BITF has taken off and the momentum isn’t fading. Is there a growth the market’s quietly pricing in? Or is it time to re-rate the inventory altogether?

The next visitor put up comes from BitcoinMiningStock.io, a public markets intelligence platform delivering information on corporations uncovered to Bitcoin mining and crypto treasury methods.

Bitfarms Inventory Surges – Re-Score Part Subsequent?

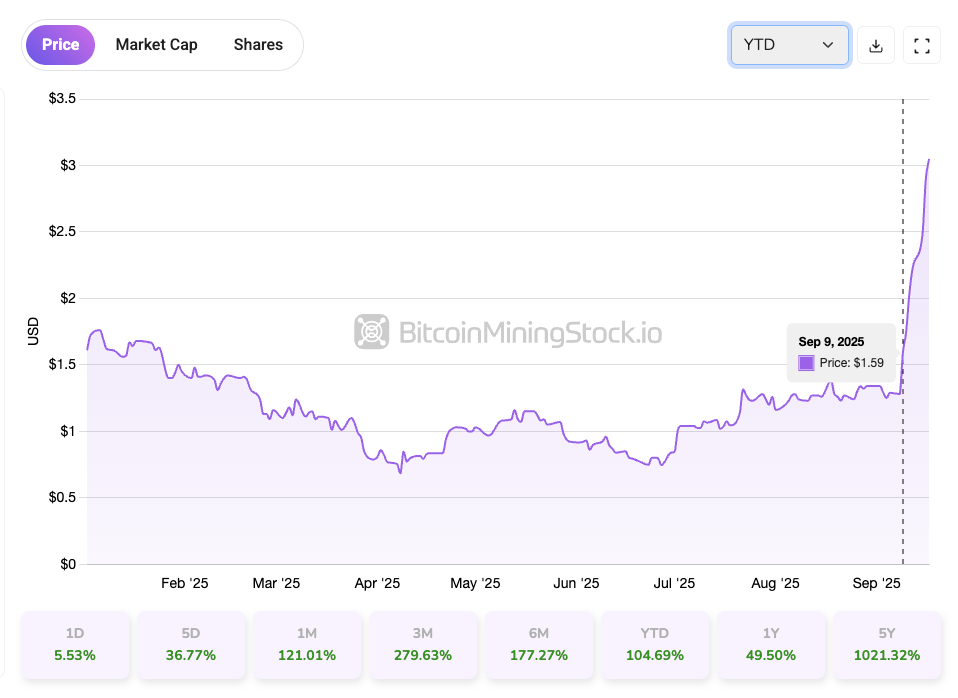

Bitfarms (Nasdaq: BITF) closed final week because the top-performing Bitcoin mining inventory tracked by BitcoinMiningStock.io, posting a surprising 72.86% acquire over a 5-day buying and selling interval. The rally started round September ninth and exhibits little signal of slowing on the time of writing. Notably, this run-up occurred within the absence of any firm information launch bulletins. As a substitute, investor sentiment appears to have been pushed by a renewed understanding of Bitfarms’ enterprise transformation, amplified by CEO Ben Gagnon’s presentation on the H.C. Wainwright twenty seventh Annual World Funding Convention.

Whereas the presentation wasn’t broadly broadcast, investor dialogue on X picked up tempo and social feeds turned noticeably extra bullish on BITF. For these accustomed to my December 2024 report, this marks a shift. Again then, I wrote:

“Whereas Bitfarms’ monetary and operational methods are aligned with business traits, the corporate struggles to face out because of an absence of a transparent, distinctive aggressive benefit.”

9 months later, it appears that evidently the corporate has discovered an edge – to turn into a North American power and compute infrastructure firm. And this evolving technique is lastly getting investor consideration.

So I need to return to the basics of Bitfarms’ current developments, and decide whether or not it’s time to re-rate the inventory.

What Bitfarms’ CEO Mentioned on the H.C. Wainwright Convention

On the H.C. Wainwright occasion, Gagnon positioned Bitfarms as a future “North American power and compute infrastructure firm.” He framed the corporate’s 18 EH/s Bitcoin mining operation as a “low-cost bridge financing instrument” to assist its transition into HPC and AI infrastructure. Whereas mining nonetheless covers all working bills and contributes to capex, no additional miner purchases or fleet expansions are deliberate. As a substitute, the prevailing fleet, benefiting from low-cost electrical energy and excessive operational effectivity, is predicted to generate secure free money circulation by 2026 below most BTC pricing eventualities. In brief, Bitfarms intends to unlock the potential of its power portfolio, as soon as constructed to assist mining, to serve the rising HPC/AI market.

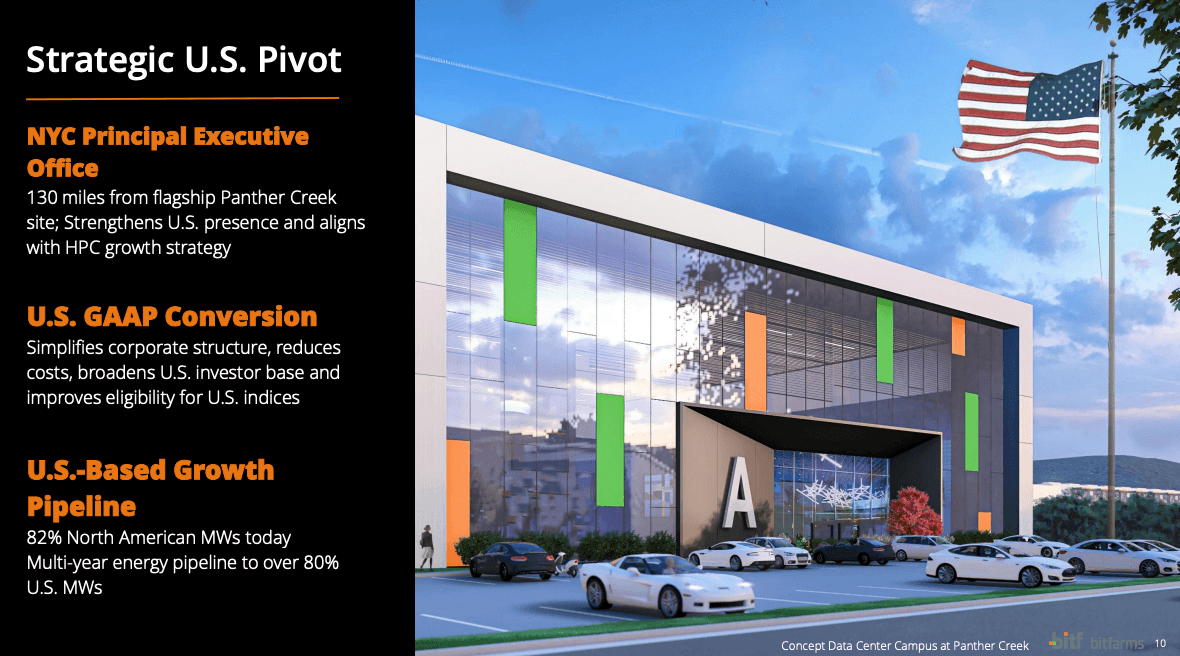

Bitfarms’ geographic footprint has additionally shifted to assist this technique. When Gagnon turned CEO, simply 45% of the corporate’s footprint was in North America. At present, that quantity stands at 82%, with practically all future development concentrated within the U.S. The eventual exit from Latin America, notably Argentina, by November 11, 2025, marks a decisive pivot towards changing into a U.S.-focused platform.

Screenshot from Bitfarms presentation.

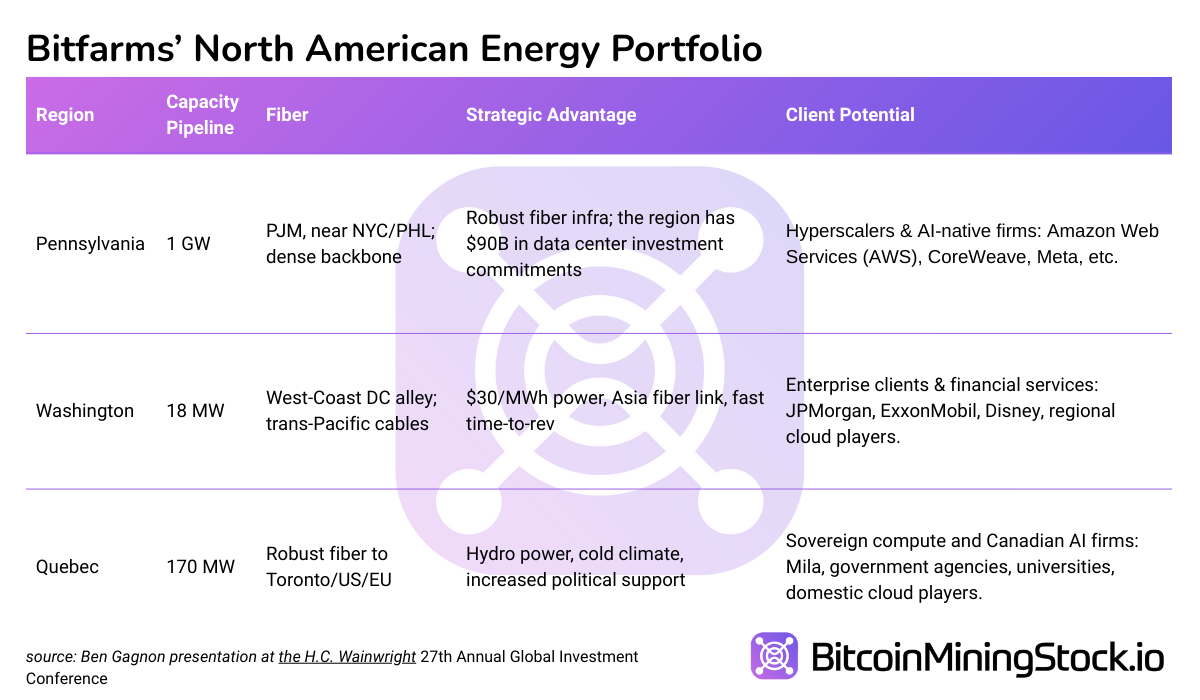

In North America, the corporate now has a 1.2 GW energy pipeline. Key websitesembody Panther Creek in Pennsylvania, its established operations in Quebec, and a rising footprint in Washington state. These websites are situated close to main fiber optic corridors, enabling them to assist information heart workloads throughout North America and probably throughout the Atlantic. With favorable energy economics and improved Energy Utilization Effectiveness (PUE), Bitfarms believes it may possibly ship increased compute yields per megawatt which supplies a important edge in HPC markets.

This evolving narrative of mining as we speak, infrastructure tomorrow, is aligned with investor sentiment. Markets are displaying a transparent choice for long-term, secure income from AI infrastructure internet hosting.

Bitfarm’s HPC Growth: Hype or Actual Progress?

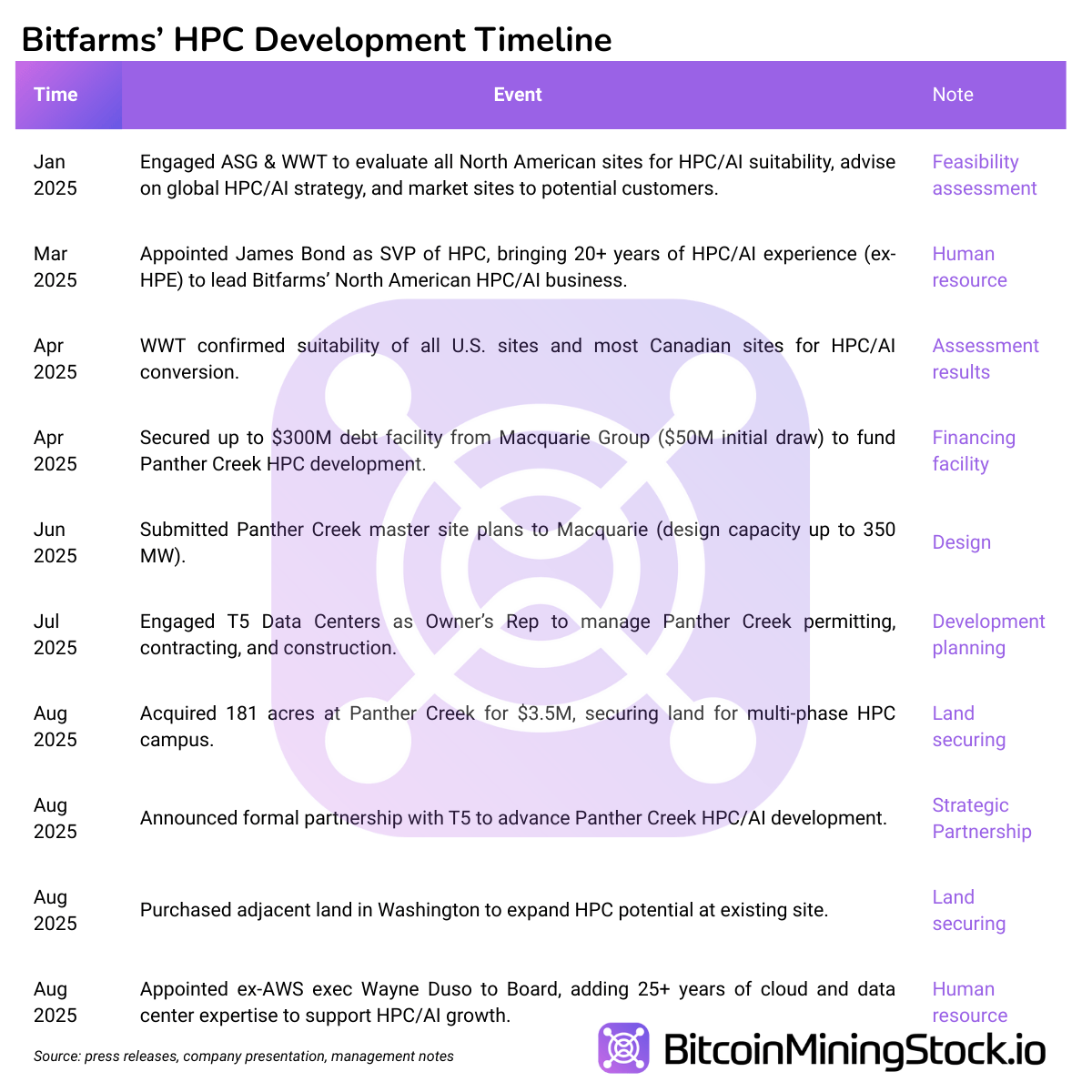

Bitfarms’ HPC growth is starting to take tangible form, although it stays within the early phases. Over current quarters, the corporate has initiated site-level feasibility assessments, secured permits and capability, strengthened its crew with related experience and established strategic partnerships to market the websites to potential prospects.

To the shock of many, even the long-criticized Stronghold acquisition, as soon as deemed as overpriced, has turned out to be a strategic asset. The acquisition offered Bitfarms with a big, scalable footprint in Pennsylvania, an rising hub for AI and HPC information heart growth. This will increase the possibilities of the corporate to draw future AI and HPC purchasers.

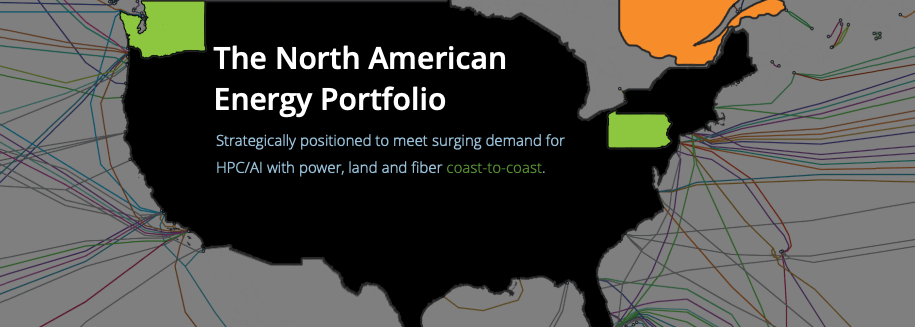

In reality, Pennsylvania, a part of the PJM interconnection, is now Bitfarms’ main area for AI/HPC buildout (the corporate has a 1 GW power pipeline there). In keeping with its newest investor presentation, Bitfarms is positioned to satisfy surging HPC and AI demand with coast-to-coast infrastructure: east (Pennsylvania), west (Washington) and north (Quebec).

Screenshot from the Bitfarms’ presentation.

Collectively, these fiber related websites allow Bitfarms to serve latency-sensitive workloads on each U.S. coasts and hyperlink them with Europe. This networked structure is a key differentiator as the corporate pivots towards HPC infrastructure.

The next desk summarizes the traits of every area:

In brief, Bitfarms has laid significant groundwork for its HPC and AI pivot, however the initiative stays firmly within the pre-commercial section. The subsequent few quarters will probably be important in figuring out whether or not this technique matures right into a scalable income engine, or as an alternative turns into a capital-intensive distraction that strains the stability sheet with out near-term payoff.

Financing the Pivot

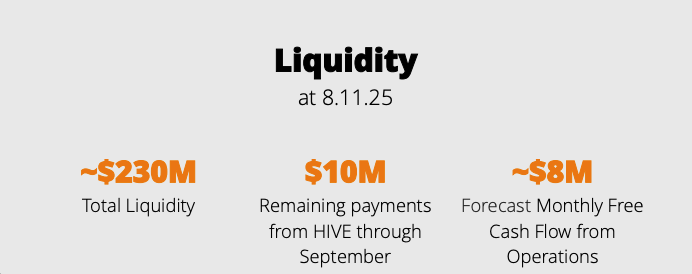

Bitfarms is financing its transition to HPC by a mix of inside money circulation, asset optimization, and a brand new credit score facility. Its 17.2 EH/s mining fleet generates ~$8M/month FCF below the present market. Administration continues to promote Bitcoin to fund capex and opex whereas nonetheless holding 1,005 BTC on their stability sheet. Bitfarm’s exit in Argentina by November 11, 2025 will unlock roughly $18 million by lease releases, legal responsibility reductions, and the sale of not too long ago imported S21+ miners.

As of August 11, the corporate held ~$230 million in liquidity (money plus unencumbered BTC), with an extra ~$10 million anticipated from the Yguazu/HIVE sale and pending miner gross sales.

Bitfarms Liquidity Place (screenshot from the firm presentation).

As well as, Bitfarms secured a as much as $300 million credit score facility from Macquarie to fund its Panther Creek website. The primary $50 million has been drawn to assist early growth, with the remaining $250 million obtainable in tranches tied to development milestones. Upon activation, the construction converts to non-recourse challenge debt. The ability carries an 8% rate of interestand contains warrant protection, $25 million minimal money necessities, and BTC-price-linked covenants. The subsequent tranche is predicted in This fall 2025, contingent on allowing progress.

Whereas such a funding construction preserves flexibility and limits dilution, it has a timing hole to handle. HPC income stays quarters away (probably mid-2026 or later). In the meantime, friends like Core Scientific, TeraWulf, Utilized Digital are already onboarding purchasers. Execution velocity, price management, and buyer acquisition will probably be important to closing the hole.

Last Ideas

Bitfarms is actively pivoting from a world Bitcoin miner to a North American power and compute infrastructure firm. Its U.S. websites are close to main fiber traces, giving them the technical viability to assist AI internet hosting workloads from coast-to-coast* and even, hypothetically, to Europe because of low energy prices and favorable geolocation.

*Whereas “coast-to-coast” attain sounds compelling, some grounded perspective is required: Bitfarms’ West Coast presence in Washington solely has 18 MW of capability, which is nicely under the standard 100+ MW measurement seen in earlier HPC colocation offers. Its North (Quebec) websites, whereas sizable, are topic to regulatory approval earlier than being repurposed for HPC workloads. That leaves the East (Pennsylvania), with websites like Panther Creek, as the corporate’s solely HPC-ready asset with clear roadmap for now.

That stated, the transition is early. The corporate has but to have any objective constructed information heart prepared or land a fabric HPC deal. Till then, a lot of the upside stays aspirational. However insider habits provides some confidence: the corporate initiated a share buyback program and CEO Ben Gagnon has elevated his private holdings.

For buyers with a 12-24 month horizon and urge for food for early-stage infrastructure development at deep-value entry factors, Bitfarms could now current an asymmetrical alternative. Its developments, from senior hires to fiber-ready properties and staged financing, supply tangible causes to revisit the thesis.

In the end, it’s your name whether or not to re-rate the inventory. But when Bitfarms delivers on even a part of its infrastructure narrative, the upside case may look fairly totally different from the standard Bitcoin mining play.