Bitcoin’s mining community might face a problem adjustment on the decrease facet for the primary time in almost 4 years. The issue might go down 9% inside the subsequent 5 days, which might be the steepest since July 2021, when China’s ban on mining operations prompted a 50% collapse in international hashrate.

Over the previous two weeks, the full computational energy securing the Bitcoin blockchain has dropped by almost 30%, in line with information from Mempool.area.

Glassnode metrics present that the community’s hashrate now stands slightly below 700 exahashes per second (EH/s), in comparison with a latest excessive of round 1,000 EH/s.

Bitcoin miners at present nearly solely depend on ASICs (application-specific built-in circuits) {hardware}. In earlier instances of the community’s historical past, CPUs and GPUs had been sufficient to mine cash. Profitability now requires custom-built machines consuming important energy, over 7,000 watts, and working on 220-volt techniques with excessive amperage.

The Bitcoin protocol recalibrates its mining problem each 2,016 blocks to take care of a block manufacturing fee of roughly 10 minutes. When fewer machines compete for block rewards, the community responds by reducing the issue to compensate. This time, the response is predicted to be extra pronounced.

Profitability metrics spell mining stress

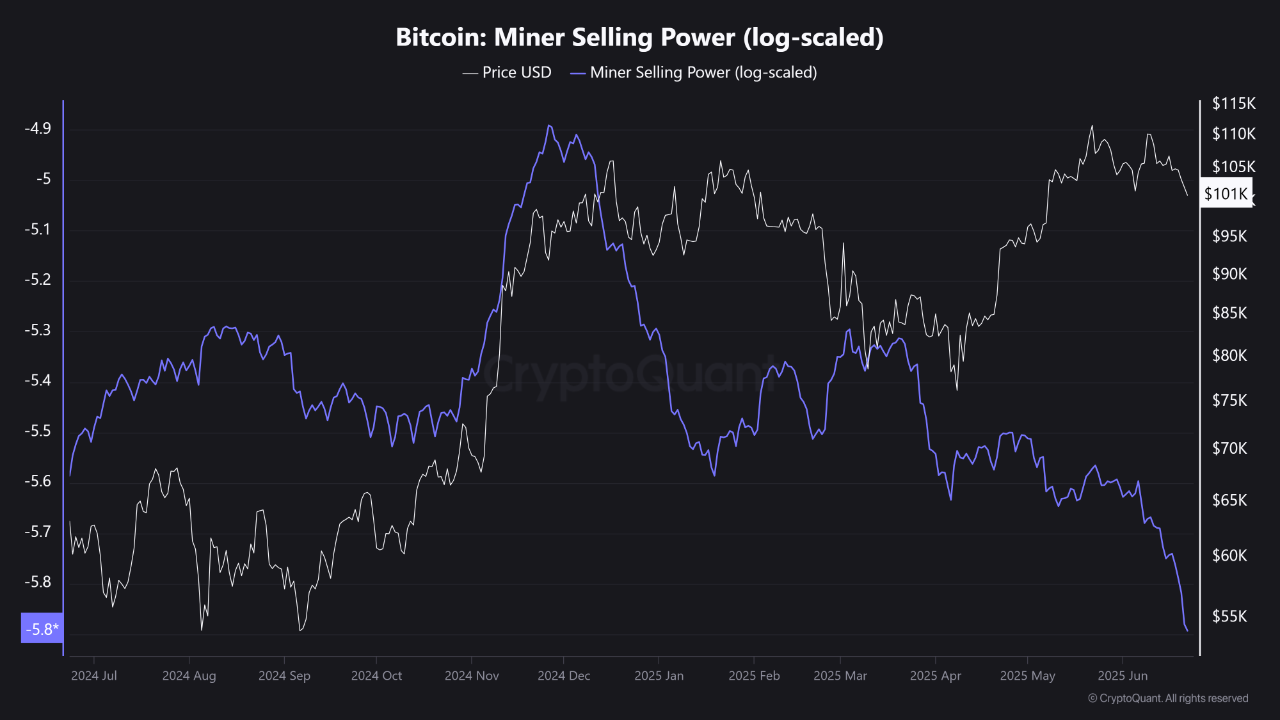

Information from CryptoQuant contributor IT Tech reveals that Bitcoin miners at the moment are “extraordinarily underpaid.” Per the analyst, the market is in a part of compelled selloffs from mining operations to remain afloat.

In latest weeks, the sustainability metric has dropped deep into destructive territory, with an uptick in promoting energy, that means miners are leaning in direction of letting go of their holdings and away from mining.

Miners had been pretty compensated in periods when Bitcoin traded within the $90,000–$105,000 vary between March and Might. But, since early June, the profitability is nearly fully eroded.

CryptoQuant’s Bitcoin: Miner Promoting Energy (log-scaled) chart reveals a downturn within the promoting power of miners. The metric, which accounts for a way a lot Bitcoin miners are able to offloading into the market, has hit a brand new low.

Bitcoin Miner Promoting Energy Chart. Supply: Cryptoquant

As of June 24, problem and hashrate values, a single miner working at 390 TH/s and consuming 7,215 watts of energy at $0.05/kWh would generate a mere $11.76 per day in revenue. It could now take 5,156 days, greater than 14 years, to mine a single Bitcoin underneath these situations.

Mining energy slides as geopolitical variations chunk

On June 22, the USA launched focused airstrikes towards Iranian nuclear services. Whereas not confirmed formally, it’s believed that energy stations might have been impacted.

Iran legalized Bitcoin mining in 2019 and constructed up a large community utilizing backed electrical energy from fossil fuels and nuclear vegetation. At its peak, Iran accounted for about 4.5% of the worldwide Bitcoin hashrate. The determine now stands nearer to three.1%.

Following the US strikes, there have been a number of experiences of blackouts and digital community disruptions from each Iran and neighboring Israel. The outages might have affected mining services, both damaging or forcing them to close down as a consequence of energy loss.

Some analysts noticed a pointy decline in Bitcoin’s hashrate earlier this week, with the community’s computational energy dropping by 8% between Sunday and Thursday. The hashrate reportedly fell from 943.6 million terahashes per second (TH/s) to 865.1 million TH/s.

The market has to this point rebounded towards the backdrop of US President Donald Trump’s announcement of a “whole ceasefire” settlement between Iran and Israel. Phrase from Trump seemingly helped restore investor confidence, pushing Bitcoin again up above the $106,000 stage on Monday. On the time of this report, the most important coin by market cap is altering fingers round $105,300.