The Bitcoin value in the present day is buying and selling close to $101,200 after a unstable weekend session that noticed consumers defend a important liquidity pocket simply above $100,000. With the June 27 choices expiry approaching, value motion displays tightening situations as bulls and bears conflict close to key technical zones.

Whereas the broader construction stays rangebound on increased timeframes, decrease timeframes reveal weakening bullish momentum and indicators of accelerating volatility.

What’s Occurring With Bitcoin’s Value?

BTC value forecast (Supply: TradingView)

As of June 23, 2025, the Bitcoin value stays below stress following a rejection from the $105,200 zone, which aligns with each trendline resistance and a previous order block. Value has been consolidating simply above $101,000 after sweeping a key help cluster on June 21, with sellers remaining lively beneath $103,000.

BTC value forecast (Supply: TradingView)

The latest rejection marks the third failed try to interrupt above $106,000 this month. On the 12-hour and day by day charts, BTC construction stays neutral-to-bearish, with value buying and selling beneath all main EMAs (20/50/100/200). This alignment is now forming a bearish cluster that implies sellers proceed to manage the short-term pattern.

The present Bitcoin value motion additionally coincides with heavy sell-side liquidity seen round $105,000–$106,000. If value fails to reclaim this zone forward of the June 27 choices expiry, additional draw back stress towards the $98,000–$100,000 help base can’t be dominated out.

Bitcoin Value Motion Faces Rejection at Key Resistance

BTC value forecast (Supply: TradingView)

The 4-hour chart reveals a transparent downtrend from the mid-June peak. Bitcoin has constantly printed decrease highs, with value now trapped beneath a declining trendline that has been examined a number of occasions with out affirmation of a breakout.

A sequence of order blocks between $104,200 and $106,400 have acted as sturdy overhead resistance. The latest try to interrupt by this zone failed, with a pointy wick rejection again towards $101,000.

Moreover, the Bollinger Bands on this timeframe present narrowing volatility adopted by enlargement, a typical precursor to sturdy directional strikes. The value rejection on the higher band on June 21 means that sellers are actively defending rallies.

Momentum Indicators Sign Bearish Stress Forward

BTC value forecast (Supply: TradingView)

On the 2-hour and 30-minute charts, momentum indicators proceed to favor the bears. The RSI has damaged beneath 40 and stays in a weak zone, whereas the MACD histogram on each timeframes has flipped pink, signaling a loss in bullish power. A hidden bearish divergence on the RSI could be noticed when evaluating latest swing highs close to $104,000 to prior peaks.

BTC value forecast (Supply: TradingView)

The 4-hour Supertrend stays in bearish mode, with resistance now anchored at $105,207. The DMI indicator on the 4-hour chart highlights dominant -DI power at 33.18 versus +DI at 15.21, with the ADX climbing towards 25, suggesting a rise in directional bearish momentum.

These indicators align with short-term dealer issues across the upcoming choices expiry, which is now influencing intraday positioning and volatility expectations.

Trade Flows and Choices Information Verify Bearish Bias

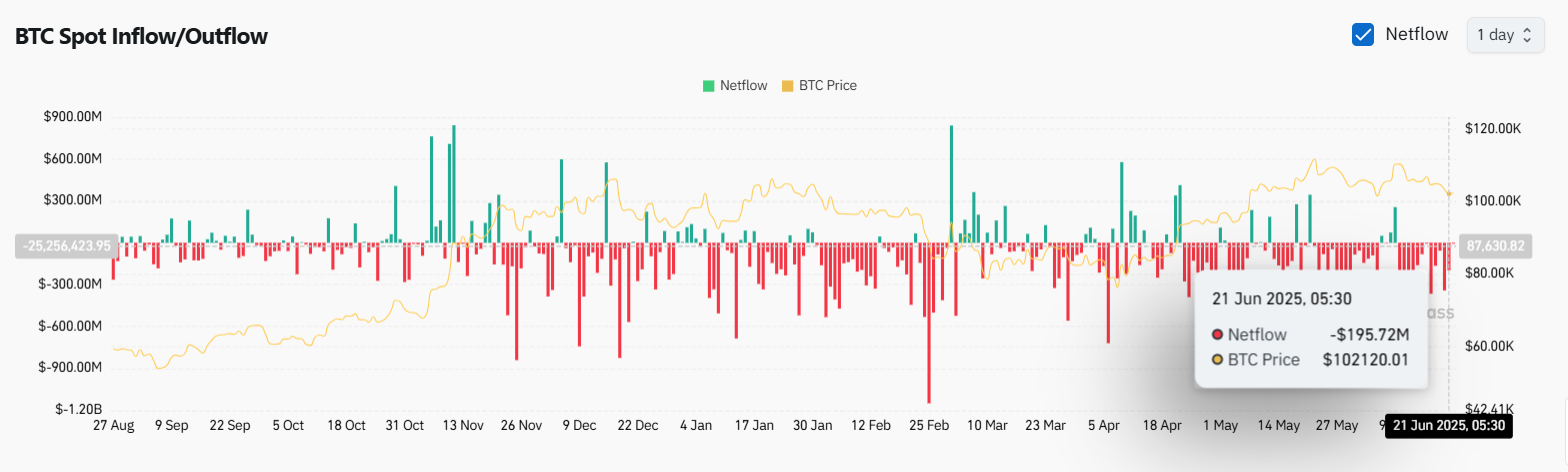

BTC internet inflows/outflows (Supply: Coinglass)

On-chain change information reveals that on June 21, over $195.72 million in Bitcoin value internet outflows have been recorded, with BTC priced round $101,200 on the time. This unfavorable netflow displays risk-off sentiment as merchants seemingly reposition forward of volatility anticipated across the June 27 choices expiry.

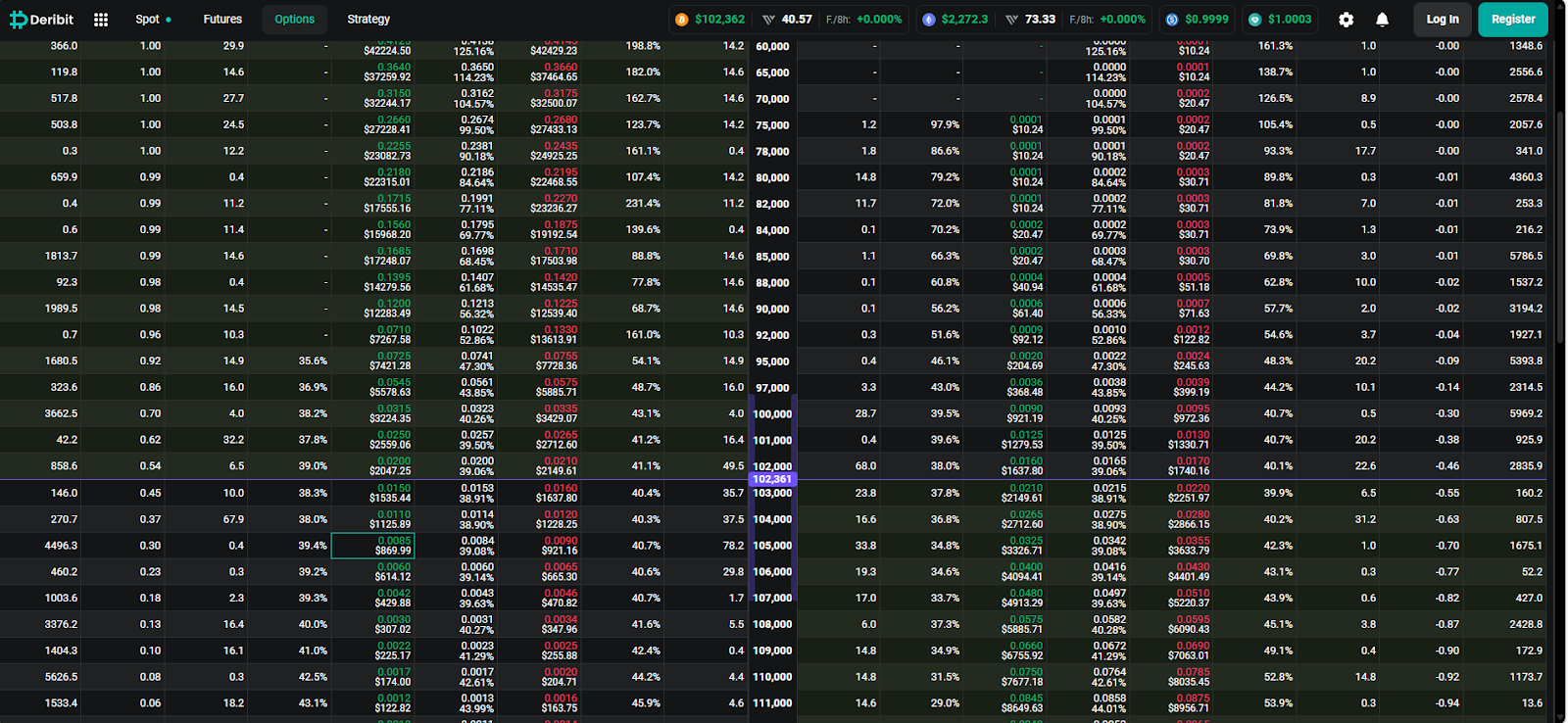

BTC choice chain information (Supply: Deribit)

From a spinoff perspective, open curiosity stays closely skewed towards places on the $100,000 strike, indicating sturdy market anticipation of additional draw back until BTC can rapidly reclaim the $105,000 zone. This provides stress to bulls to stage a significant bounce early within the week.

Why Bitcoin Value Going Down In the present day?

BTC value forecast (Supply: TradingView)

The Bitcoin value in the present day is down as a result of a number of compounding elements. First, technical resistance between $104,200 and $106,000 stays agency. Second, key momentum indicators like RSI and MACD have turned bearish throughout a number of timeframes. Third, the June 27 choices expiry introduces near-term volatility and encourages risk-averse positioning.

Lastly, bearish dominance on the DMI indicator and unfavorable spot change flows add weight to a possible short-term pullback.

Till BTC can flip $105,200 into help, any reduction bounce is prone to be met with renewed promoting stress.

Quick-Time period Outlook and Technical Forecast

BTC must decisively break above $105,200 and shut above the trendline resistance to invalidate the bearish setup. Failure to take action retains the draw back targets at $100,000 and $98,400 in play. A breakdown beneath $98,000 might open the door to a retest of the $95,700–$96,300 demand zone. Upside targets stay at $106,400 and $108,000 if a breakout happens.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.