At 8:45 a.m. Jap, bitcoin hovered at $113,366 per coin, buoyed by a market capitalization of $2.25 trillion and 24-hour buying and selling quantity of $44.94 billion. The intraday value vary between $110,822 and $113,484 factors to a day of measured consolidation inside a bigger bullish restoration.

Bitcoin

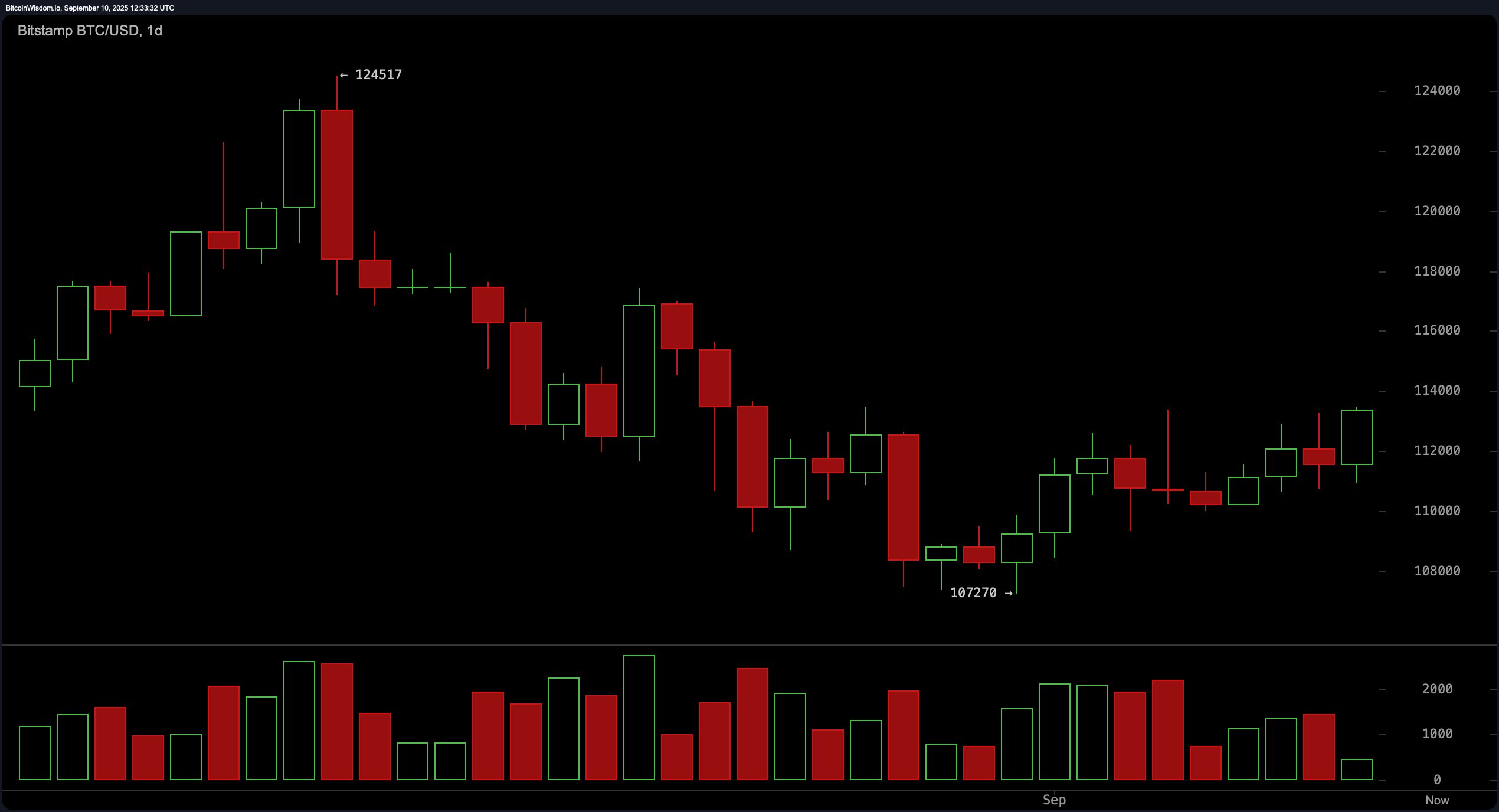

The short-term momentum seems cautiously optimistic, as bitcoin has begun recovering from a latest drawdown. Worth motion throughout bitcoin‘s each day chart reveals a fall from the $124,517 area all the way down to an area backside close to $107,270, adopted by a modest bullish reversal. The presence of a falling wedge sample and bullish engulfing candles close to the bottom means that this rebound could have structural assist. Key resistance is noticed within the $113,500 to $114,000 vary, whereas instant assist rests close to $107,000. Any pullback into the $110,000–$111,000 zone could provide a tactical entry level, notably if accompanied by declining quantity, signaling a possible setup for a reattempt at greater resistance ranges.

BTC/USD by way of Bitstamp 1-day chart on Sept. 10, 2025.

On the 4-hour chart, bitcoin exhibits indicators of stabilization and accumulation. A double backside close to $109,500 and $110,000 marks a technical base, adopted by a clear breakout by means of a descending value construction. Quantity evaluation signifies that bullish makes an attempt have been underpinned by wholesome demand, strengthening the validity of the breakout. The value at present sits in a good entry zone round $111,800 to $112,200. Nevertheless, the $113,500 to $114,000 ranges stay a important ceiling until quantity surges to substantiate upward continuation.

BTC/USD by way of Bitstamp 4-hour chart on Sept. 10, 2025.

The 1-hour bitcoin chart factors to a consolidation part following a minor rally. Bitcoin not too long ago climbed from a dip close to $110,768 and decisively broke above the $112,000 mark, forming the next low construction—a typical precursor to continuation patterns. Worth motion has since moved sideways round $112,500, with thinning quantity suggesting merchants are awaiting a catalyst. Breakout merchants could contemplate entries above $112,600 if accompanied by a spike in quantity, whereas conservative positioning might favor accumulation close to $111,800 with tight threat controls. Revenue-taking ought to be thought-about close to $113,700 and as much as $114,000, the place sellers beforehand emerged.

BTC/USD by way of Bitstamp 1-hour chart on Sept. 10, 2025.

From an indicator standpoint, oscillators stay largely impartial. The relative power index (RSI) stands at 50, whereas the Stochastic oscillator reads 76, and the commodity channel index (CCI) registers at 35—all indicating indecision. The common directional index (ADX) is at 14, confirming the absence of a powerful development. Nevertheless, the momentum oscillator exhibits a studying of 4,128 and the transferring common convergence divergence (MACD) is at −879, each flashing bullish indicators and implying latent upside potential.

A breakdown of transferring averages displays a market within the midst of transition. Quick-term averages—such because the 10-day exponential transferring common (EMA) at 111,384 and the 20-day EMA at 111,890—assist bullish motion, providing constructive indicators. Nevertheless, intermediate-term averages just like the 30-day and 50-day transferring averages flash bearish indicators, suggesting resistance stays overhead. Longer-term indicators, together with the 100-day and 200-day easy and exponential transferring averages, all sign a broader bullish construction, underlining the continuing restoration.

As bitcoin consolidates beneath resistance, quantity would be the important variable figuring out whether or not the market breaks greater or faces rejection. Merchants are suggested to look at the $113,500 to $114,000 area carefully—if bitcoin fails to pierce this degree with conviction, a reversal could observe. Conversely, a confirmed breakout above might pave the best way for a retest of prior highs above $114,500 to $115,000, reigniting bullish momentum.

Bull Verdict:

Bitcoin stays in a bullish restoration part following a latest backside, supported by favorable short-term and long-term transferring averages, constructive chart patterns, and constructive momentum indicators. If quantity confirms a breakout above the $113,000–$113,500 resistance vary, the trail to retesting the $114,000 degree and doubtlessly greater stays open.

Bear Verdict:

Regardless of bitcoin’s restoration, key resistance close to $113,500–$114,000 has but to be breached with convincing quantity. Oscillators stay impartial, and mid-range transferring averages proceed to flash promote indicators. A failure to interrupt greater could end in a rejection, exposing bitcoin to a retracement towards the $110,000–$107,000 assist zone.