Ethereum’s bullish construction has began to indicate early indicators of exhaustion as the value retraces from the $4,400 resistance zone. Regardless of sustaining a robust mid-term uptrend, short-term momentum has weakened after a neighborhood bearish divergence and a current market construction shift.

The subsequent few days will likely be key to figuring out whether or not that is only a wholesome correction or the beginning of a deeper pullback.

Technical Evaluation

By Shayan

The Day by day Chart

On the each day timeframe, ETH stays inside a long-term ascending channel however has as soon as once more failed to interrupt via the $4,800 resistance space. The asset is now dropping towards the channel’s decrease trendline and the 100-day shifting common at $4,000.

The RSI has additionally cooled to 49, indicating that bullish momentum has light for now however hasn’t turned bearish but. So long as the construction holds above $4,000, the broader pattern stays intact. Nevertheless, shedding that stage might open the door for a deeper transfer towards $3,400, the place the following important demand zone lies.

The 4-Hour Chart

Within the 4-hour view, ETH has confirmed a Market Construction Shift (MSS) after failing to maintain greater highs close to $4,800. A transparent bearish divergence on RSI supported this transfer, exhibiting momentum loss earlier than the drop. The worth has now entered a short-term corrective section and will revisit the $4,200–$4,100 zone, which aligns with earlier demand.

For consumers to regain management, ETH must reclaim $4,500 and invalidate the current lower-high formation. Till then, short-term bias stays barely bearish inside the context of the broader bullish channel.

Sentiment Evaluation

Open Curiosity

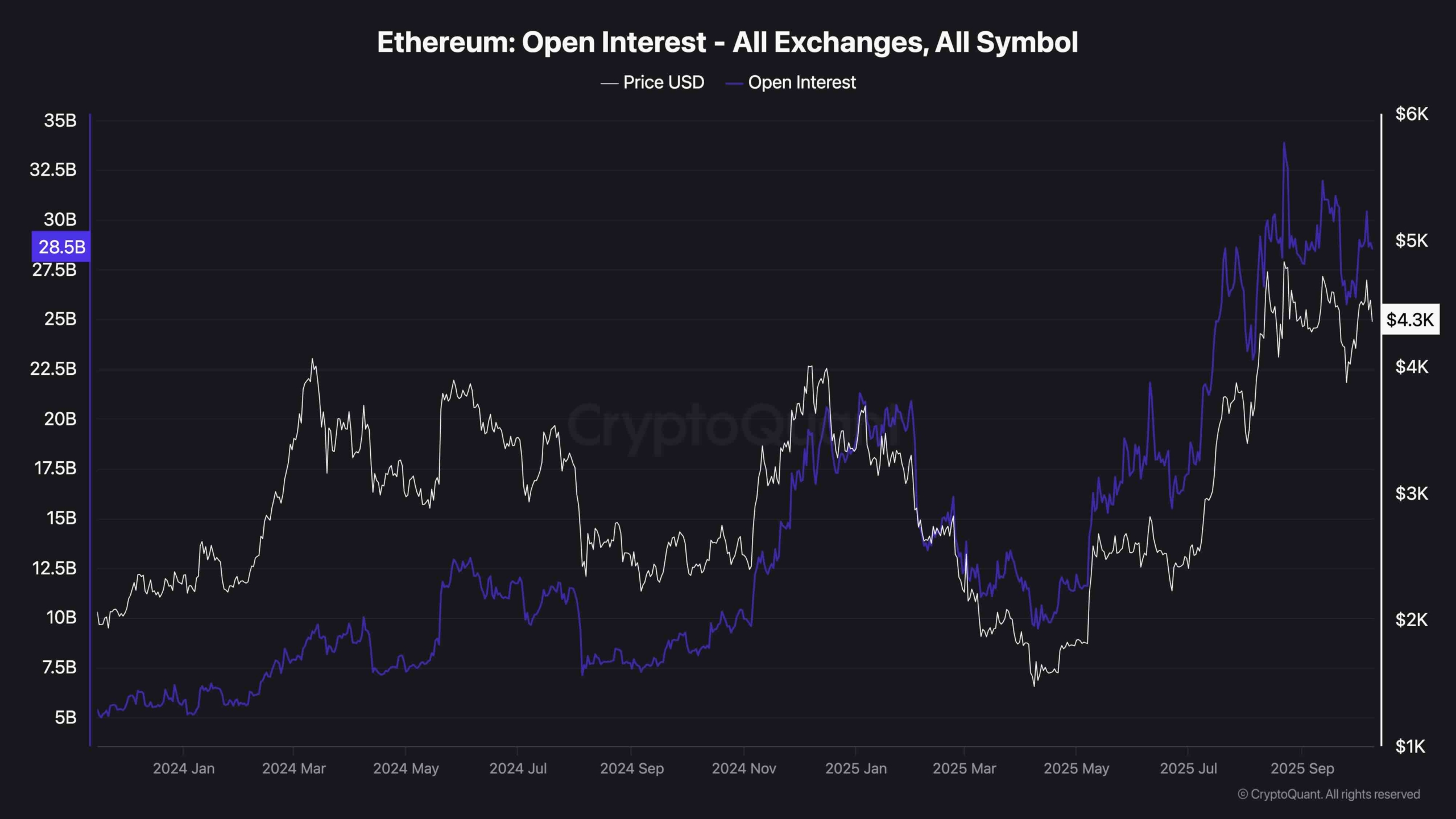

Open curiosity throughout all exchanges stays elevated at round $28.5 billion, exhibiting that derivatives merchants are nonetheless closely positioned regardless of the current pullback. This means sturdy speculative curiosity, nevertheless it additionally means the market is weak to liquidations if volatility will increase.

If open curiosity continues to remain excessive whereas worth tendencies decrease, it might set off a cascade of compelled lengthy liquidations earlier than a correct backside types. On the flip aspect, a gradual cooling of open curiosity throughout this correction would sign wholesome resetting of leverage, probably setting the stage for ETH’s subsequent leg greater.