The cryptocurrency fell to $108K after the “de minimis” exemption ended on Friday and core inflation got here in at 2.9%.

BTC Buckles Beneath Twin Stress of Growing Inflation and Commerce Tensions

Each crypto and inventory markets bled on Friday after core inflation got here in at 2.9% and the “de minimis” exemption, which waives tariffs on items that price lower than $800, expired sooner than deliberate. Bitcoin sank to its lowest degree since July on the information.

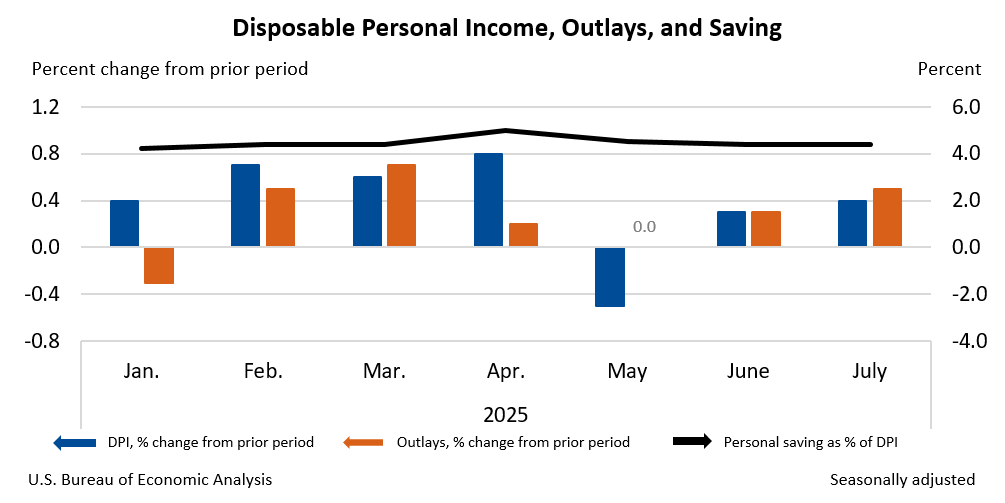

The U.S. Bureau of Financial Evaluation (BEA) revealed its month-to-month private consumption expenditures (PCE) worth index information, a measure of inflation favored by the Federal Reserve, displaying July’s PCE at 2.6% if all items are included, however revealing a better “core” fee of two.9% when unstable objects within the meals and power classes are eliminated. Whereas that core determine was in keeping with analysts’ expectations, it was additionally the best fee of inflation since February 2025.

(Core inflation for July got here in at 2.9%, which, whereas in keeping with expectations, is its highest degree since February 2025 / U.S. Bureau of Financial Evaluation)

So as to add insult to harm, an obscure commerce rule that allowed low-cost items beneath $800 to enter the U.S. duty-free, abruptly ended on Friday after President Donald Trump signed an government order earlier within the 12 months to maneuver the expiration date to August 29 as an alternative of later in 2027. The change might price American households an extra $136 per household and “would disproportionately harm low-income and minority households,” in response to two professors.

Overview of Market Metrics

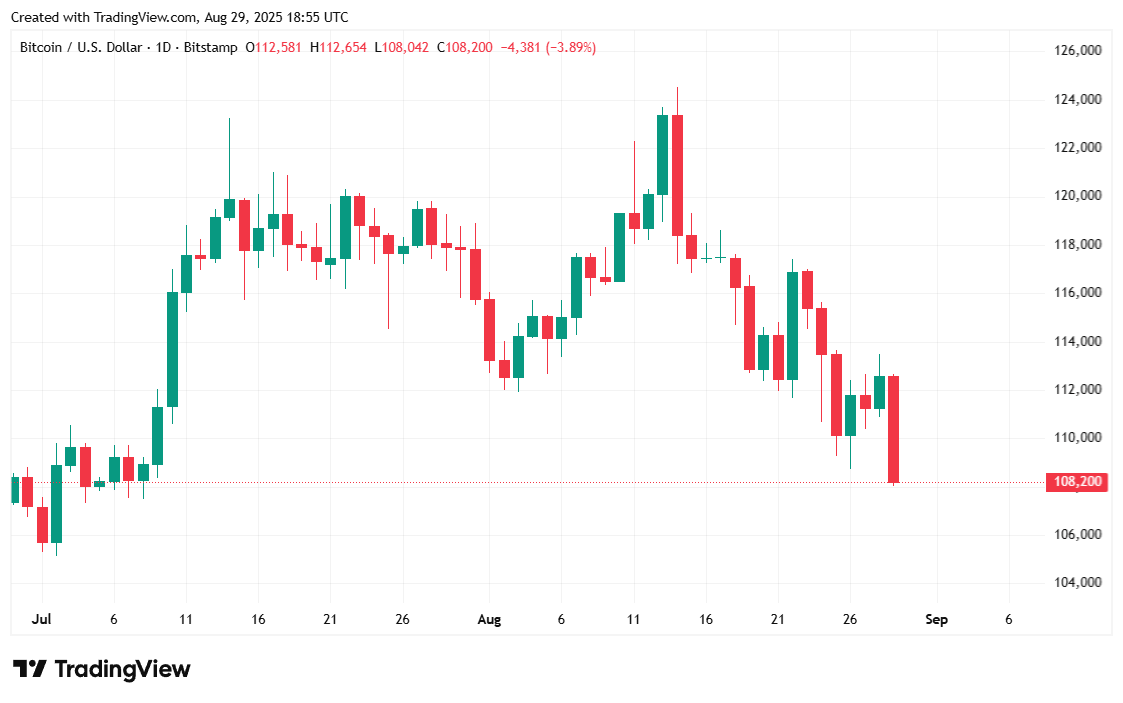

Bitcoin was priced at $108,186.53 on the time of reporting, down 3.79% for the day and seven.38% for the week, in response to Coinmarketcap. The digital asset has been buying and selling between $108,098.62 and $112,619.05 over 24 hours.

( Bitcoin worth / Buying and selling View)

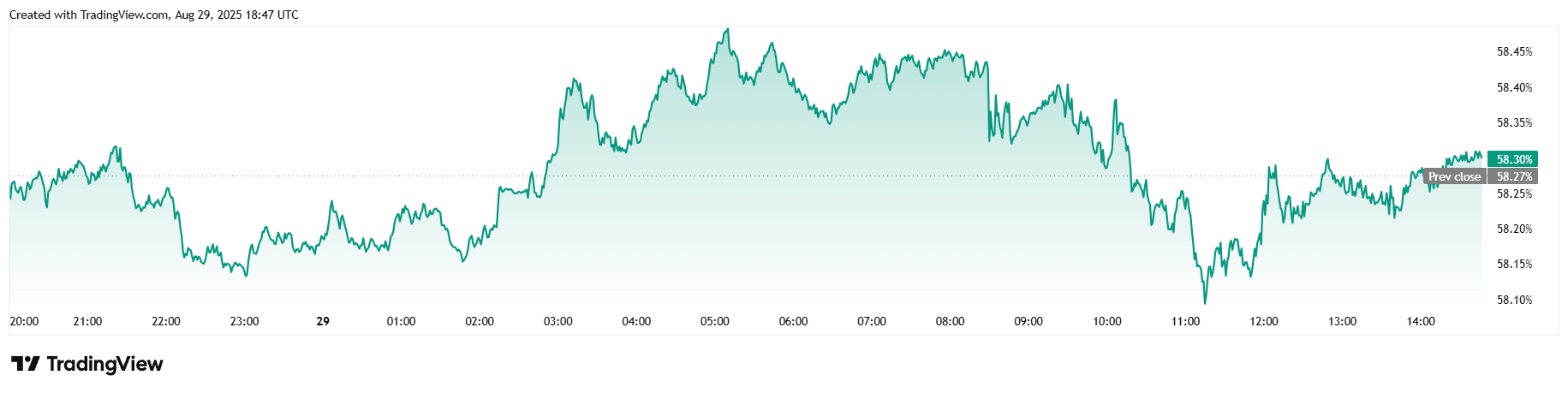

Twenty-four-hour buying and selling quantity was up 15.84% at $72.77 billion, however market capitalization fell 3.72% to $2.15 trillion, in keeping with the worth decline. Nonetheless, bitcoin dominance rose barely, inching up by 0.09% to 58.30%, in response to information from Coinmarketcap.

( Bitcoin dominance / Buying and selling View)

Complete bitcoin futures open curiosity fell by 1.17% to $80.28 billion over 24 hours and bitcoin liquidations on Coinglass climbed to $133.62 million throughout the identical interval. Of that complete, $121.61 million was lengthy liquidations, and a considerably smaller $12.01 million was from shorts.