Bitcoin is buying and selling for $117,276 on Sept. 18, 2025, marking a continuation of its restoration rally from current lows. The cryptocurrency at the moment holds a market capitalization of $2.33 trillion with a 24-hour buying and selling quantity of $58.34 billion and an intraday value vary between $114,940 and $117,815.

Bitcoin

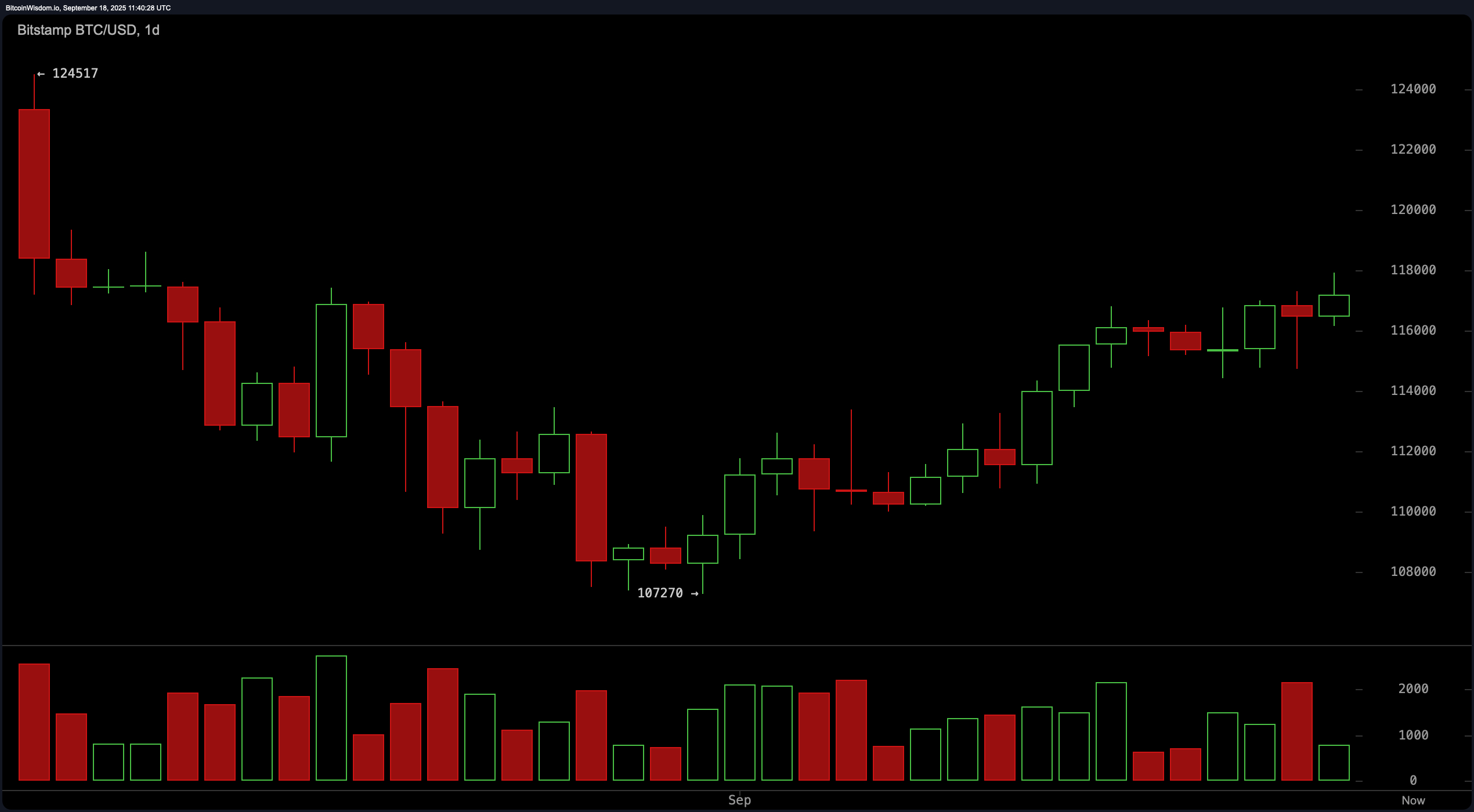

On the day by day chart, bitcoin has fashioned a rounded backside sample that confirms a restoration from the native low of $107,270. This construction factors to a possible pattern reversal, however quantity information indicators warning: as costs have risen, buying and selling quantity has steadily declined, sometimes an indication of waning momentum.

The worth seems to be stalling slightly below the $118,000 resistance stage, an space which will act as an exit or partial take-profit zone. A break and shut above this vary might open the door towards $120,000, however affirmation by renewed quantity is required. Total, the day by day chart suggests bitcoin is in a reduction rally, however with out follow-through shopping for, the transfer could lack sustainability.

BTC/USD 1-day chart by way of Bitstamp on Sept. 18.

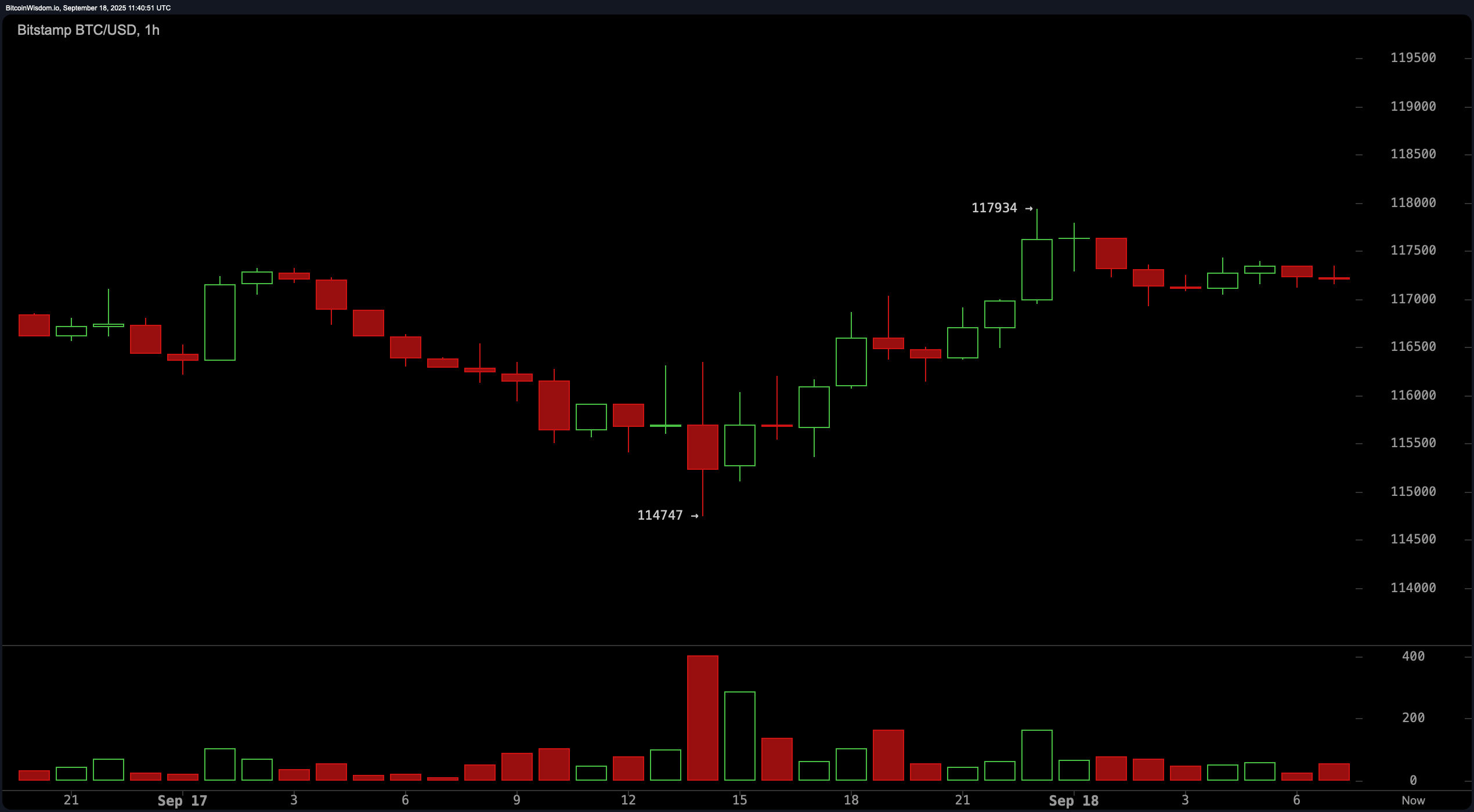

The 4-hour chart exhibits that bitcoin had been accumulating sideways between September 13 and 16 earlier than breaking out on Sept. 17. That transfer was supported by a notable quantity spike, with the worth reaching close to $117,934. Since then, bitcoin has consolidated modestly, discovering help round $117,000. This conduct is in keeping with a continuation setup, assuming quantity returns to the market. Ought to value revisit the $116,000–$116,500 zone and maintain, that space might act as a secondary entry. Nevertheless, failure to breach $118,000 with energy could set off a near-term reversal.

BTC/USD 4-hour chart by way of Bitstamp on Sept. 18.

On the 1-hour chart, bitcoin accomplished a textbook cup and deal with sample that culminated in a breakout close to $117,934. Following the surge, the worth has entered a good consolidation section, presumably forming a bull flag or pennant. The quantity spike through the breakout, adopted by a low-volume pullback, is taken into account a wholesome consolidation in technical phrases. An entry on the breakout at $117,000 has already handed, however a re-entry alternative could current itself if bitcoin clears the $117,800 to $118,000 zone with conviction. Conversely, a drop beneath $116,500 would invalidate the present bullish setup.

BTC/USD 1-hour chart by way of Bitstamp on Sept. 18.

Oscillators current a blended image. The relative energy index (RSI) at 61, the Stochastic oscillator at 92, and the commodity channel index (CCI) at 114 all sign a impartial bias. The typical directional index (ADX) at 18 additionally exhibits an absence of sturdy pattern momentum. Whereas the Superior oscillator is barely constructive at 2,914, it too indicators neutrality. The momentum indicator exhibits a worth of 5,105, which points a bearish sign—indicating potential fatigue within the present uptrend. Notably, the shifting common convergence divergence (MACD) stage is at 921 and continues to flash a bullish sign, providing some help for bulls.

Shifting averages paint a broadly bullish image throughout all main durations. The ten-day exponential shifting common (EMA) and easy shifting common (SMA) sit at $115,387 and $115,435, respectively, each signaling a bullish alternative. This sample continues throughout the 20-, 30-, 50-, 100-, and 200-day EMA and SMA indicators. The 200-day EMA stands at $105,631 whereas the SMA is at $103,088—far beneath the present value—pointing to sturdy long-term bullish sentiment. These traits help the case for a continuation larger, assuming key resistance ranges are cleared.

In abstract, bitcoin’s short-term technical posture stays bullish, albeit with indicators of weakening momentum. Merchants ought to carefully watch the $118,000 stage for affirmation of energy or weak point. Whereas chart patterns throughout timeframes stay favorable, quantity and oscillator information urge warning, notably for high-leverage or short-term trades. A decisive break above resistance supported by quantity might verify pattern continuation towards $120,000. Conversely, a rejection might immediate a retest of decrease help close to $116,000.

Bull Verdict:

If bitcoin can decisively break and maintain above the $118,000 resistance stage with accompanying quantity, the bullish case strengthens considerably. Chart constructions throughout all timeframes help continuation towards $120,000 and past, with shifting averages reinforcing long-term upward momentum. A transparent breakout would verify a renewed leg larger on this rally.

Bear Verdict:

Ought to bitcoin fail to breach $118,000 or fall again beneath the $116,500 help zone, it could sign a possible exhaustion of the present rally. Waning momentum on larger timeframes, coupled with neutral-to-bearish oscillator readings, could point out that this transfer is a short lived reduction bounce fairly than a sustained uptrend. A deeper pullback towards $114,000–$112,000 might comply with.