Following a notable surge, Ethereum has approached a crucial resistance zone round $1.8K and has begun shedding momentum. However, the emergence of a bearish divergence suggests a possible short-term corrective consolidation earlier than the following bullish continuation.

Technical Evaluation

The Every day Chart

Following the substantial value enhance as of late initiated by robust shopping for strain on the crucial $1.5K help degree, ETH has reached a major resistance zone close to $1.8K. This upward displacement has resulted within the formation of a good worth hole, highlighting the presence of good cash on the consumers’ facet. Nonetheless, the $1.8K area coincides with a previous order block, doubtless full of provide, making it a formidable barrier.

Consequently, Ethereum is anticipated to enter a brief consolidation section, doubtlessly adopted by a minor correction earlier than the following main transfer. Ought to consumers handle to breach this resistance, the following goal could be the essential $2.2K degree.

The 4-Hour Chart

On the decrease timeframe, ETH’s bullish market construction shift was confirmed after a breakout above a multi-month descending channel, resulting in a powerful surge towards the $1.8K resistance zone. This degree aligns with earlier vital swing lows, reinforcing its significance. Nonetheless, momentum has stalled upon reaching this crucial threshold, with the value getting into a low-volatility consolidation section.

Concurrently, a bearish divergence between the value and the RSI indicator has emerged, suggesting the chance of a short-term corrective transfer. In consequence, prolonged consolidation or a minor pullback is anticipated earlier than any additional bullish breakout try.

Onchain Evaluation

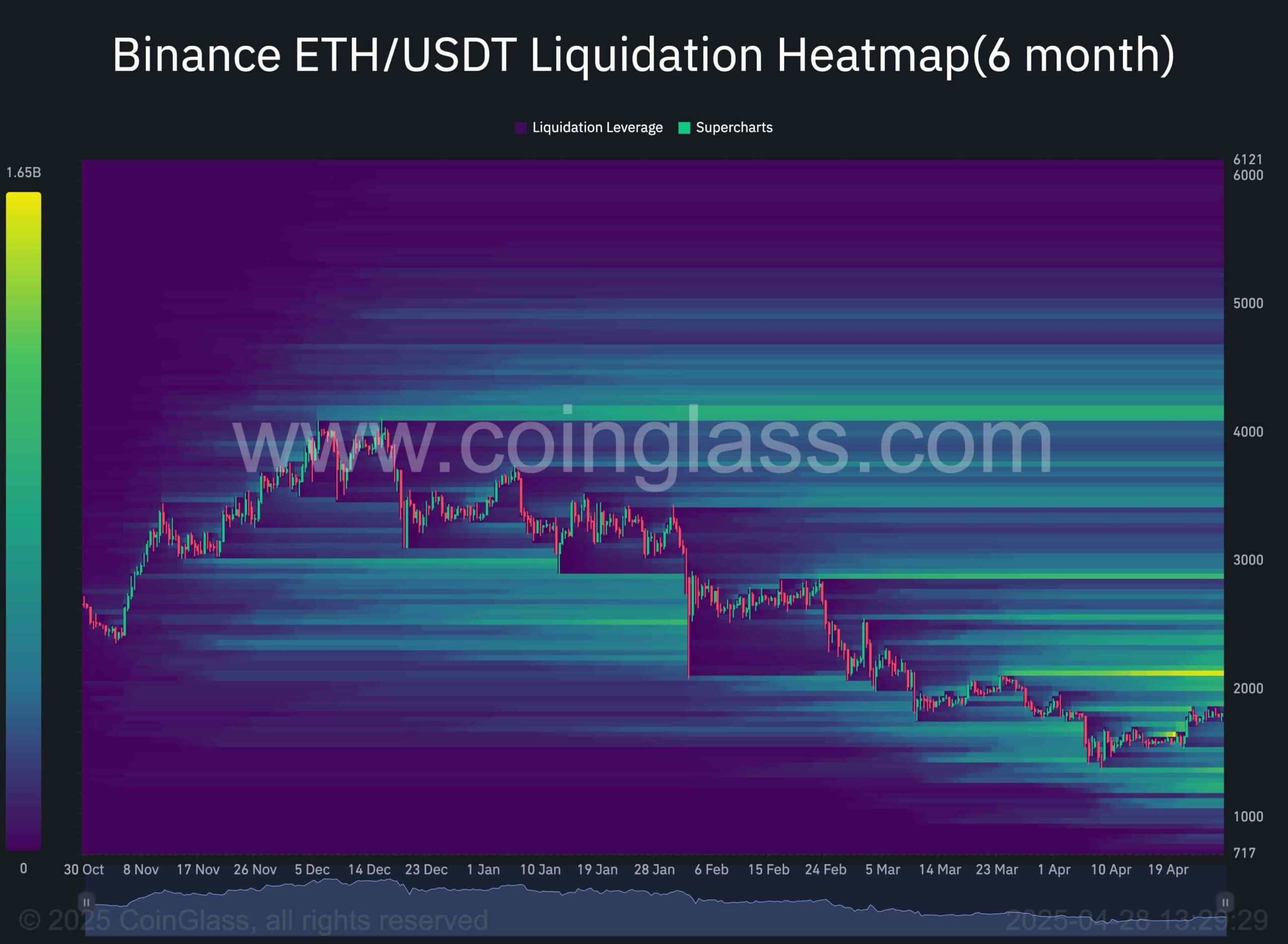

The Binance liquidation heatmap continues to supply worthwhile insights into Ethereum’s present market construction and potential future value actions. Liquidity zones, usually clustered round key psychological ranges, are likely to act as magnets, attracting the value as market members search to set off stop-losses and liquidations.

Following the current vital downtrend, a large focus of liquidation ranges has shaped simply above Ethereum’s earlier swing excessive across the crucial $2K mark. Traditionally, in periods of restoration or bullish sentiment, markets are drawn towards such liquidity pockets, as institutional gamers and good cash members look to use trapped sellers by triggering compelled liquidations.

At present, Ethereum’s value motion signifies rising energy, having efficiently rebounded from the important thing $1.5K help space and reclaimed vital technical ranges. Ought to the asset proceed its upward momentum and enter the $2K liquidity cluster, a cascade of quick liquidations could possibly be unleashed. This might doubtless inject further volatility and amplify shopping for strain, pushing Ethereum quickly towards the following crucial resistance zone close to $2.5K.