Bitcoin’s worth is on the verge of breaking beneath one other key stage, after failing to regain momentum following its all-time excessive a few weeks in the past. Buyers at the moment are fearful that its worth motion may quickly put an finish to your entire crypto bull market.

BTC Worth: Technicals

By Shayan

The Every day Chart

On the every day chart, the asset has been dropping progressively since hitting the $124K all-time excessive, with August doubtlessly closing bearish. It is a worrying signal for traders, as the value is now breaking beneath the important thing $110K stage, which might drag the value towards the $104K area and doubtlessly even beneath $100K.

The RSI can also be stabilizing beneath 50, indicating the dominance of bearish momentum. Consequently, additional draw back seems extra possible in the intervening time, until market dynamics change drastically.

The 4-Hour Chart

Dropping right down to the 4-hour chart, issues get a bit extra attention-grabbing. The asset has been declining inside a steep descending channel over the previous couple of weeks, breaking beneath main assist ranges. With the $110K stage breaking down, traders are trying on the key FVG situated at $104K. This stage coincides with the decrease sure of the Fibonacci golden zone, which reinforces its significance.

With the RSI additionally indicating clear bearish momentum, if the $104K zone can also be tons, a decrease low beneath $100K could possibly be imminent, in addition to a bearish pattern for the approaching weeks.

Onchain Evaluation

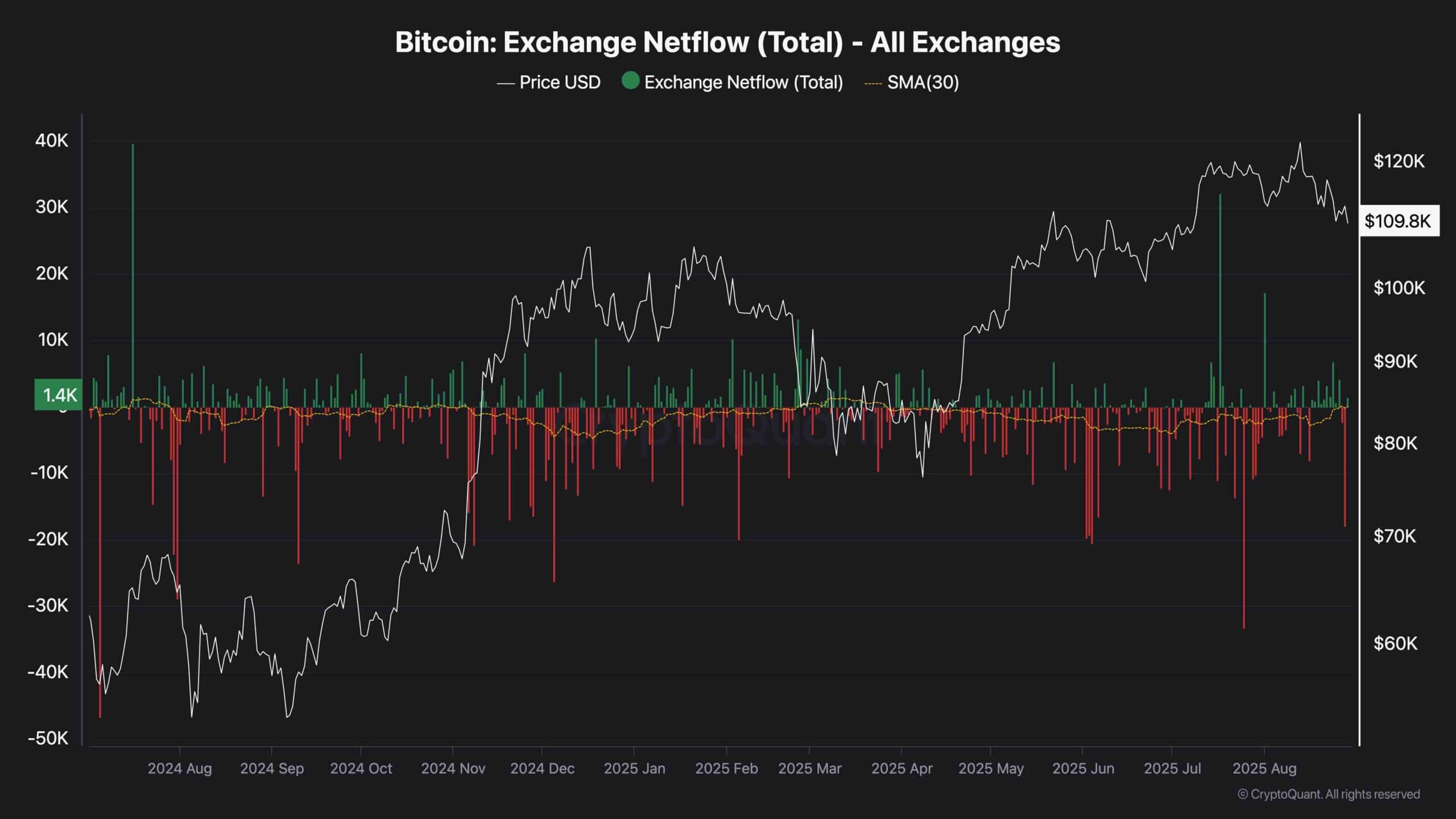

Alternate Netflow (30-day transferring common)

The chart exhibits that since April, alternate netflows have leaned extra bearish than bullish, with the 30-day transferring common constantly sitting in detrimental territory.

This implies extra Bitcoin has been leaving exchanges than coming into, which regularly indicators investor desire for holding slightly than making ready to promote. The general pattern aligns with a decline in obtainable alternate reserves, suggesting a provide squeeze could also be growing beneath the floor.

On the similar time, whereas there have been remoted days of enormous inflows into exchanges, they’ve been countered by equally robust outflows. This steadiness reinforces the concept that short-term spikes in promoting stress haven’t been sufficient to reverse the broader accumulation pattern.

So long as reserves proceed to drop and cash transfer off exchanges, it signifies that long-term holders are nonetheless assured, and this underlying accumulation might present assist for worth over the approaching months. That is, in fact, if it overwhelms the promoting stress from the futures market.