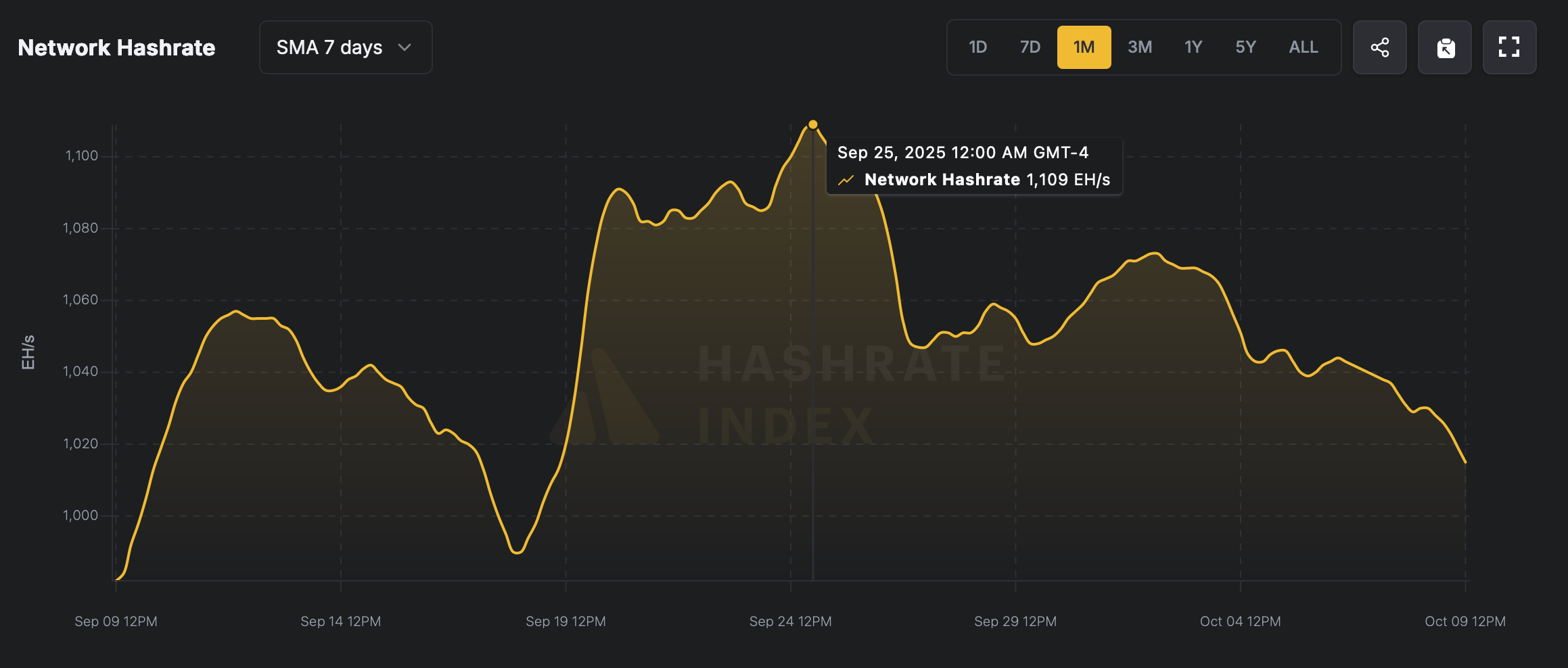

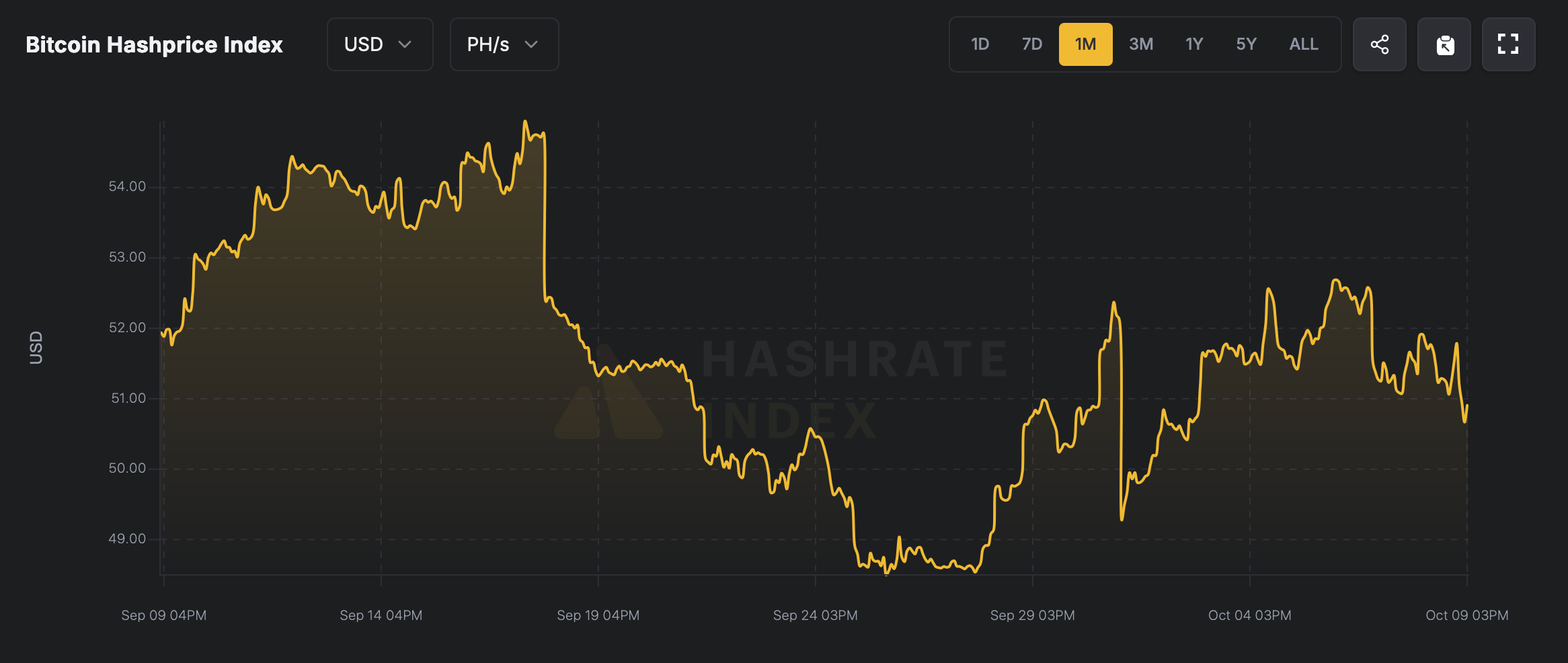

Over the previous two weeks, Bitcoin’s hashrate has fallen by practically 100 exahashes per second (EH/s) — signaling a slowdown in international mining exercise. This decline coincides with a $2 drop in mining income per petahash (PH/s) since final month, reflecting tighter revenue margins for miners amid fluctuating community circumstances.

World Bitcoin Hashrate Pulls Again From All-Time Excessive, Signaling Community Rebalance

As the following problem adjustment approaches subsequent week, estimates anticipate a notable discount in mining problem, probably providing short-term aid however pointing to broader volatility throughout the bitcoin mining ecosystem.

Roughly two weeks in the past, Bitcoin’s whole community hashrate reached a record-breaking peak of 1,109 EH/s — marking the very best stage of computational energy in its historical past. Since then, the community’s energy has eased, with the present hashrate hovering round 1,011 EH/s, signaling a measurable contraction in mining exercise and community effectivity.

A lot of this decline stems from Bitcoin’s mining problem climbing to an all-time excessive of 150.84 trillion, following seven consecutive problem will increase — a sustained development that has tightened miner profitability and amplified community competitors throughout the worldwide Bitcoin ecosystem.

As of Oct. 10, projections point out that Bitcoin’s mining problem is about to lower by roughly 7.57%, providing a possible reprieve for miners after a number of weeks of tightening margins. This problem discount may assist operators get better from the latest hashrate downturn and restore stability to the community’s economics.

Mining income briefly improved when bitcoin’s worth surged to new worth highs earlier this week, pushing the hashprice — the estimated worth of 1 PH/s — near $53. On the time of writing, the hashprice stands at roughly $51.20, reflecting a modest cooling that also stays favorable in comparison with prior months.

Within the weeks forward, the bitcoin mining panorama will hinge on how miners adapt to the approaching problem adjustment and the broader market dynamics shaping profitability. A 7.57% discount in problem may present short-term aid, however sustained restoration relies on bitcoin’s worth stability, vitality prices, and international community participation.

Traditionally, such cycles of hashrate contraction and rebound have served as pure recalibrations for the community — filtering out much less environment friendly operations whereas rewarding these capable of innovate and scale. For now, the dip in hashrate and the easing of mining problem sign a possible stabilization part, providing miners a window to optimize operations earlier than the following main shift within the BTC financial system.

💡 FAQ: Bitcoin Hashrate & Mining Issue

- What brought on Bitcoin’s hashrate to drop not too long ago?The decline stems primarily from rising mining problem and decreased profitability margins throughout the community.

- How a lot is the Bitcoin mining problem anticipated to alter?Estimates from hashrateindex.com recommend a 7.57% lower, marking the primary important problem drop in a number of weeks.

- What’s Bitcoin’s present hashprice per PH/s?The hashprice is hovering close to $51.20 per petahash, barely beneath its latest $52 peak.

- How will this problem drop have an effect on miners?Decrease problem may quickly enhance miner rewards and assist stabilize operations amid latest volatility.