The Bitcoin worth right now is buying and selling round $107,400 after a gentle climb from the latest low close to $99,500. Bulls have reclaimed essential floor above the $106,000 mark, however robust resistance zones slightly below $109,000 are starting to strain the present rally. As momentum slows and worth motion compresses, merchants are eyeing a breakout or pullback within the coming 24 hours.

What’s Taking place With Bitcoin’s Worth?

BTCUSD worth dynamics (Supply: TradingView)

Bitcoin has rebounded sharply off the $99,500 zone, breaking above the native trendline resistance and reclaiming assist above the $104,000–$105,000 vary. The every day construction stays bullish, with BTC again inside its ascending channel and at the moment testing the median line close to $107,000. The value is inching nearer to the pivot resistance at $109,870, adopted by the R4 zone at $114,956 — each of which align with prior rejection factors.

BTCUSD worth dynamics (Supply: TradingView)

Nevertheless, the every day provide zone between $108,000 and $110,000 continues to cap additional upside. The present candle formation suggests indecision, and a failure to interrupt and shut above this vary may set the stage for one more consolidation leg. On the upper timeframe, bulls nonetheless management the macro development, however quantity will likely be essential for confirming continuation towards the $114K–$125K ranges.

Why Is The Bitcoin Worth Going Up As we speak?

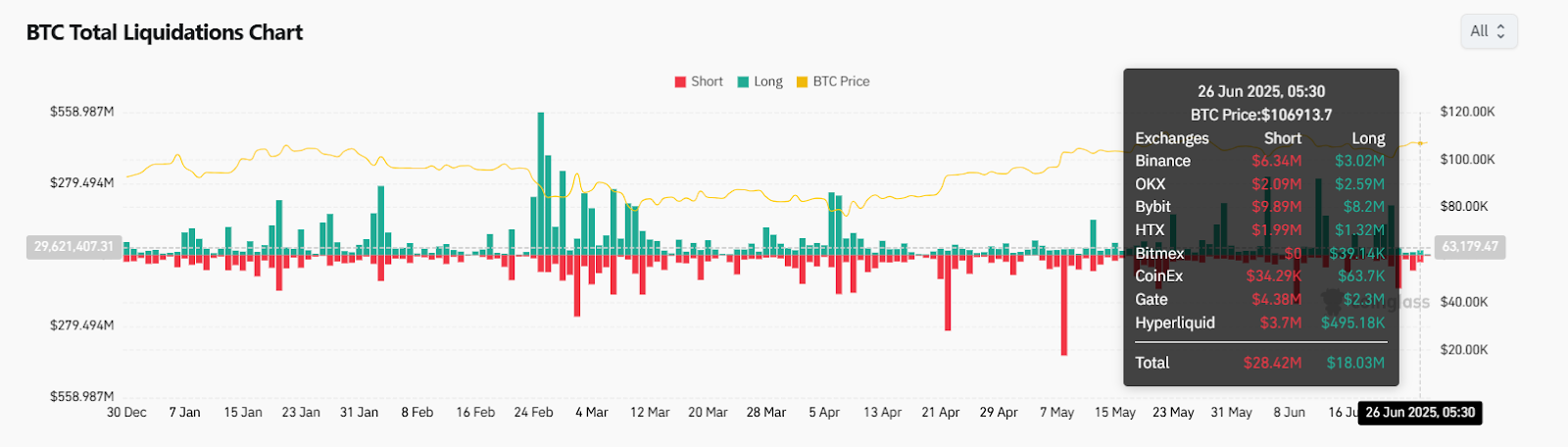

The push greater is supported by key structural reclaim and liquidation information. The 4-hour chart confirms that Bitcoin worth motion held agency above $105,000, resulting in quick liquidation spikes as seen on the liquidation heatmap — the place over $28.42 million in shorts had been closed in opposition to $18.03 million in longs throughout exchanges on June 26. This quick squeeze triggered the speedy transfer to the $107,000 zone.

BTCUSD worth dynamics (Supply: TradingView)

On the 30-minute chart, RSI stands at 52.22 with the MACD histogram recovering into constructive territory, exhibiting delicate bullish bias.

BTCUSD worth dynamics (Supply: TradingView)

The VWAP and Parabolic SAR on this timeframe additionally sit slightly below present worth, suggesting that bulls nonetheless keep short-term momentum. Nevertheless, RSI is starting to flatten, whereas the MACD line remains to be beneath the sign line — hinting at diminished power heading into resistance.

Bitcoin Indicators Present Divergence As Bulls Hit Ceiling

BTCUSD worth dynamics (Supply: TradingView)

On the 4-hour view, Bitcoin worth volatility is compressing beneath the higher Bollinger Band close to $108,672. The candle unfold is tightening as worth sits between the 20 and 200 EMA, each of that are stacked positively however at the moment are exhibiting convergence — a standard pre-breakout sign.

BTCUSD worth dynamics (Supply: TradingView)

The Supertrend stays inexperienced above $104,448, reinforcing bullish construction, however the DMI reveals falling ADX (15.24) and narrowing +DI/-DI, signaling weakening momentum.

Help stays well-established at $103,996, with the decrease liquidity cluster close to $99,515 providing stronger backing if a deeper pullback emerges. For bulls to retain management, Bitcoin should keep above $104,800 within the subsequent 24 hours.

BTC Worth Prediction: Quick-Time period Outlook (24h)

BTCUSD worth dynamics (Supply: TradingView)

If Bitcoin worth can shut firmly above $107,600 and push previous $108,800 with confirmed quantity, the subsequent upside goal lies close to $109,870, adopted by $114,950. Nevertheless, failure to clear the $108,600–$109,000 resistance zone may result in a retracement again to $105,300 after which the $103,900 assist space.

On the draw back, a break beneath $103,500 would put strain on the $99,500 base. With decrease timeframes exhibiting early indicators of distribution and blended RSI/MACD alerts, Bitcoin could enter a short-term vary until a breakout resolves cleanly.

Bitcoin Worth Forecast Desk: June 28, 2025

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.