Bitcoin’s worth hovered at $106,848 on June 27, 2025, with a 24-hour buying and selling quantity of $22.27 billion and a market capitalization of $2.12 trillion. The intraday vary spanned from $106,709 to $107,884, signaling a constrained session because the market digested latest volatility.

Bitcoin

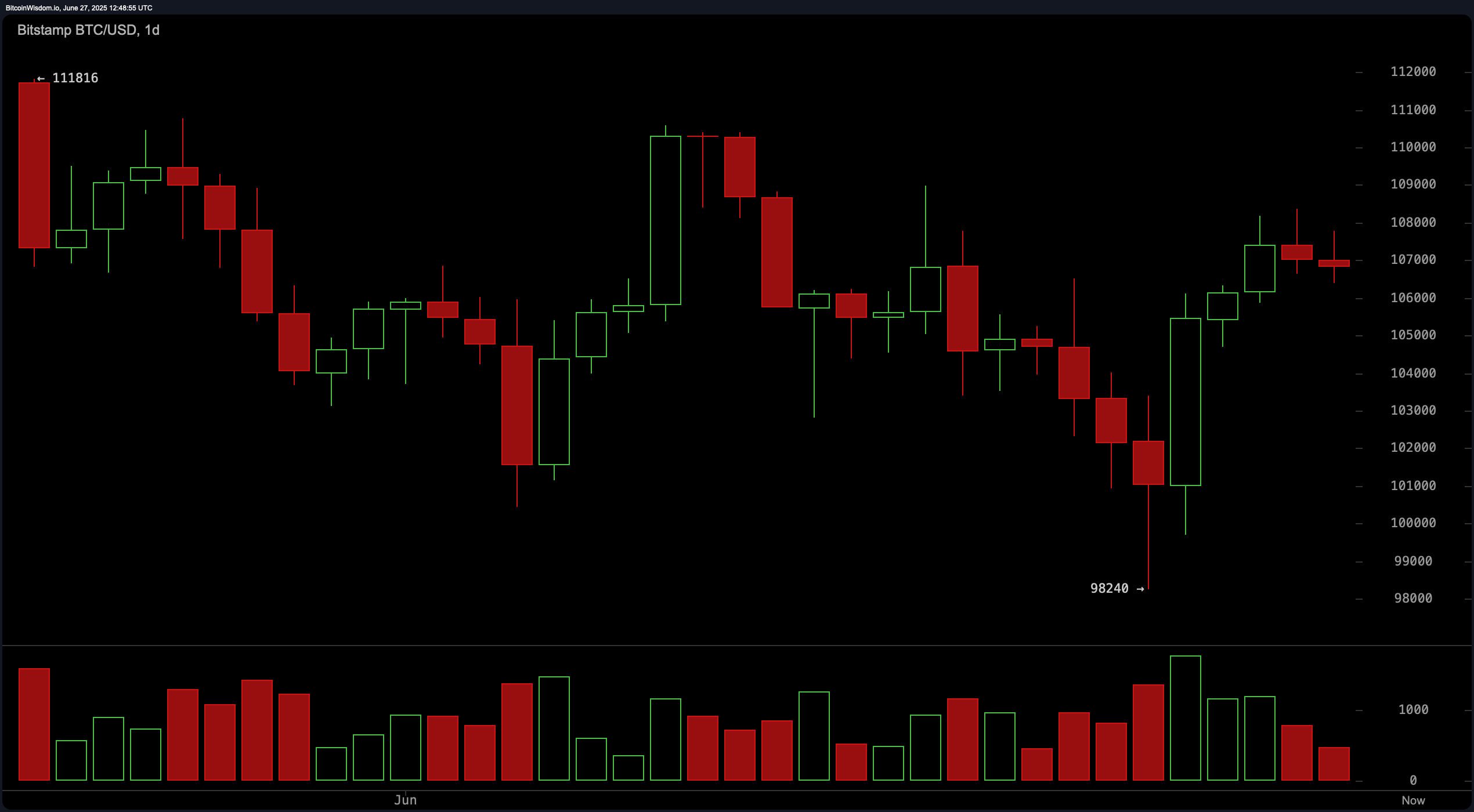

The every day chart for bitcoin reveals a short-term bullish construction rising from a pointy V-shaped restoration off the $98,240 assist degree. Present worth motion stays above $105,000, supported by a sequence of purchase indicators throughout a number of shifting averages, together with the exponential shifting common (EMA) 10 at $105,718 and the easy shifting common (SMA) 10 at $104,894. Momentum indicators such because the superior oscillator (AO), momentum, and the shifting common convergence divergence (MACD) additionally register bullish indicators, whereas key resistance stands close to $111,816. If quantity reaccelerates, bulls could look to problem this resistance zone within the coming classes.

BTC/USD 1-day chart by way of Bitstamp on June 27, 2025.

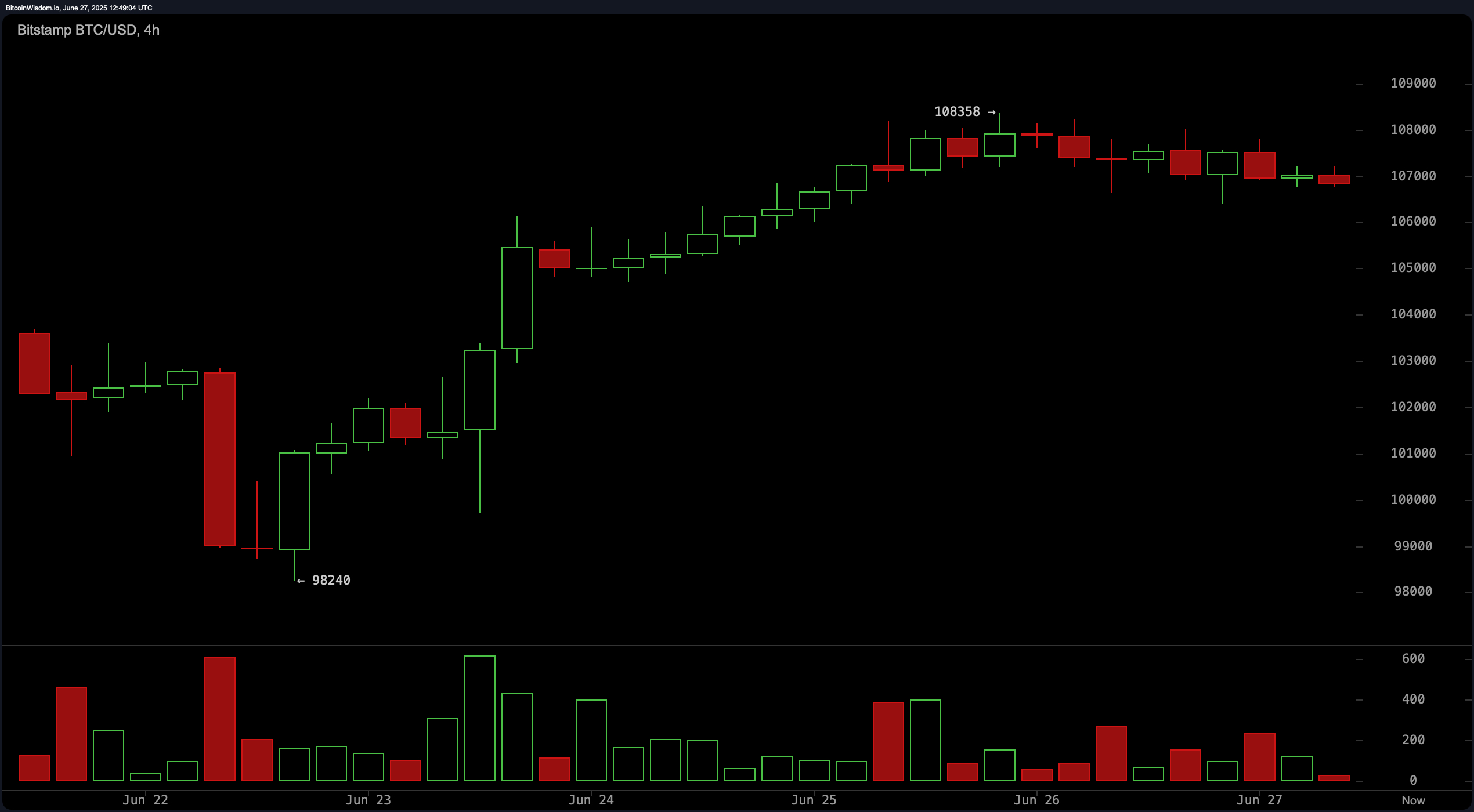

The 4-hour chart displays consolidation following a robust advance to $108,358, with worth motion forming both a bullish flag or a distribution sample. The range-bound habits and declining quantity counsel indecision, however a breakout above $108,500 on rising quantity would validate a bullish continuation. Alternatively, a bounce off the $105,000 assist space would provide a safer lengthy entry. The potential exit zone lies between $109,000 and $111,000, contingent on how the value responds to the higher consolidation boundary.

BTC/USD 4-hour chart by way of Bitstamp on June 27, 2025.

The 1-hour chart offers a extra granular view of bitcoin’s latest habits, the place the asset is displaying indicators of short-term bearish stress after setting a decrease excessive at $108,358. Key assist at $106,394 has been examined twice, reinforcing its relevance. Scalpers could discover alternatives throughout the $106,000 to $106,400 vary, with upside potential capped close to $107,800 to $108,200. Breakouts above $107,500 with elevated quantity may set off momentum-driven trades, although a decent stop-loss beneath $106,300 is suggested for threat administration.

BTC/USD 1-hour chart by way of Bitstamp on June 27, 2025.

Oscillators reinforce a neutral-to-positive stance on bitcoin’s present trajectory. The relative energy index (RSI) is at 55, indicating balanced momentum with out overbought circumstances. The stochastic oscillator at 82 and commodity channel index (CCI) at 50 each stay impartial, whereas the typical directional index (ADX) at 15 suggests a weak development energy. These metrics spotlight the significance of quantity affirmation earlier than initiating directional trades.

Transferring averages (MAs) current a constant bullish alignment throughout timeframes. All key exponential and easy shifting averages—from the 10-period to the 200-period—are positioned beneath the present worth, issuing purchase indicators. This technical construction underscores the sustained energy behind bitcoin’s latest rally, although merchants are suggested to watch quantity intently as the value nears important resistance. A failure to maintain momentum may sign a short-term prime and immediate a retracement towards examined assist zones.

Bull Verdict:

If quantity confirms a breakout above $108,500, supported by bullish indicators from all main shifting averages and momentum indicators such because the superior oscillator, momentum, and MACD, bitcoin is poised to check the $111,000–$112,000 resistance space. Sustained buying and selling above $105,000, paired with rising institutional inflows, may additional solidify bullish momentum and mark the continuation of a broader uptrend.

Bear Verdict:

Ought to bitcoin fail to interrupt above $108,500 and as a substitute lose the $105,000 assist zone on rising quantity, the short-term bullish construction could unwind. With impartial oscillators and declining quantity throughout consolidation, a breakdown may expose the asset to a retest of the $98,240 assist, significantly if broader market sentiment turns risk-averse.