Analysts at Bitfinex see Bitcoin focusing on $117K–$120K, however restoration hinges on contemporary capital getting into the spot market.

Abstract

- Analysts at Bitfinex report a 2.5x imbalance between sellers and consumers in crypto markets

- U.S.–China commerce tensions erased $1 trillion from the crypto market

- For Bitcoin to get well, contemporary capital must enter, regardless of murky fundamentals

After weathering one of the vital violent liquidation occasions in crypto historical past, Bitcoin could possibly be making a comeback. On Monday, Oct. 13, Bitfinex launched a report detailing the crash and outlining a possible restoration. Nevertheless, the outlook largely is determined by spot demand and macro readability.

BTC rebounded from the most important liquidation occasion in historical past by notional worth. Sparked by U.S.-China commerce tensions, the crash worn out virtually $1 trillion from the crypto market cap in hours, from $4.26 trillion to $3.30 trillion.

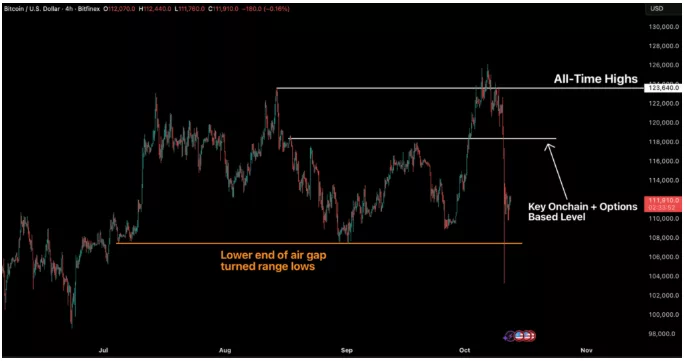

Bitcoin worth chart, displaying the foremost worth drop that led to the liquidation occasion | Supply: Bitfinex Alpha

Whereas Bitcoin (BTC) fell 18.1%, altcoins declined as a lot as 80%, with some briefly turning into illiquid. The report notes {that a} 2.5x imbalance towards sellers created the circumstances for the flash crash, contributing to $19 billion in futures liquidations in a single day. Though BTC bounced, additional restoration stays unsure.

Chart depicting Bitcoin liquidations, which reached greater than $19 billion in a single day | Supply: Bitfinex Alpha

You may also like: Might the crypto crash set Bitcoin up for its subsequent main rally?

Will Bitcoin get well to $120,000?

In response to Bitfinex analysts, the restoration will largely rely on BTC holding key assist at $110,000. That may put it in place to retest the $117,000 to $120,000 vary. Nevertheless, further good points will rely on spot demand and the macro backdrop.

For a full restoration, Bitcoin wants contemporary capital inflows to drive spot demand. This may largely rely on macro circumstances, that are presently clouded by the dearth of financial information because of the U.S. authorities shutdown.

“For now, the absence of knowledge could also be masking underlying fragility. If the shutdown persists, delayed studies on inflation and employment may amplify volatility as soon as they’re launched. However the market message is evident: liquidity, credit score confidence, and the expectation of additional easing from the Fed are protecting the economic system afloat, even because the lights in Washington stay dim,” wrote analysts at Bitfinex.

Learn extra: Because the crypto market rallies right this moment, watch out for a dead-cat bounce