Bitcoin (BTC) is up greater than 7% over the previous seven days, holding agency above the $100,000 degree and displaying indicators of continued bullish momentum. Nevertheless, latest whale exercise paints a extra cautious image, with solely a slight improve in giant holders and blended alerts over the previous month.

Whereas the Ichimoku Cloud and EMA indicators stay supportive, in addition they replicate a market missing robust conviction. With key resistance and assist ranges in focus, BTC’s subsequent transfer might decide whether or not it pushes towards new highs or dangers falling again under six figures.

BTC Whales Inch Up, however Confidence Nonetheless Blended

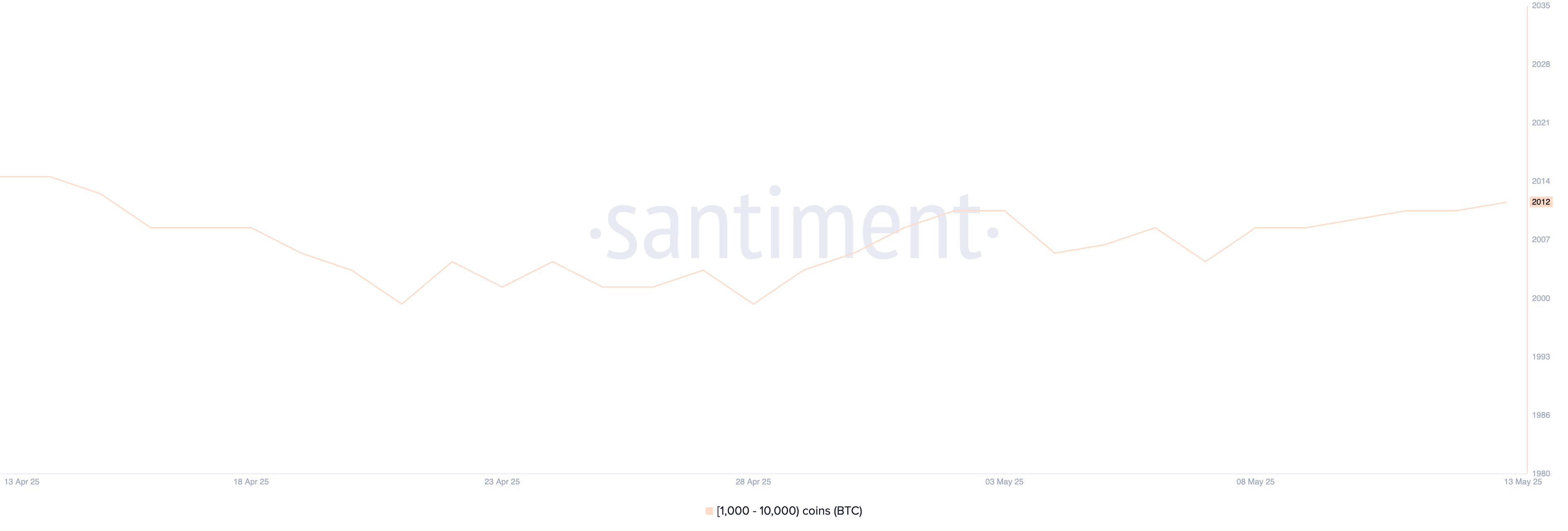

The variety of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—has barely elevated, rising to 2,012 as of immediately, up from 2,009 on Could 9.

Whereas this uptick could seem marginal, whale exercise is intently monitored by analysts and traders as a result of these giant holders usually affect market course by means of important transactions.

Whale accumulation usually displays rising confidence in Bitcoin’s medium- to long-term outlook, whereas reductions in holdings can sign warning or profit-taking.

Bitcoin Whales. Supply: Santiment.

That stated, the present tempo of development in whale numbers stays modest, and their exercise has been removed from steady during the last 30 days.

The final month has proven blended alerts, with whales alternating between accumulation and distribution amid macro uncertainty and unstable value motion, as all 12 Bitcoin ETFs see purple because the market shrugs off $96 million exit within the final 24 hours, their greatest single-day outflow since April 16.

This inconsistency means that, regardless of the slight rise in latest days, main gamers are nonetheless navigating the market cautiously relatively than committing to a sustained shopping for development, regardless of some analysts stating that Bitcoin might attain a brand new all-time excessive quickly.

Bitcoin Holds Above Cloud, However Momentum Slows

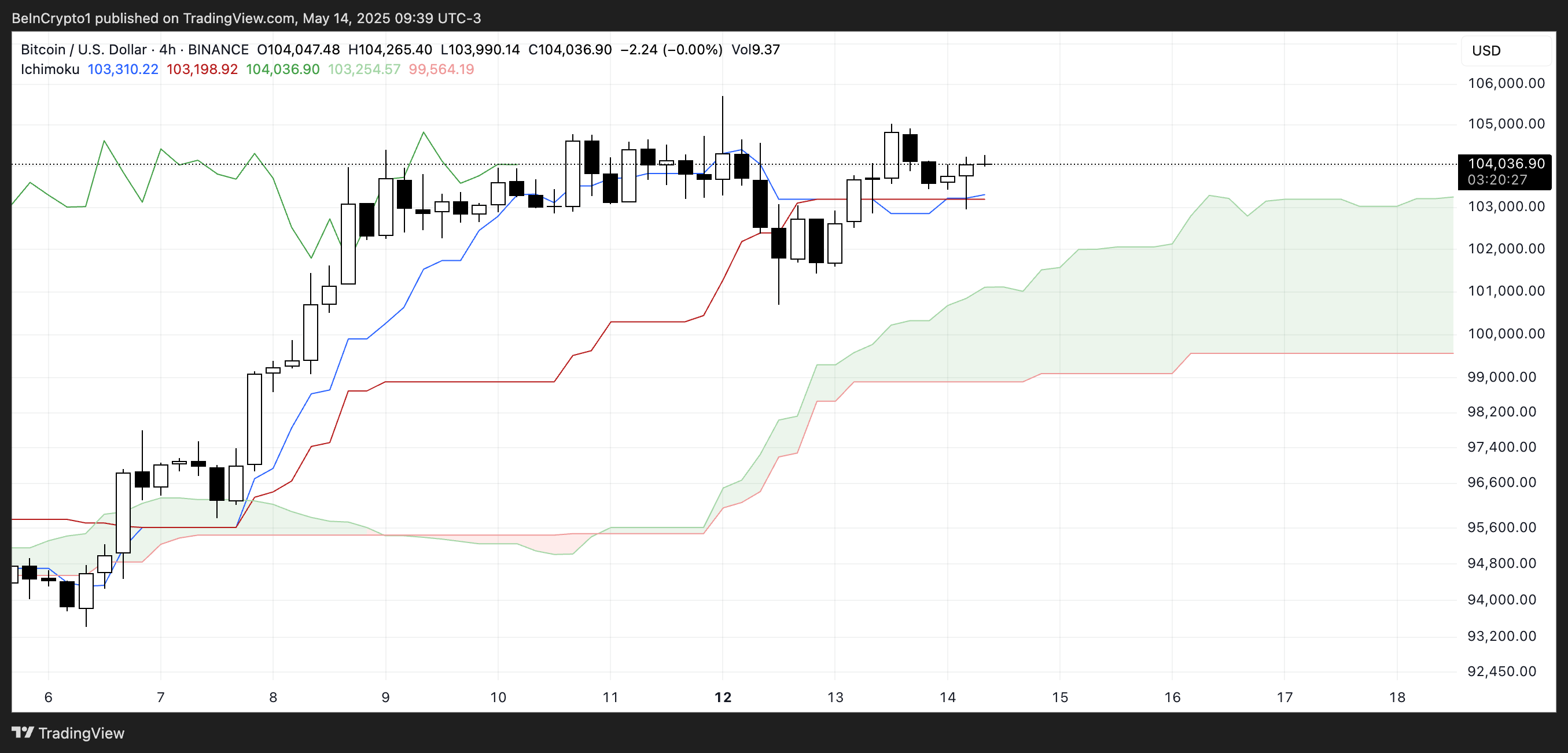

The Ichimoku Cloud chart for Bitcoin at the moment exhibits a comparatively neutral-to-bullish setup. Worth candles sit simply above the Kijun-sen (purple line) and Tenkan-sen (blue line), indicating that short-term assist is holding for now.

The cloud (Kumo) forward is bullish, with the Senkou Span A (inexperienced cloud boundary) positioned above the Senkou Span B (purple cloud boundary), reflecting a constructive forward-looking development.

BTC Ichimoku Cloud. Supply: TradingView.

The Chikou Span (lagging inexperienced line) stays above the value from 26 durations in the past, signaling cautious bullish sentiment.

Worth continues to be above the cloud, which is a bullish zone, however sideways motion and a narrowing hole between the Tenkan-sen and Kijun-sen present indecision.

For the uptrend to realize energy, the blue line should cross above the purple line clearly, with a thicker and steeper cloud forming forward.

Key Ranges to Watch: Bitcoin’s Subsequent Transfer After Holding $100,000

Bitcoin value has been steadily holding above the important thing psychological degree of $100,000 for the previous six days, with its EMA strains indicating a transparent uptrend—short-term averages are positioned above long-term ones, signaling sustained bullish momentum.

If BTC can break above the quick resistance at $105,705, it might set off one other leg up towards $107,038.

BTC Worth Evaluation. Supply: TradingView.

A robust continuation might push the value additional to $109,312, with a possible breakout towards $110,000, which might mark a historic milestone.

Nevertheless, if the present development loses steam, Bitcoin could face a pullback towards its first key assist at $101,296.

A break under that degree might convey the value again underneath $100,000, opening the door to deeper corrections at $97,766 and doubtlessly $93,422.