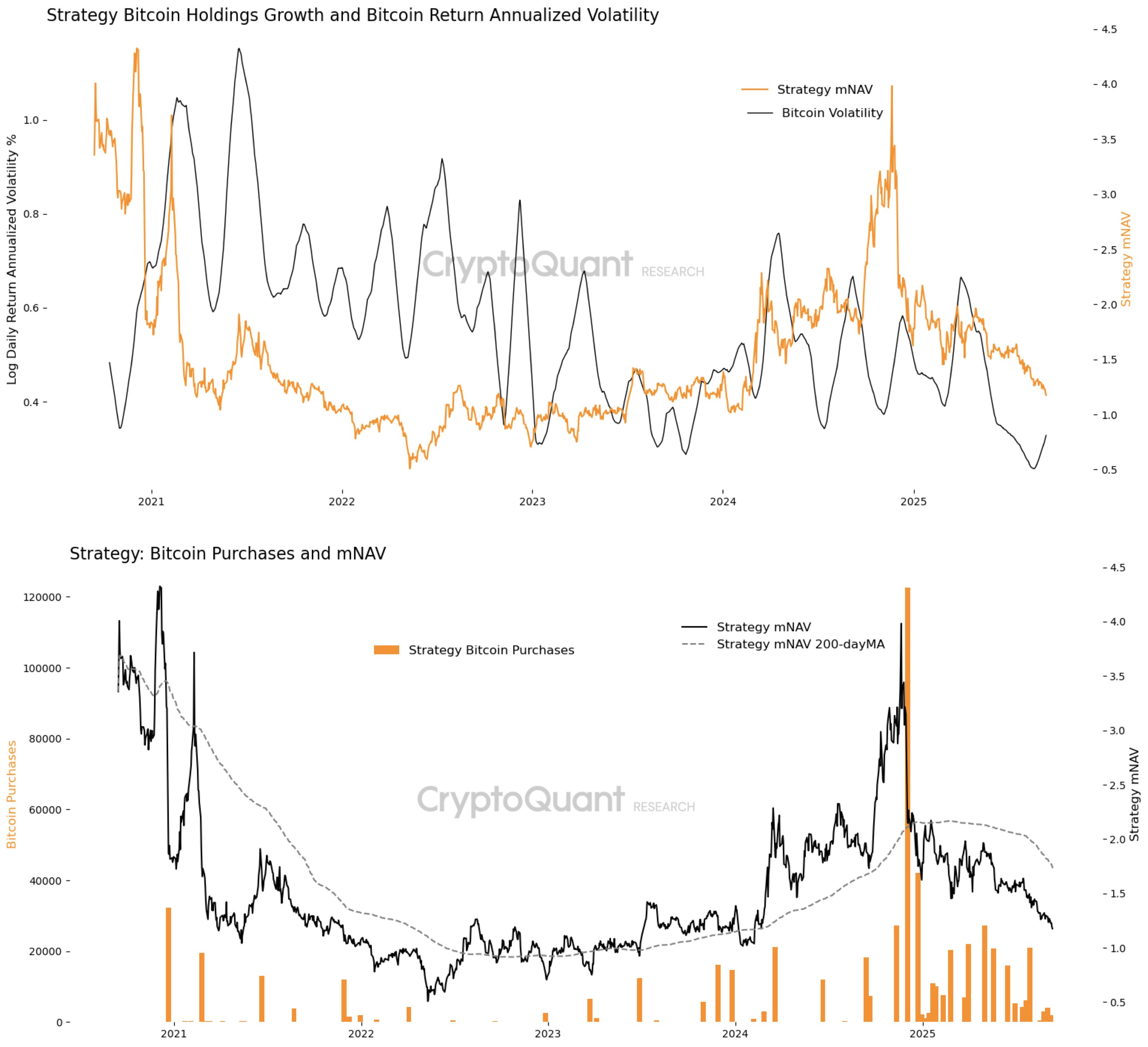

Falling Bitcoin Volatility Threatens Bitcoin Treasuries Market Worth

Typically, Bitcoin treasuries commerce at a premium, that means their market worth exceeds the precise value of the BTC they maintain, as traders consider these firms can develop their holdings, monetize volatility, and act as a protected publicity to the premier cryptocurrency. Due to this fact, the market internet asset worth (mNAV), which compares these firms’ share value to the NAV of their Bitcoin holdings, is all the time better than 1.

Nevertheless, CryptoQuant Head of Analysis, Julio Moreno, shares that annualized Bitcoin volatility has fallen to multi-year lows, eradicating a key driver of that premium as treasuries have fewer alternatives to capitalize on value swings and justify valuations above their underlying BTC holdings.

In analyzing market information for Technique, the most important company BTC holder, it may be noticed that sure spikes in volatility have produced intervals when the mNAV surged above 2.0, most notably in early 2021 and once more in mid-2024. Throughout these home windows, treasury firms have been capable of monetize volatility, elevating fairness or debt at a premium and deploying these proceeds into fast BTC purchases.

At present, nevertheless, volatility has compressed far beneath 0.4 log every day return annualized, reaching its lowest degree since 2020. The flattening volatility curve has coincided with a gentle decline in mNAV, which has slipped again towards 1.25. This narrowing premium suggests traders now not see treasury firms as providing significant leverage over merely holding Bitcoin instantly.

Weakening Demand Compounds Treasuries’ Drawback

With out the “gas” of value swings, Bitcoin treasury corporations battle to broaden their holdings in ways in which justify a premium valuation. Whereas there have been remoted bursts of shopping for in late 2024 and early 2025, general exercise stays muted.

Correspondingly, Technique’s mNAV has been trending downward because the flip of 2025, whilst BTC itself has traded in a comparatively elevated value vary in comparison with current years. The information means that when treasuries purchase aggressively, investor enthusiasm pushes mNAV increased, reinforcing the cycle of premium issuance and BTC accumulation.

Julio Moreno explains that for the mNAV premium to persist, a rebound in BTC volatility and renewed demand by way of large-scale purchases are instantly wanted. Till then, treasury firms might discover it more and more troublesome to justify valuations above their Bitcoin internet asset worth, forcing traders to contemplate a direct publicity to Bitcoin for returns fairly than on company technique.

At press time, Bitcoin trades at $115,810, reflecting a 4.72% achieve up to now week.

Featured picture from Pexels, chart from Tradingview

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.