- Lengthy-term holder (LTH) selloffs cool, easing Bitcoin worth promoting stress.

- BTC worth holds above $116,817 regardless of rejection close to $122K.

- CPI knowledge could resolve the subsequent main BTC worth transfer.

Bitcoin worth forecast exhibits BTC worth steadying as long-term holder selloffs cool.

In the meantime, merchants are watching on-chain flows and macro prints for indicators of the subsequent directional transfer.

Lengthy-term holders’ selloff cools

Lengthy-term holders have materially decreased each day gross sales, and consequently, the market has seen a transparent shift towards holding.

In accordance with on-chain knowledge, each day LTH gross sales slipped beneath $1 billion in August, after averaging above that threshold in July, and this shift has eliminated a notable chunk of promoting stress.

Furthermore, the decreased stream of cash to exchanges, in accordance with Coinglass, has coincided with renewed accumulation, which in flip helps a calmer BTC worth close to present vary ranges.

On-chain proof factors to accumulation

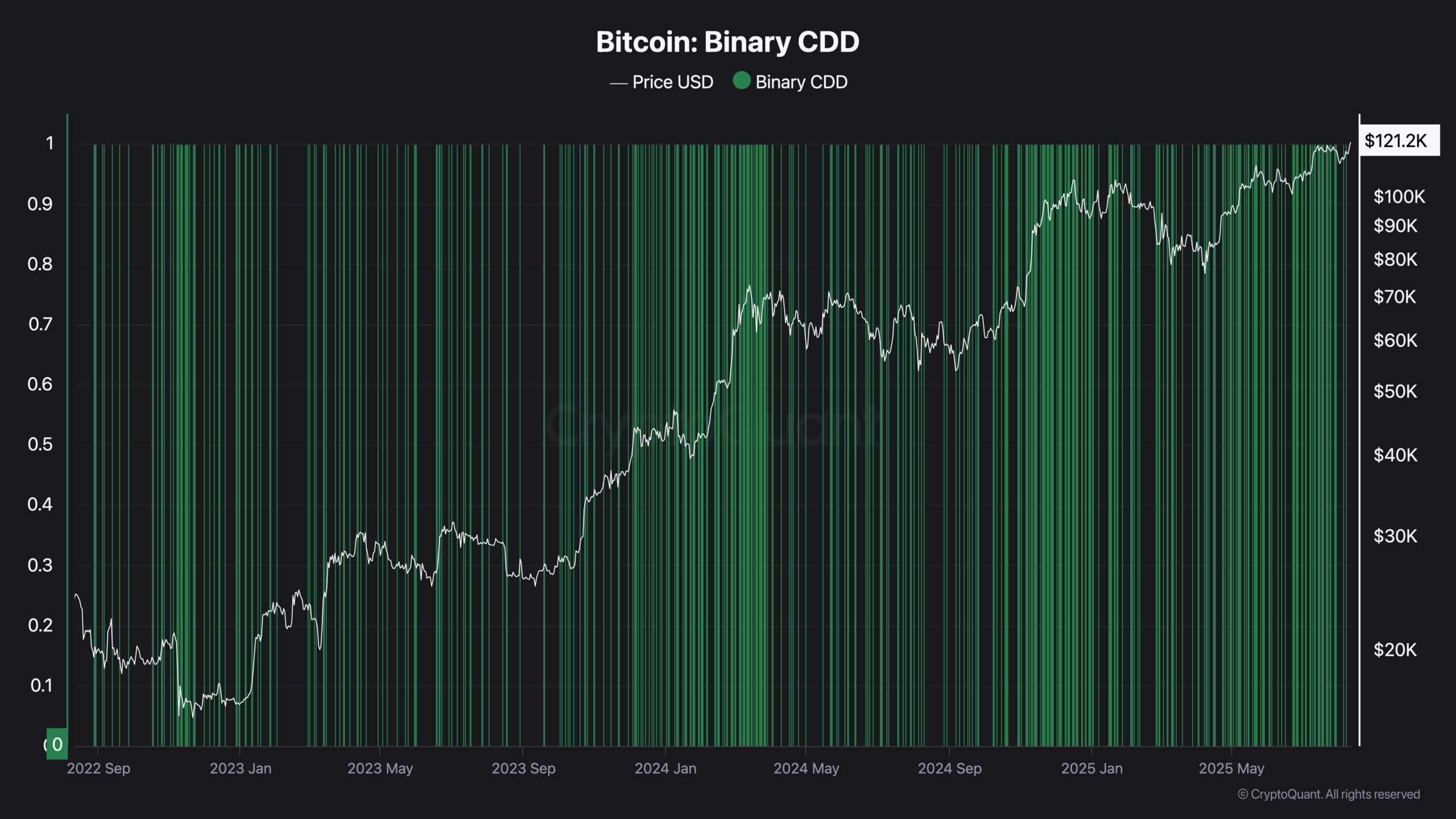

Binary Coin Days Destroyed has dropped towards zero, signalling that older cash should not shifting and subsequently are being held longer.

Moreover, the Fund Stream Ratio sits at unusually low ranges, round 0.057, and this implies fewer property are being despatched to exchanges.

Consequently, spot market internet inflows — together with a current $51 million purchase day after a $242 million sell-off on August 10 — reinforce that demand is returning extra steadily than earlier than.

Triangle breakout holds, however dangers stay

Technically, Bitcoin broke upward from a triangle and stays above the $116,817 breakout threshold, which suggests momentum continues to be intact.

Nevertheless, current makes an attempt to clear $122,000 ended with a rejection and a “headstone” doji candlestick, and therefore, merchants be aware that the trail to a brand new ATH will not be easy.

In the meantime, a CME futures hole close to $117K and four-hour 200MA/EMA confluence add short-term technical magnetism that would invite retests earlier than any sustained push larger.

CPI and Fed coverage may tilt the scales

Macro catalysts are entrance and centre as a result of upcoming US CPI figures affect rate-cut expectations and greenback power.

If core inflation prints larger than anticipated — for instance, close to 3.1% — then Fed-cut odds for September would probably decline, and because of this BTC worth could face stress.

Conversely, a softer CPI close to 2.9% would increase rate-cut prospects, weaken the greenback, and certain favour renewed upside for crypto and BTC worth momentum.

Two believable paths for Bitcoin merchants

On the bullish path, continued LTH holding, regular capital inflows, and a break above current highs may carry BTC to new discovery above $123,000 and right into a $120K–$125K zone.

On the bearish path, a confirmed distribution part — as some Wyckoff-analysing merchants warn — may open a markdown towards the $92K–$95K space, and subsequently, merchants should respect danger controls.

$BTC | Wyckoff Logic in Play 📊

After a robust Accumulation Part in March–April confirmed by bullish RSI divergence, BTC entered a strong Mark-Up part, reaching new highs.

At the moment, worth motion is exhibiting indicators of a Distribution Part — sideways motion with weakening… pic.twitter.com/PTDoosNnDb

— ZAYK Charts (@ZAYKCharts) August 12, 2025

Thus, momentum and macro prints will resolve whether or not the market grinds larger or re-enters a corrective part.

Bitcoin worth forecast: What merchants ought to watch

Watch whether or not BTC holds $116,817 and whether or not alternate inflows stay subdued, as a result of these are instant indicators of provide drying up.

Additionally, monitor short-term technical confluence on the CME hole close to $117K and the response to CPI knowledge, since each can set off fast directional strikes.

Whereas sentiment consists of bullish voices just like the co-founder of PayPal, Peter Thiel, who sees structural undervaluation, merchants ought to stay nimble and think about each upside targets and draw back situations.

The present Bitcoin forecast balances improved on-chain accumulation towards near-term macro danger, and this equilibrium shapes the prevailing BTC worth outlook.