Bitcoin (BTC) stays inside a decent buying and selling vary following a latest pullback from its all-time excessive. On the time of writing, the world’s largest cryptocurrency is priced at $118,570, reflecting a 0.3% improve over the previous 24 hours.

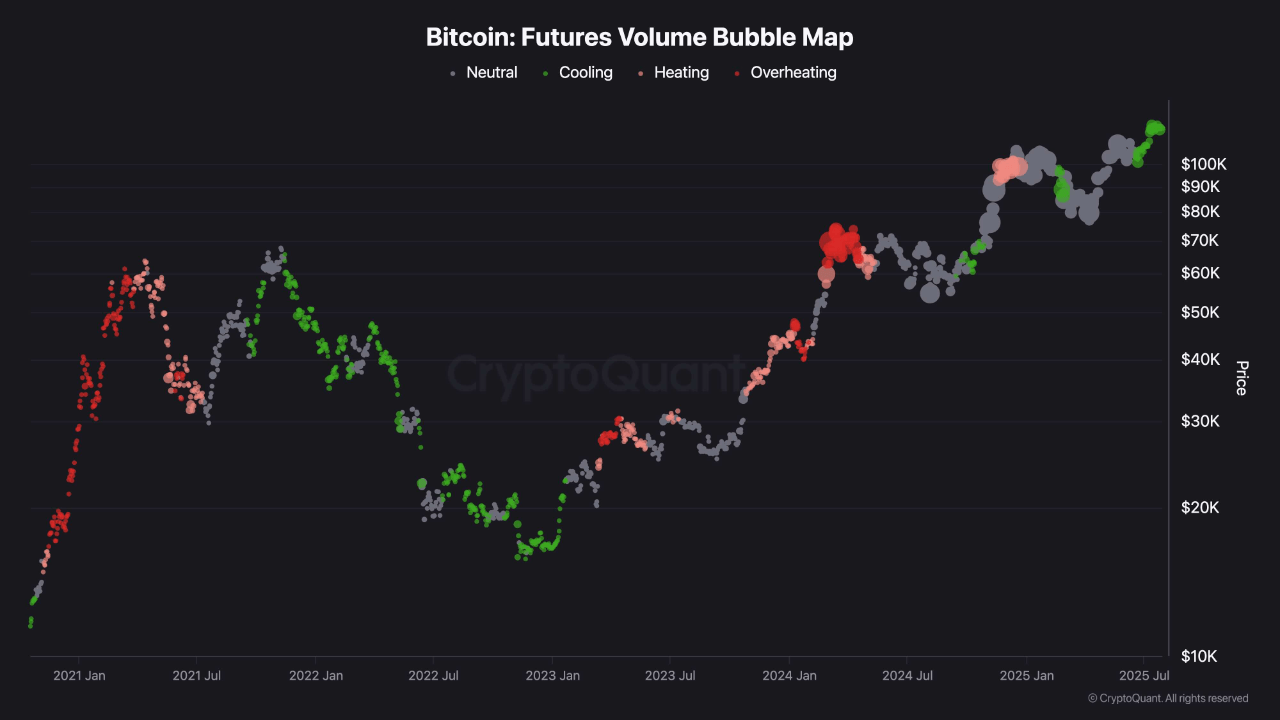

Current evaluation shared on CryptoQuant’s QuickTake platform by market contributor ShayanMarkets highlights a noticeable change in Bitcoin’s futures market exercise.

In accordance with the analyst, whereas earlier worth surges within the $70,000–$90,000 vary have been marked by vital speculative strain and leverage buildup, the present pattern exhibits indicators of cooling regardless of elevated worth ranges. This shift may play a key function in figuring out Bitcoin’s trajectory within the coming weeks.

Bitcoin Futures Market Exhibits Indicators of Normalization

ShayanMarkets defined that in previous rallies, the futures market displayed what he referred to as “heating and overheating phases,” usually seen in pink clusters on the amount bubble map. These durations sometimes led to corrections or non permanent worth consolidations as leveraged positions unwound.

Nonetheless, the present knowledge displays a distinct setup. Regardless of Bitcoin remaining close to report highs, futures market exercise has transitioned to impartial and cooling phases, proven by gray and inexperienced bubbles on the chart.

The analyst famous that this cooling part might be an indication of de-risking amongst merchants, as speculative exercise eases whereas spot demand helps the value. In a press release on QuickTake, ShayanMarkets mentioned:

This reset in leverage, regardless of BTC staying above $100K, alerts more healthy market circumstances as demand shifts towards natural shopping for quite than high-risk speculative bets.

The analyst added that if the diminished speculative strain continues, it may present the muse for one more vital worth improve, doubtlessly setting Bitcoin as much as break previous its earlier all-time excessive above $123K.

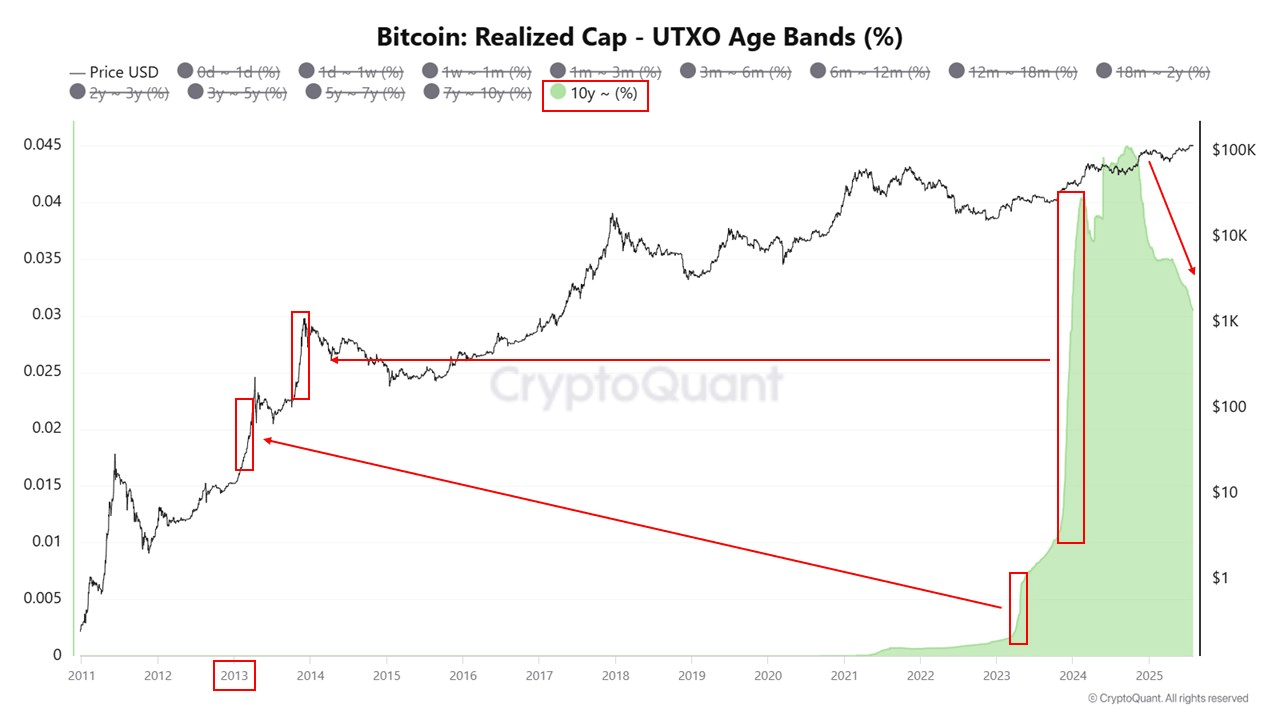

Lengthy-Time period Whales Take Income Amid Value Stability

In the meantime, one other evaluation from CryptoQuant contributor CoinCare revealed promoting exercise from long-term Bitcoin holders, also known as “whales,” who’ve maintained their positions for over a decade.

In accordance with CoinCare, a few of these holders, together with those that first amassed Bitcoin round 2013, have began to liquidate a portion of their holdings.

This promoting exercise aligns with the historic timeline of Bitcoin’s sharp rise from beneath $100 to roughly $1,000 throughout that interval, representing a possible 117,900% return for early adopters.

Such profit-taking from early traders shouldn’t be uncommon in periods of elevated costs and doesn’t essentially point out a shift in long-term market sentiment.

Traditionally, whale exercise has influenced short-term volatility however has additionally contributed to market redistribution, permitting newer individuals to enter the market.

Featured picture created with DALL-E, Chart from TradingView