Bitcoin’s value is shortly recovering and paving its manner towards a brand new all-time excessive after the Federal Reserve cuts rates of interest by 1 / 4 level and indicators there are nonetheless extra to come back within the upcoming yr. Subsequently, buyers’ fears are alleviated, and the market is prone to rally additional within the coming weeks.

By Shayan

The Day by day Chart

Bitcoin’s every day chart demonstrates a transparent bounce from the $107K demand zone and an increase again above the 100-day shifting common, positioned across the $113K mark. After yesterday’s Fed price minimize, the asset is continuous its path towards the $124K provide zone, which aligns with the present BTC all-time excessive.

The RSI can also be trending above the 50% stage, indicating that the momentum has now shifted bullish as soon as once more. All these indicators level to a possible continuation towards the $124K ATH and certain an additional rally towards $130K and even larger.

The 4-Hour Chart

Because the 4-hour chart demonstrates, Bitcoin’s latest rally has occurred after the value efficiently broke out of a descending channel, following a swift double backside rebound on the $108K provide zone.

The asset has now swept the liquidity pool above the earlier $107K excessive, which may result in two attainable eventualities. The market can both stick with it with the uptrend and assault the $124K space as soon as once more, or it could actually pull again a minimum of to the $112K order block, which is essentially the most notable demand zone close by. But, with the RSI nonetheless beneath the overbought area, the value seemingly has extra room to develop earlier than a correction happens.

Sentiment Evaluation

Open Curiosity

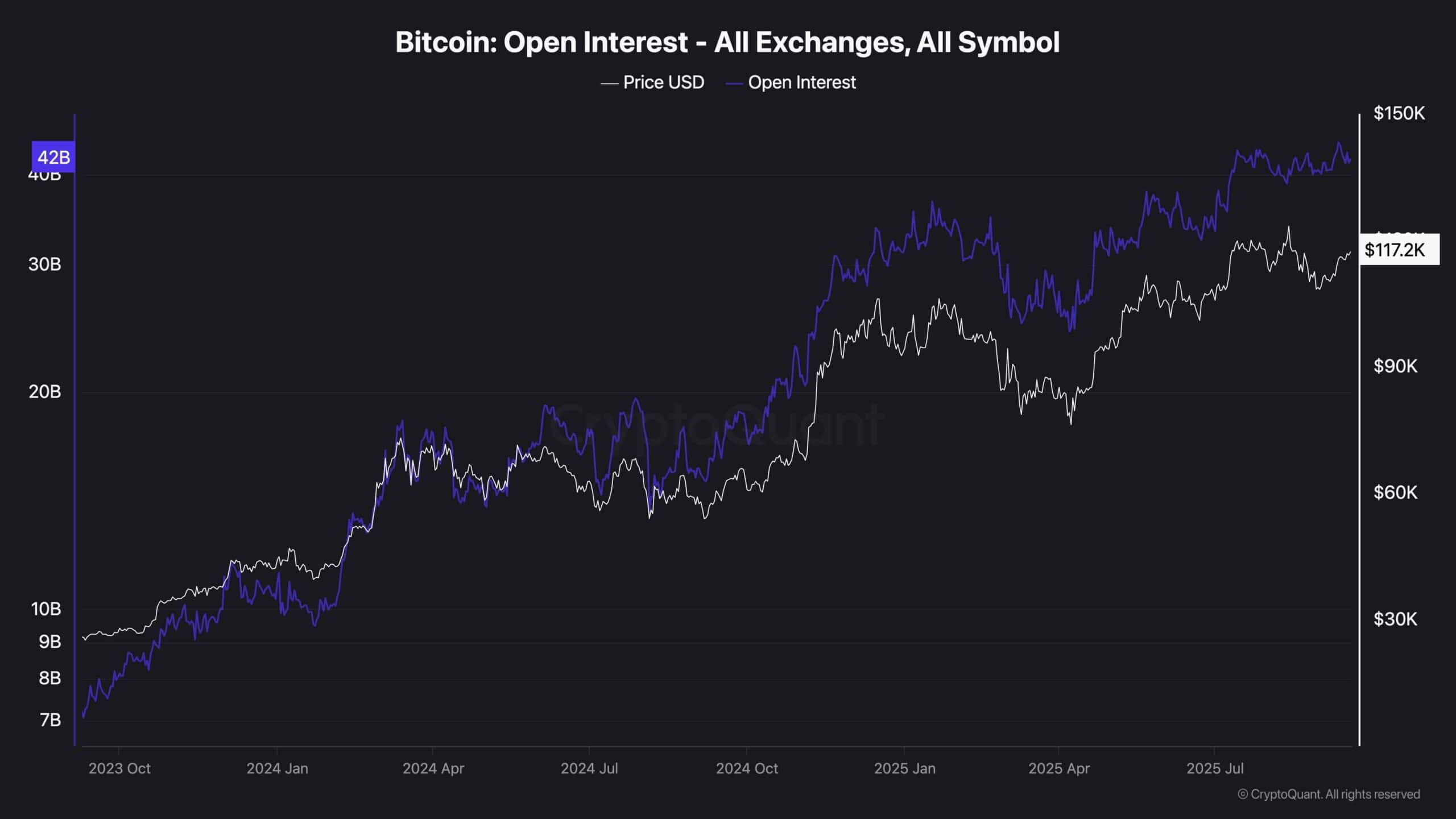

This chart shows the Bitcoin combination open curiosity, which reveals the variety of open perpetual futures positions. Sometimes, throughout bullish market circumstances, this metric climbs larger or consolidates, as increasingly more merchants are taking leveraged positions. That is precisely what will be seen on the chart.

In the meantime, one other attention-grabbing statement is that even with the market going by a short-term correction just a few weeks in the past, the open curiosity has but to drop. Whereas that is usually a bullish signal, it additionally factors to the truth that the futures market would possibly nonetheless be overheated. Subsequently, there’s nonetheless the chance for a liquidation cascade to occur within the brief time period, which may trigger a flash crash earlier than the market stabilizes once more.