Bitcoin’s worth is at present sitting at an important degree that might form market route within the coming weeks. Consumers and sellers are locked in a good battle, and the market seems to be standing on the sting of a possible breakdown.

BTC Value Technical Aspect

By Shayan

The Each day Chart

On the day by day chart, Bitcoin has not too long ago slipped beneath the big ascending channel that had been driving its uptrend over the previous few months. The failure to carry above $120K is a bearish sign, and with the $110K assist and the 100-day transferring common now liable to breaking, the market could possibly be heading for a pointy drop towards the $100K zone, the place the 200-day transferring common additionally resides.

The RSI is holding beneath 50, additional confirming bearish momentum and strengthening the case for continued draw back. At this stage, solely a powerful wave of shopping for strain may stop a deeper decline and stabilize the market.

The 4-Hour Chart

The 4-hour chart exhibits a transparent faux breakout and rejection across the $116K resistance, signaling that even the anticipation of decrease rates of interest has not been sufficient to spark a brand new rally. This can be a bearish signal, as markets failing to react positively to excellent news typically counsel underlying weak spot.

Presently, the $111K assist is breaking down, which may pave the best way for a swift decline towards the crucial $100K zone. Whereas the earlier accumulation between $105K and $110K could generate some shopping for curiosity and short-term assist, the general market construction factors to the next chance of additional draw back.

On-Chain Evaluation

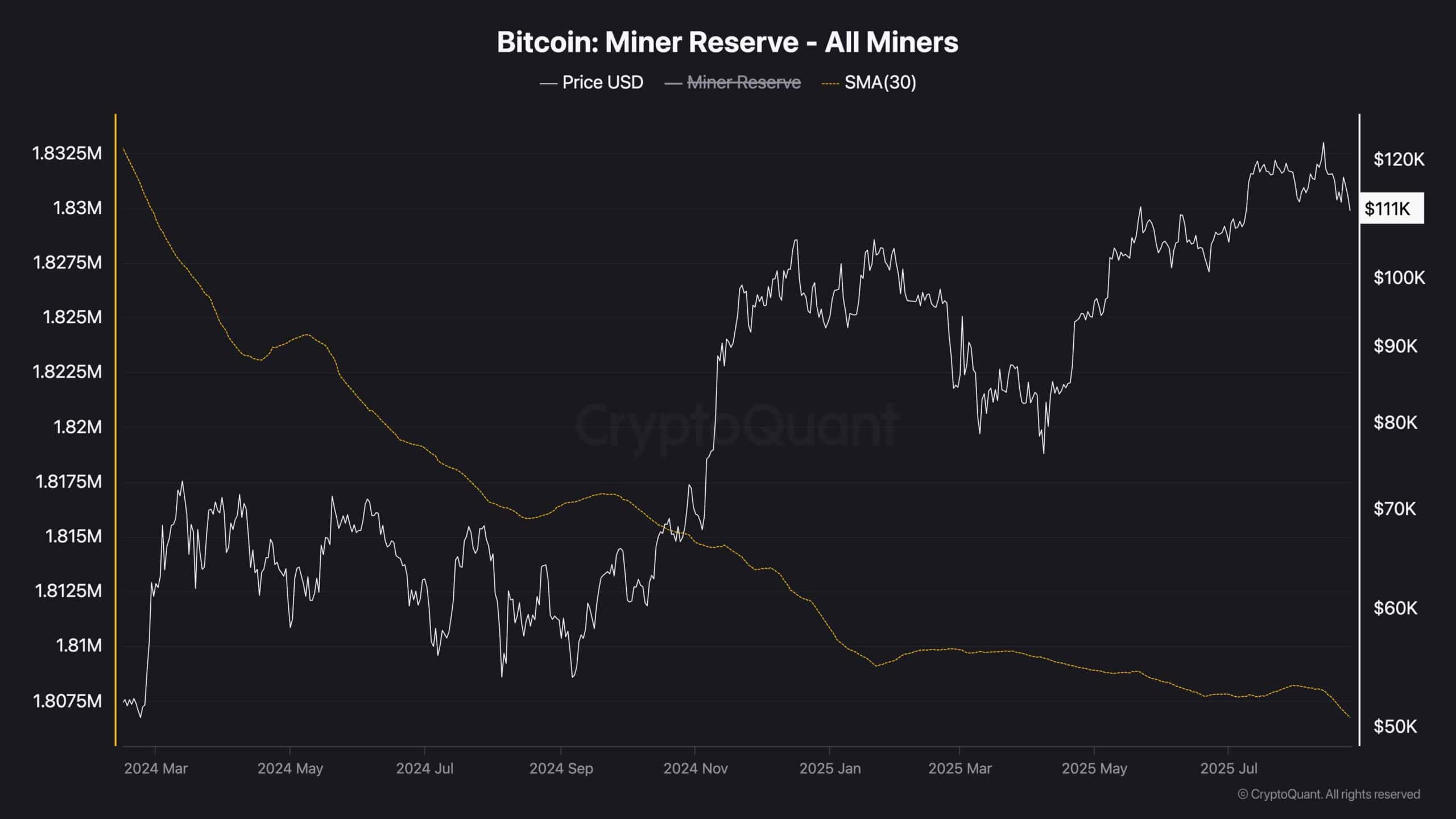

Miner Reserve (30-Day Shifting Common)

Bitcoin miners have been persistently promoting their holdings over the previous couple of years, primarily to cowl operational prices. Whereas anticipated, this regular outflow provides additional promoting strain to the market, which might weigh on worth efficiency.

In current days, the decline in miner reserves has accelerated, signaling a rise in promoting exercise. This surge in provide is probably going one of many elements contributing to the current downturn following Bitcoin’s new all-time excessive a couple of weeks in the past. If this development continues and demand fails to soak up the extra provide, the market may face deeper draw back strain.