The Ethereum worth at this time is holding above $3,430 after a steep rally that adopted a breakout from a multi-month cup and deal with sample. Value surged previous $3,100 earlier this week and is now approaching a key zone close to $3,500. Merchants are watching carefully to see if this upside continuation holds or if a brief pause units in at resistance.

What’s Occurring With Ethereum’s Value?

ETHUSD worth dynamics (Supply: TradingView)

The each day chart exhibits a transparent breakout above the deal with construction of the big cup and deal with sample, with Ethereum worth climbing from the $3,100 neckline into open air. This sample confirms a structural bullish reversal with projected targets between $3,700 and $4,100 based mostly on measured transfer concept. The weekly chart additionally reveals a clear breach of the 0.618 Fibonacci retracement at $3,177, with ETH now transferring towards the 0.786 Fib degree at $3,525.

ETHUSD worth dynamics (Supply: TradingView)

From a quantity and construction perspective, worth has invalidated the earlier CHoCH (change of character) and reclaimed main liquidity zones. The Good Cash Ideas chart exhibits a clear BOS (break of construction) above the prior weekly excessive, aligning with the beginning of an aggressive markup section. So long as ETH sustains above $3,100, the bullish construction stays intact.

Why Is The Ethereum Value Going Up Right now?

ETH Spinoff Evaluation (Supply: Coinglass)

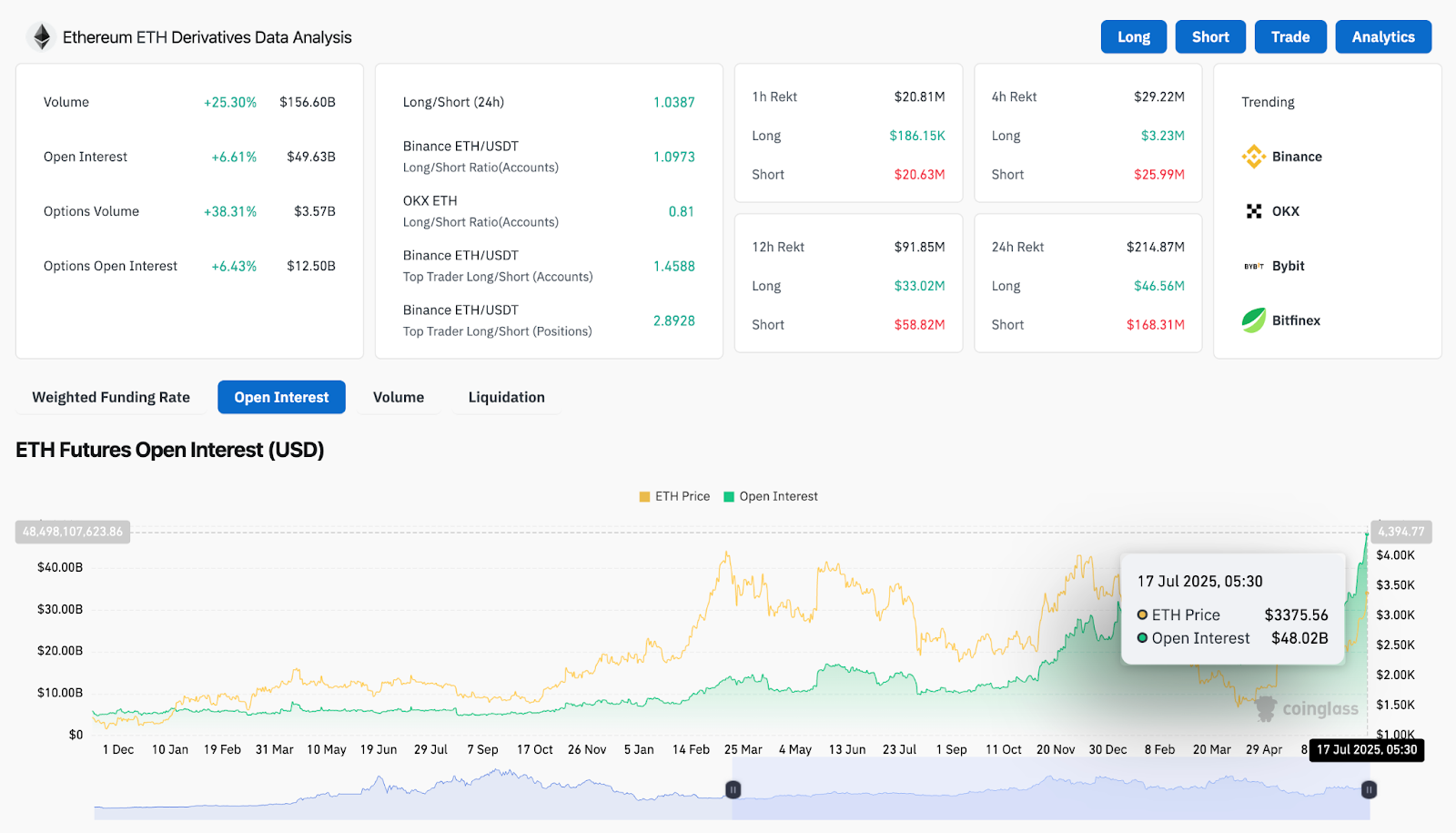

The primary catalyst behind why Ethereum worth going up at this time lies within the mixture of technical breakout affirmation and rising speculative demand. Derivatives information from Coinglass exhibits a 25.30% surge in ETH futures quantity to $156.6 billion over the previous 24 hours, with open curiosity up 6.61% to $49.63 billion. This indicators contemporary lengthy positioning and excessive conviction shopping for curiosity.

Lengthy/quick ratios are skewed bullish throughout exchanges. Binance accounts present a 1.0973 lengthy ratio, whereas high dealer positions on Binance are much more aggressively lengthy at 2.89. The choices market can also be heating up with 38.31% increased quantity and rising open curiosity, displaying merchants are betting on additional upside. This confluence of technical and sentiment-based assist is fueling the rally.

Bollinger Bands and EMAs Affirm Breakout Energy

ETHUSD worth dynamics (Supply: TradingView)

On the 4-hour chart, Ethereum worth motion is buying and selling far above the 20/50/100/200 EMA cluster. All 4 exponential transferring averages are stacked bullishly beneath present worth, with the 200 EMA sitting at $2,691 and the 20 EMA now close to $3,163. This construction offers a powerful dynamic assist base in case of short-term pullbacks.

The Bollinger Bands have expanded sharply, indicating elevated volatility after the breakout. Value has pierced above the higher band at $3,418, confirming aggressive worth growth. Nonetheless, short-term consolidation could happen between $3,400 and $3,500 as merchants take income.

ETHUSD worth dynamics (Supply: TradingView)

On the 30-minute chart, RSI has hit 71.4, getting into overbought territory. MACD stays in bullish territory, although histogram bars are starting to flatten, suggesting momentum may cool within the quick time period.

Ethereum Value Prediction: Quick-Time period Outlook (24H)

ETHUSD worth dynamics (Supply: TradingView)

The short-term outlook for Ethereum worth stays bullish, with quick resistance seen on the $3,525 zone, aligning with the 0.786 Fibonacci degree. A breakout above this area may speed up the transfer towards $3,715 and $4,107, as outlined within the each day breakout projection. On the draw back, assist rests at $3,307 and the prior breakout degree of $3,107.

Merchants ought to look ahead to any consolidation close to $3,450 to $3,500, which may supply a launchpad for the following leg increased. A drop beneath $3,307 would counsel non permanent exhaustion however wouldn’t invalidate the bigger bullish development until $3,100 breaks.

Ethereum Value Forecast Desk: July 18, 2025

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.