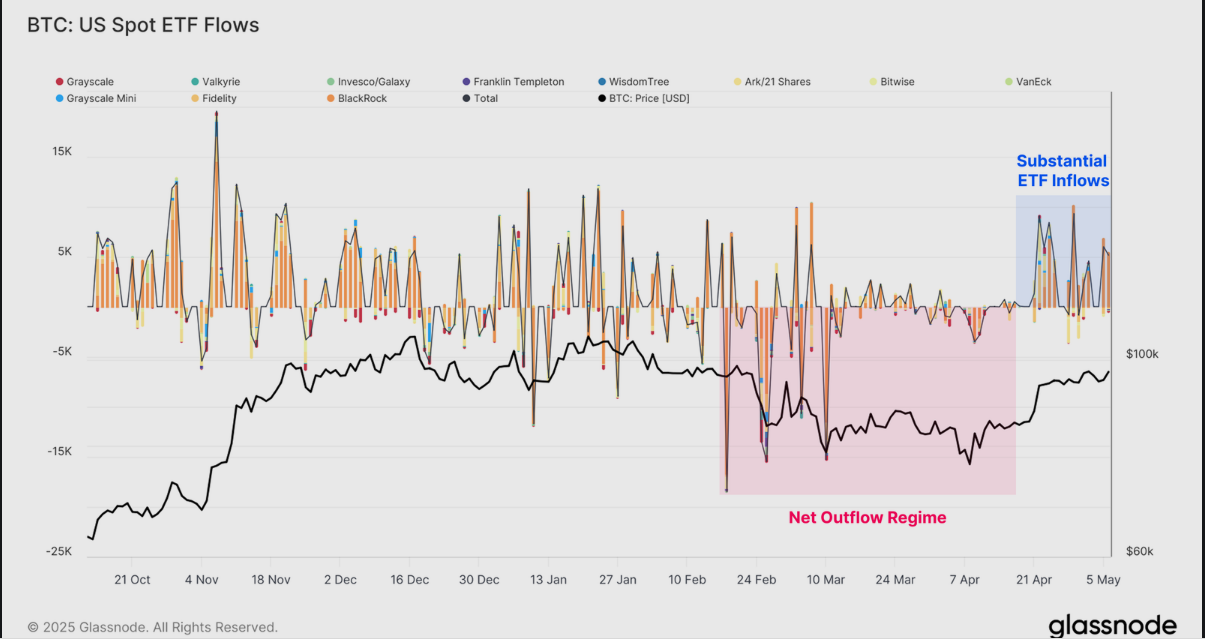

After months of bleeding, U.S. Bitcoin ETFs pulled in $4.6 billion over two weeks, the largest two-week turnaround ever, per Might seventh The Week On-chain publication named “Gaining Floor.”

Spot Bitcoin ETFs noticed practically $1.3 billion in internet inflows over simply two buying and selling days this previous week, signaling a pointy shift in institutional sentiment.

BlackRock’s IBIT alone drew $970.9 million in a single session—its second-largest each day influx since launch—whereas opponents like Constancy’s FBTC continued to lag.

After enduring the biggest sustained outflow streak on report in April, the ETF advanced is now again in development mode.

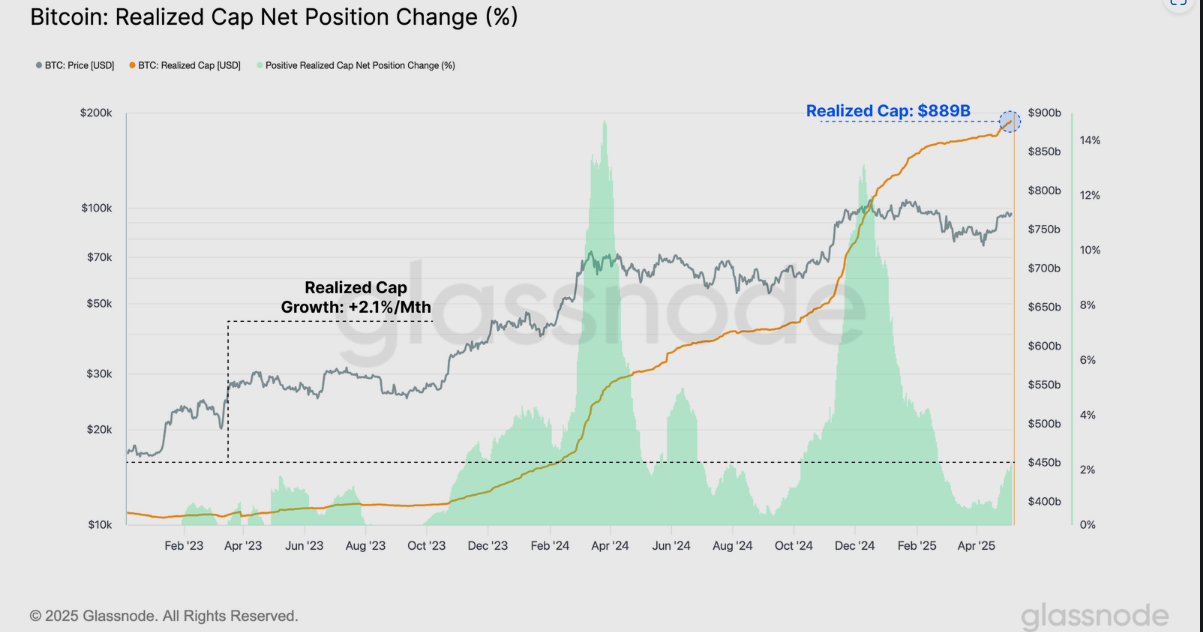

Bitcoin value itself soared to $97,900 on April 27, 2025, from a $74,000 low, pushing the market’s realized cap to a report $889 billion, based on CoinMarketCap knowledge.

This rally introduced reduction to tens of millions of holders, however with costs teetering close to a important threshold and volatility expectations oddly quiet, is that this the market backside—or a setup for one more twist?

Document Bitcoin ETF Inflows and BTC “Gaining Floor”

Bitcoin ETFs had been in a rut. From January to March 2025, they misplaced 70,000 BTC in internet outflows—the longest sustained exit on report.

Then, every part modified. Between April 13 and April 27, 2025, ETFs absorbed $4.6 billion, practically wiping out prior losses.

US Spot BTC Flows| Supply: Glassnode

Property underneath administration hit 1.171 million BTC, simply 11,000 shy of the 1.182 million BTC peak. This surge, fueled by Bitcoin’s climb to $97,900, indicators institutional demand is again with a vengeance.

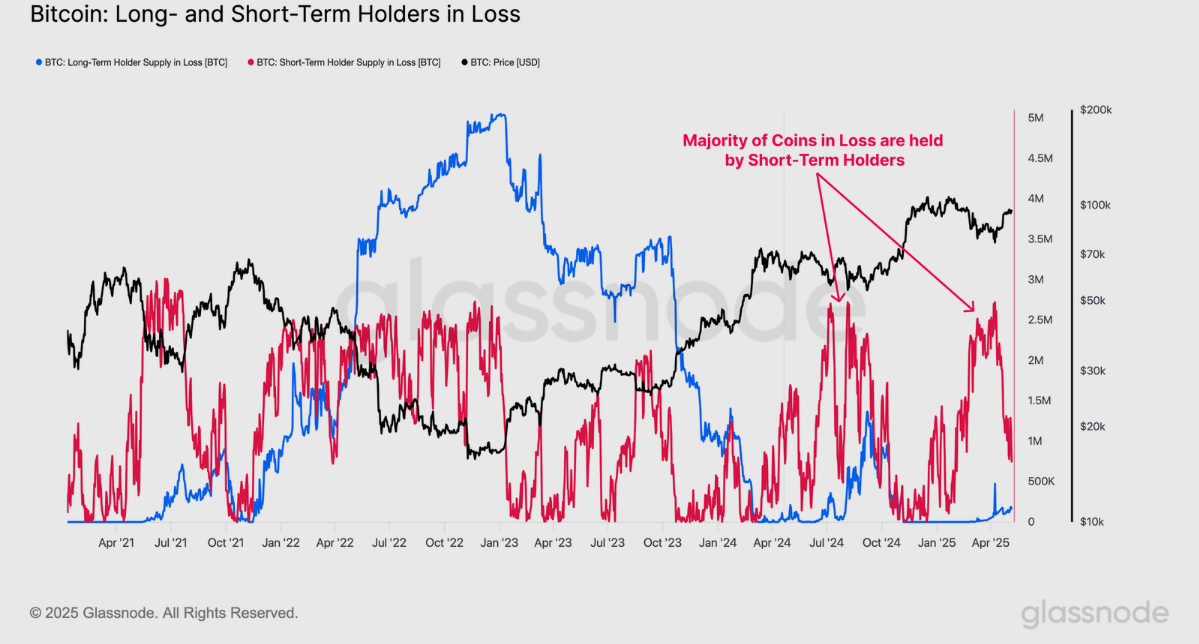

The Bitcoin value leap from $74,000 to $97,900 wasn’t only a chart blip—it was a lifeline. On the April low, over 5 million BTC had been underwater.

By April 27, 2025, only one.9 million remained in loss, with 3 million BTC flipping to revenue,based on the publication. Quick-Time period Holders (STH), holding 83% of underwater cash, led profit-taking.

BTC LTH Vs. STH In Loss| Supply: Glassnode

Day by day capital inflows reached $1 billion, with earnings dominating 98% of transactions. The realized cap grew 2.1% in a month to $889 billion, an all-time excessive, reflecting sturdy demand.

BTC Realized Cap Internet Place| Supply: Glassnode

Bitcoin value is buying and selling at $97,000, however it’s on a tightrope. As per Glassnode’s evaluation, the worth cleared the 111-day shifting common and STH cost-basis, each close to $94,000.

But, the Realized Provide Density metric spiked, exhibiting a dense cluster of cash with cost-bases round $95,000, accrued from December 2024 to February 2025. Small value strikes may spark massive reactions, elevating volatility dangers.

Choices markets add intrigue. Implied volatility for 1-week and 1-month contracts hit lows not seen since July 2024. Three- and six-month contracts additionally compressed, with March 2026 choices at a 50% premium—a traditionally low stage.

Traditionally, such low volatility expectations precede sharp value swings. Merchants could also be underestimating turbulence.

Backside or Bounce?

The rally reshaped investor actions. Mixed revenue and loss volumes hit $1 billion each day, with solely 15% of buying and selling days this cycle seeing extra.

Losses made up simply 1-2% of transactions, exhibiting most holders above $96,000 are holding agency. STH unrealized losses, which spiked in the course of the August 2024 Yen-Carry-Commerce unwind and early 2025 downturn, dropped to impartial, easing monetary stress.

Per the report, a drop under $94,000 may derail the rally, per. For now, Bitcoin’s $97,000 value and ETF rally level to a possible backside—however it’s not a finished deal.

Merchants will watch whether or not ETF momentum holds and if on-chain energy interprets into value positive factors. With spot funds again in favor and fewer underwater holders, the market might have discovered a flooring—no less than till the subsequent volatility surge.