Ethereum Worth Prediction: BlackRock Sparks Bullish Hopes for $4,000 ETH

Ethereum ($ETH) is again within the highlight after reviews surfaced that BlackRock—the world’s largest asset supervisor—has bought $103 million value of ETH. This information has reignited bullish sentiment throughout the crypto market, with merchants eyeing the important thing $4,000 resistance degree as the subsequent large milestone.

By TradingView – ETHUSD_2025-08-08 (YTD)

Ethereum Worth Efficiency

On the time of writing, ETH is buying and selling round $3,894, up barely on the day. Over the previous week, the token has held a good vary between $3,805 and $3,953, suggesting consolidation after a interval of volatility.

- Rapid Resistance: $3,950–$4,000 (psychological and technical barrier)

- Key Assist: $3,800, with stronger backing close to $3,600 if promoting strain intensifies

BlackRock’s $103M Ethereum Buy

Based on market chatter, BlackRock’s transfer marks some of the important institutional Ethereum buys thus far. Whereas not but formally confirmed by means of regulatory filings, the sheer scale of the acquisition is sufficient to enhance short-term sentiment.

- Institutional Confidence: BlackRock’s entry alerts rising acceptance of Ethereum as an institutional-grade asset.

- Potential ETF Play: The timing aligns with growing hypothesis a few U.S. spot Ethereum ETF launch later this 12 months.

- Market Influence: Massive-scale buys can shift market liquidity and encourage retail traders to comply with swimsuit.

Technical Evaluation

- RSI (Relative Energy Index): Hovering close to impartial, indicating ETH has room to maneuver earlier than hitting overbought territory.

- MACD: Near a bullish crossover, suggesting upward momentum might strengthen if shopping for continues.

- Bollinger Bands: Worth is close to the higher band, pointing to attainable short-term resistance earlier than a breakout try.

If ETH breaks above $4,000 with sturdy quantity, the subsequent targets lie round $4,150–$4,250. Failure to take action might see the worth retest assist ranges.

Elementary Drivers Past BlackRock

- Ethereum Community Development: Rising DeFi exercise and NFT volumes proceed to drive demand for ETH gasoline charges.

- On-Chain Metrics: Energetic addresses and staking participation stay wholesome, displaying regular consumer engagement.

- Macro Elements: U.S. Federal Reserve coverage and broader risk-on sentiment in equities and crypto will play a task in ETH’s course.

Ethereum Worth Prediction

- Quick-Time period (1–2 weeks): If bullish momentum from the BlackRock information holds, ETH might problem and break $4,000.

- Medium-Time period (1–3 months): A confirmed breakout might push ETH towards $4,250–$4,500, particularly if ETF approval rumors acquire traction.

- Bearish Situation: Failure to interrupt $4,000 might see ETH drift again towards the $3,600 assist zone.

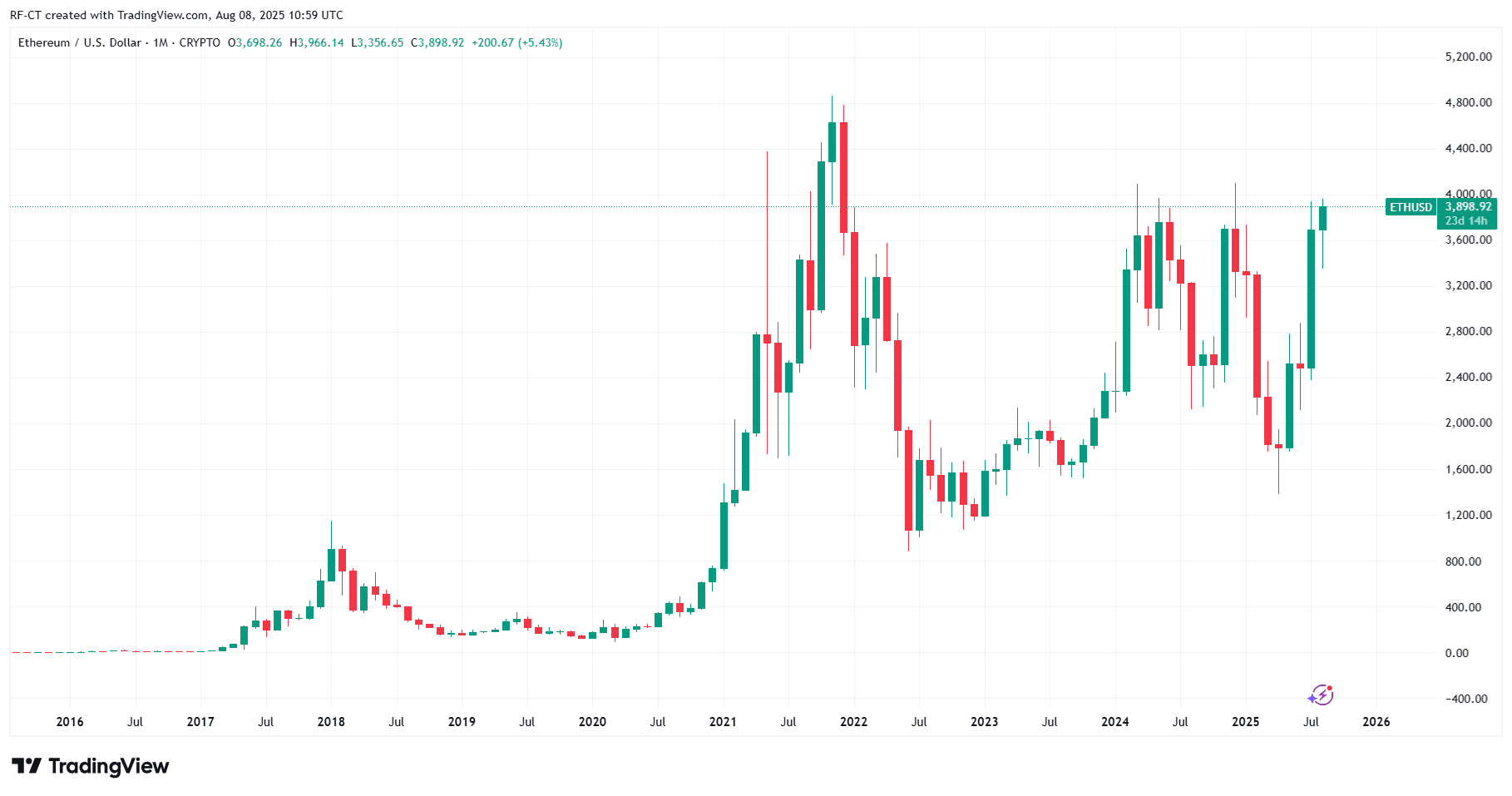

By TradingView – ETHUSD_2025-08-08 (All)

BlackRock’s reported $103M Ethereum buy provides a brand new bullish layer to ETH’s market outlook. Whereas the $4,000 resistance stays a formidable barrier, institutional curiosity mixed with wholesome technical indicators suggests the bulls have a preventing probability.

💡 The place to Purchase ETH: Examine High Exchanges Right here

📊 Reside ETH Worth: Test Ethereum Worth in Actual-Time