Hyperscale Knowledge revealed that the worth saved in its Bitcoin treasury now represents round 66% of the corporate’s complete market capitalization based mostly on the earlier closing inventory value.

Abstract

- Hyperscale Knowledge’s Bitcoin holdings have reached round 150.21 BTC ($16.3 million) by mining and open-market purchases, with $43.7 million in extra funds.

- The corporate goals to construct a $100 million Bitcoin treasury, equal to 100% of its market capitalization, reporting weekly progress. Up to now, it has managed to make it into the highest 100 public corporations ranked by Bitcoin holdings.

In accordance with a press launch shared by the corporate, the agency’s Bitcoin treasury holds property and funds to be allotted for purchases amounting to roughly $60 million. The corporate claims that this quantity represents about 66% of the corporate’s complete market cap, which is acknowledged as $75 million in line with Bitcoin Treasuries.

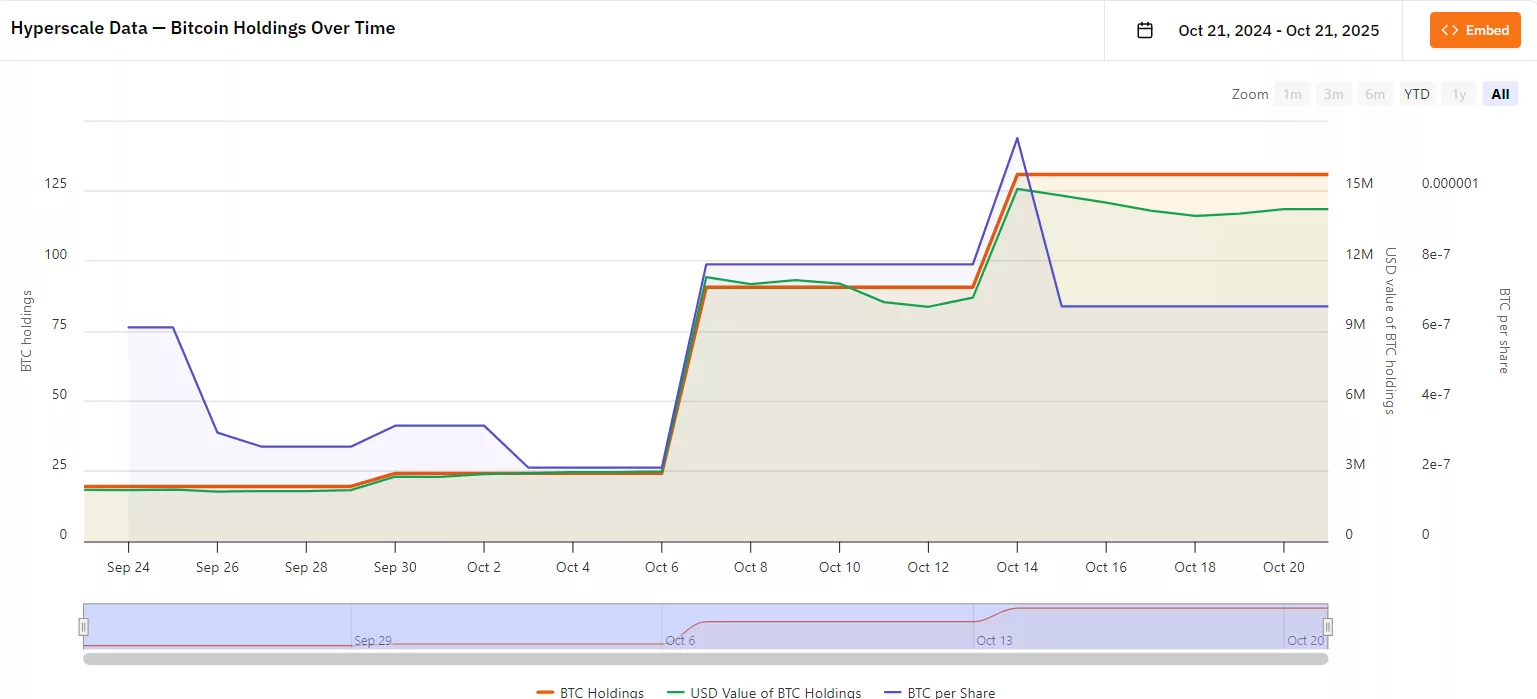

As of Oct. 19, the corporate’s Bitcoin (BTC) treasury subsidiary Sentinum reportedly held about 150.21 Bitcoin ($16.2 million). This quantity consists of Bitcoin acquired from mining operations, which is 32.632 BTC or equal to $3.52 million, in addition to Bitcoin bought from the open-market.

Up to now, the corporate has bought as a lot as 117.58 BTC. Its newest buy occurred through the week of Oct. 19, when the agency purchased 15.88 BTC. Based mostly on the Bitcoin closing value of $108,666 on October 19, 2025, these holdings had been valued at roughly $16.3 million.

Hyperscale Knowledge’s complete Bitcoin holdings have reached $60 million in worth | Supply: Bitcoin Treasuries

You may also like: Michael Saylor hints at Technique’s subsequent Bitcoin purchase

Furthermore, the corporate claims to have allotted round $43.7 million in company funds for Sentinum to purchase extra Bitcoin on the open-market. The corporate acknowledged that it plans to maintain investing funds utilizing what it calls a “measured dollar-cost averaging strategy” that goals to restrict the affect of market fluctuations whereas additionally rising the worth of its long-term reserve holdings.

“Volatility in Bitcoin’s value has offered significant alternatives to construct our place methodically and at favorable long-term averages,” stated Govt Chairman of Hyperscale Knowledge Milton “Todd” Ault III in his assertion.

Hyperscale Knowledge’s plan to carry 100% of its market cap in BTC

Hyperscale Knowledge acknowledged that it’ll proceed buying extra Bitcoin to meet its long-term aim of increase a Bitcoin treasury with a price that matches 100% of its market capitalization. As a part of its broader digital asset treasury technique, it goals to stockpile as a lot as $100 million price of Bitcoin from open-market purchases and self-mined BTC.

“Hyperscale will proceed to situation weekly stories each Tuesday morning detailing its Bitcoin holdings because it advances towards its $100 million DAT goal,” stated the agency in its official assertion.

In accordance with knowledge from Bitcoin Treasuries, Hyperscale Knowledge has solely been buying BTC for lower than a month. It began holding BTC in September 23 of this yr. Up to now, its Bitcoin holdings have reached 130.8 BTC or equal to $14.18 million. With a mean price of $115,460, the corporate has accrued a lack of about 6.02% after the worth of Bitcoin plummeted under $110,000.

In comparison with bigger and extra established Bitcoin treasury corporations like Technique, Metaplanet, Tesla and Galaxy Digital, it nonetheless has a protracted technique to go. Nevertheless, it has managed to make it into the highest 100 public corporations that maintain Bitcoin regardless of its late begin. Bitcoin Treasuries has ranked Hyperscale Knowledge in 98th place with 131 BTC, beating Mac Home and Bitcoin Depot.

At press time, Bitcoin has dropped 2.5% prior to now 24 hours, persevering with its downward development of two.75% inside the previous week. The biggest cryptocurrency by market cap is presently buying and selling fingers at $108,153 because it makes an attempt to climb again as much as the $110,000 threshold.

You may also like: Bitcoin value trades sideways as previous wallets promote into institutional demand