- BlackRock boosts Ethereum holdings with $54.8M buy, now holding 1.4M ETH.

- Ethereum futures open curiosity stays excessive regardless of worth dips, signaling robust market exercise.

- ETH trades close to $2,450 with regular quantity and $295B market cap amid intraday worth swings.

BlackRock, the world’s largest asset supervisor, has bought 22,058.53 Ethereum (ETH), valued at roughly $54.8 million. This current acquisition marks one other transfer in BlackRock’s rising engagement with the crypto market, significantly with Ethereum, the second-largest digital asset by market capitalization.

JUST IN: BlackRock buys 22,058.53 Ethereum value $54.8 million. pic.twitter.com/x52Opwsswq

— Whale Insider (@WhaleInsider) July 2, 2025

The acquisition was confirmed via blockchain monitoring information shared by analytics agency Arkham, which screens massive transactions and institutional exercise. The info indicated that BlackRock’s Ethereum purchase was a part of a sequence of transactions on Coinbase Prime, with particular person purchases starting from 9,000 to over 58,000 ETH tokens. These transactions replicate values between $23 million and $61 million every.

Following this newest buy, BlackRock’s Ethereum holdings are estimated at round 1.4 million ETH, rating it among the many largest institutional holders of the cryptocurrency. The corporate’s curiosity in Ethereum enhances its earlier investments in Bitcoin-related merchandise, together with its iShares Bitcoin Belief and a USD Institutional Digital Liquidity Fund that operates on the Ethereum blockchain.

Ethereum Market Exercise and Futures Overview

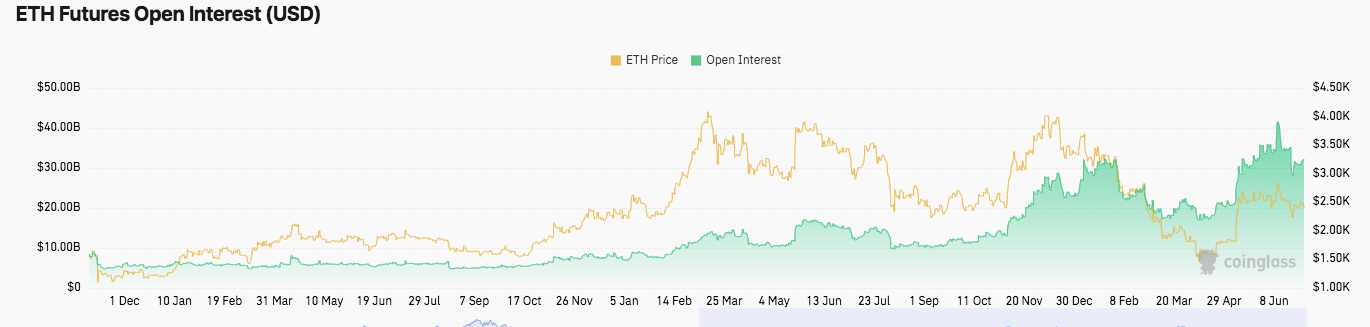

In parallel with BlackRock’s accumulation, Ethereum futures markets have remained lively over current months. From December via mid-March, Ethereum’s worth ranged between $1,500 and $2,500, whereas futures open curiosity hovered round $5 billion. Beginning in mid-March, Ethereum’s worth surged, peaking at roughly $4,300 in mid-April. Open curiosity in Ethereum futures elevated alongside this rally, reaching almost $30 billion.

Supply: Coinglass

Regardless of a worth decline beneath $2,000 in Could and June, open curiosity in futures contracts stayed excessive, fluctuating between $20 billion and $35 billion. This persevering with stage of futures market exercise signifies ongoing buying and selling curiosity, which might embrace hedging and speculative positions by institutional and retail contributors. As of late June and early July, Ethereum’s worth recovered above $2,500, with futures open curiosity sustaining ranges above $30 billion.

Present Ethereum Market Metrics

In the course of the time of writing, Ethereum was buying and selling at $2,450, displaying a 0.32% lower within the final 24 hours. The market capitalization stands at $295.72 billion, with a drop of 0.33%. Buying and selling quantity elevated by 4.07%, reaching $16.39 billion throughout this era.

Supply: CoinMarketCap

The circulating provide of Ethereum can also be experiencing no capped provide at 120.71 million ETH, which is the same as its whole provide. It’s a diluted worth of about $295.69 billion. The near-term worth motion reveals that it has moved up briefly below $2,400 after which got here again to just about $2,450, which is proof of standard intraday motion.